Monitoring your credit has become easier with services like Credit Karma. Many wonder if Credit Karma scores match their actual credit scores. The answer isn’t simple.

This article explores the differences between Credit Karma scores and your true credit profile. We’ll help you understand these nuances for better financial decisions.

Key Takeaways

- Credit Karma provides an estimate of your credit score, which may differ from your actual FICO or VantageScore.

- Factors like the credit scoring model, data sources, and reporting agencies can impact the differences between Credit Karma and your true credit score.

- Understanding the impact of credit inquiries, credit utilization, and other factors can help you interpret your Credit Karma score and take steps to improve your overall credit health.

- Regularly monitoring your credit reports and scores from different sources can give you a more comprehensive view of your credit standing.

- Developing good credit habits, such as paying bills on time and maintaining low debt levels, is crucial for building and maintaining a strong credit profile.

Understanding Credit Karma Scores

Credit Karma offers free access to credit reports and scores. However, these scores may differ from those used by lenders. Let’s explore Credit Karma’s scoring model and its potential differences from your actual credit score.

What Is Credit Karma?

Credit Karma is a fintech company providing credit monitoring and financial management tools. It offers free access to credit reports from Equifax and TransUnion. The platform helps users understand their financial health and credit standing.

Credit Karma’s Scoring Model

Credit Karma uses a model based on VantageScore 3.0. VantageScore is an alternative to the widely-used FICO score. It was developed by the three major credit bureaus.

Both VantageScore and FICO share similarities but use different algorithms. They calculate consumer credit scores using unique weightings.

The credit karma vs actual score may differ because lenders typically use FICO scores. This discrepancy can stem from various factors like data sources and reporting methods.

“The scores you see on Credit Karma are not the same as the scores lenders use to make decisions about your creditworthiness.”

Knowing the differences between credit karma vs actual score is crucial. It helps when monitoring your credit and making important financial decisions.

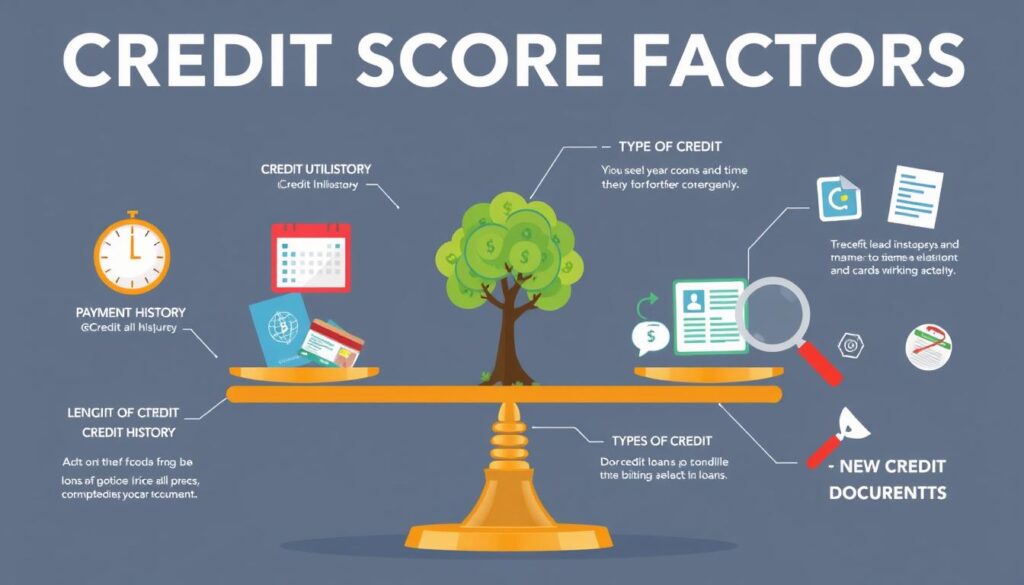

Factors Affecting Your Credit Score

Your credit score is a key indicator of financial health. It’s determined by various factors. Understanding these factors helps explain why your Credit Karma score may differ from lenders’ scores.

The main factors influencing your credit score include:

- Payment History: This is the biggest part of your credit score. It shows if you make timely payments on your credit accounts.

- Credit Utilization Ratio: This measures how much credit you use compared to your limits. Keep this ratio below 30% for a good score.

- Credit Age: A longer credit history can boost your score. It shows you’ve managed credit over time.

- Credit Mix: Having different types of credit can help. It shows you can handle various credit types responsibly.

- Recent Credit Inquiries: Hard inquiries can lower your score temporarily. Their impact usually decreases over time.

Knowing these credit score factors helps you make smart choices. You can take steps to keep your credit profile healthy.

| Credit Score Factor | Approximate Impact on Score |

|---|---|

| Payment History | 35% |

| Credit Utilization Ratio | 30% |

| Credit Age | 15% |

| Credit Mix | 10% |

| Recent Credit Inquiries | 10% |

Monitor these factors to keep your credit profile strong. This helps ensure your Credit Karma score reflects your true creditworthiness. It can help you reach your financial goals.

Potential Differences Between Credit Karma and Actual Scores

Credit Karma scores might not match your actual credit score. Credit Karma provides Vantage scores, while lenders often use FICO scores. The data sources and reporting agencies may also differ between Credit Karma and lenders.

Scoring Models Used

Credit Karma uses the Vantage scoring model, developed by major credit bureaus. Lenders typically rely on FICO scores, which use a different model. Both are based on credit history, but factor weights may vary.

Data Sources and Reporting Agencies

Credit Karma may not access the same information as lenders. This can lead to differences in credit data and reported scores. The variation stems from different data sources and reporting agencies used.

| Scoring Model | Credit Karma | Lenders |

|---|---|---|

| Credit Score | Vantage Score | FICO Score |

| Data Sources | May differ from lenders | May include additional information |

| Reporting Agencies | May not match lenders | May use different agencies |

Credit Karma provides a good estimate of your credit standing. However, it may not reflect the score lenders use. Check your credit reports from major bureaus for a complete picture.

Monitor your FICO score to understand your overall credit profile better. This will give you a more accurate view of your creditworthiness.

Why Your Credit Karma Score Might Differ from Your Actual Score

Your Credit Karma score and actual credit score may not always match. Understanding why can help you manage your finances better. Let’s explore the key reasons for these differences.

Credit Karma uses a different scoring model than most lenders. It relies on VantageScore, while many lenders use FICO scores. This can lead to credit score discrepancies between the two.

Update frequency also matters. Credit Karma refreshes scores more often than some agencies. This means your Credit Karma score might show newer info than your credit karma vs actual score.

Errors in your credit report can cause score differences. Incomplete or incorrect data affects calculations. This can make your actual score differ from Credit Karma’s.

“Understanding the factors that contribute to differences between your Credit Karma score and your actual credit score is essential for making informed financial decisions.”

Knowing these reasons helps you interpret your Credit Karma score better. It allows you to take steps to maintain good overall credit health.

credit karma vs actual score

Your Credit Karma score may differ from your actual credit score. This is due to update timing and data accuracy. Let’s explore these factors and their impact on score discrepancies.

Timing of Score Updates

Credit Karma updates scores weekly, giving a near real-time view. However, major credit bureaus may update less often, usually monthly or quarterly. This timing difference can cause variations between scores.

The data used to calculate these scores may not be in sync. This can lead to differences between your Credit Karma and actual credit scores.

Credit Report Accuracy

Data accuracy also affects score differences. Credit Karma aims for accurate information, but it may not always be up-to-date. The data comes from credit bureaus and might not be fully comprehensive.

This can cause discrepancies between your Credit Karma report and actual credit report. Regular monitoring of both can help you understand your credit health better.

It’s crucial to remember that your credit karma vs actual score may fluctuate. This is due to timing and accuracy factors. Keeping an eye on both can help you spot potential inaccuracies.

Understanding these differences helps you make smarter financial decisions. It can also improve your credit-building strategies. Regular monitoring is key to maintaining good credit health.

Interpreting Credit Score Ranges

Credit scores are key to understanding your financial health. They fall within different ranges, each showing how creditworthy you are. Knowing these ranges helps you interpret your Credit Karma or actual credit score.

FICO Score Ranges

FICO, the most common credit scoring model, uses a 300 to 850 scale. Here’s what the FICO score ranges mean:

- 800-850: Excellent credit

- 740-799: Very good credit

- 670-739: Good credit

- 580-669: Fair credit

- 500-579: Poor credit

- 300-499: Very poor credit

VantageScore Ranges

VantageScore also uses a 300 to 850 scale, but with slightly different ranges:

- 781-850: Excellent

- 661-780: Good

- 601-660: Fair

- 500-600: Poor

- 300-499: Very poor

A higher credit score shows you’re less risky to lenders. This can help you get better loans, credit cards, and financial products.

Good credit scores can lead to lower interest rates and insurance premiums. They also improve your chances of getting approved for loans and rentals.

“Maintaining a good credit score is crucial for financial well-being, as it can open doors to better interest rates, lower insurance premiums, and increased opportunities for borrowing and renting.”

Impact of Credit Inquiries

Credit inquiries can significantly affect your credit score. Both hard and soft inquiries influence your credit score factors differently. Knowing how these inquiries work helps you make smart credit decisions.

Hard inquiries happen when you apply for new credit. They can cause a small drop in your credit score. Lenders see hard inquiries as a potential risk.

The effect of hard inquiries lasts up to 12 months. However, their impact usually decreases over time. Multiple hard inquiries in a short period often count as one.

- Hard inquiries can lower your credit score by a few points, but the impact is usually temporary.

- Multiple hard inquiries within a short period (usually 14-45 days) are often treated as a single inquiry, minimizing the overall impact.

- Soft inquiries, such as those made by you to check your own credit or by lenders for pre-approvals, do not affect your credit score.

Credit Karma scores may show different impacts from credit inquiries than actual credit scores. This is because Credit Karma uses different scoring models than major credit bureaus.

Understanding credit inquiries helps you make better credit decisions. You can take steps to keep your credit profile healthy. Being aware of how inquiries work allows you to manage your credit more effectively.

Credit Utilization Ratio

Your credit utilization ratio plays a key role in your credit score. It measures how much credit you use versus your total available credit. Learning to calculate and improve this ratio can boost your credit health.

Understanding Utilization Ratio

To find your credit utilization ratio, divide your used credit by your total available credit. For instance, if you have $10,000 in credit and use $5,000, your ratio is 50%.

Lenders use this ratio to judge your creditworthiness and risk level. A lower ratio often means you’re a more responsible borrower.

Optimal Ratio for Best Scores

- Experts suggest keeping your credit utilization ratio below 30% for the best credit score factors.

- The lower your credit utilization ratio, the better it is for your credit score.

- Maintaining a ratio below 10% can help you achieve the highest possible credit scores.

| Credit Utilization Ratio | Impact on Credit Score |

|---|---|

| Below 10% | Excellent for credit scores |

| 10-30% | Good for credit scores |

| Above 30% | Negative impact on credit scores |

A low credit utilization ratio can maximize your credit score. It shows lenders you’re responsible, whether you’re checking Credit Karma or your actual credit score.

Credit Monitoring Services: Pros and Cons

Credit monitoring services like Credit Karma have gained popularity in recent years. These tools help people track their credit information easily. Let’s explore the benefits and drawbacks of using such services.

Advantages of Credit Monitoring Services

- Regular credit score updates: Credit monitoring services often provide users with regular updates on their credit scores, allowing them to track changes and identify potential issues.

- Fraud and identity theft detection: These services can alert users to suspicious activity on their credit reports, enabling them to quickly address potential identity theft or fraudulent use of their personal information.

- Credit report monitoring: Many credit monitoring services offer the ability to view and monitor your credit reports from the major credit bureaus, providing a comprehensive view of your credit history.

Limitations of Credit Monitoring Services

Credit monitoring services have their drawbacks. It’s crucial to know these limitations before relying on them too heavily.

- Differences in credit scores: The credit scores provided by these services may not always align with the actual credit scores used by lenders, leading to potential confusion or misunderstandings.

- Incomplete credit data: Credit monitoring services may not have access to all the same data sources used by lenders, resulting in a less comprehensive view of your credit profile.

- Delayed reporting: Credit information can take time to be reported and updated, meaning the credit scores and reports you see may not reflect the latest changes to your credit history.

Credit monitoring services can be useful for managing your finances. However, they shouldn’t be your only tool. Use them as part of a larger strategy.

Regularly check your credit and manage it responsibly. Understand what affects your credit score. These actions will help you maintain a healthy credit profile.

| Pros of Credit Monitoring Services | Cons of Credit Monitoring Services |

|---|---|

| Regular credit score updates | Differences in credit scores |

| Fraud and identity theft detection | Incomplete credit data |

| Credit report monitoring | Delayed reporting |

“Monitoring your credit is an important step in maintaining a healthy financial profile, but it’s crucial to understand the limitations of credit monitoring services and use them as one part of a broader credit management strategy.”

Strategies for Improving Your Credit Score

A strong credit score is vital for financial health. You can boost your creditworthiness through proven strategies. These include monitoring credit score factors and using credit repair strategies.

Paying Bills on Time

Consistently paying bills on time is crucial for improving your credit score. This covers credit cards, loans, and other financial obligations. Payment history is the single most important factor in determining your credit score.

Make it a top priority to never miss a due date. This habit will significantly impact your creditworthiness over time.

Reducing Debt Levels

Lowering your overall debt is another key strategy for boosting your credit score. Focus on paying down credit card balances and other outstanding debts. Aim to keep your credit utilization ratio below 30% for optimal results.

This ratio compares the credit you’re using to your total available credit. Maintaining a low ratio shows responsible credit management.

| Debt Reduction Strategy | Potential Impact on Credit Score |

|---|---|

| Paying down credit card balances | Significant positive impact |

| Consolidating multiple debts into a single loan | Moderate positive impact |

| Negotiating with creditors for reduced interest rates | Moderate positive impact |

Implementing these credit score factors and credit repair strategies can transform your financial future. With consistent effort, you’ll build a strong, sustainable credit profile.

Credit Repair Tactics

Good credit habits are vital, but errors can sneak into your credit reports. These mistakes can hurt your credit score. Luckily, you can use effective strategies to fix these issues.

These tactics can help improve your credit report’s accuracy. They’ll also boost your overall credit score.

Disputing Errors on Credit Reports

A powerful credit repair tactic is disputing errors on your credit reports. This involves contacting credit bureaus with evidence to support your claim.

By doing this, you ensure your credit report accurately shows your financial history. This can positively impact your credit repair strategies and credit report accuracy.

- Review your credit reports regularly to identify any potential errors or inaccuracies.

- Gather supporting documentation, such as bank statements or payment receipts, to substantiate your dispute.

- Contact the credit bureaus and follow their dispute process, providing the necessary information and evidence.

- Monitor the progress of your dispute and ensure that any verified errors are removed from your credit report.

“Disputing errors on your credit report is a crucial step in improving your credit score and maintaining financial health.”

Carefully reviewing your credit reports and disputing errors is crucial. This helps you control your credit repair strategies.

It also ensures your credit report accuracy truly reflects your financial standing. Take action today to improve your credit health.

FICO vs. Vantage Scores Explained

FICO and Vantage are two different credit scoring models. They help lenders evaluate your creditworthiness. Let’s explore the key differences between these two scores.

FICO Scores

FICO scores are the most common credit scoring system in the US. They range from 300 to 850, with higher scores indicating lower credit risk.

FICO scores consider five main factors. These include payment history, amounts owed, and length of credit history. They also look at types of credit used and new credit applications.

Vantage Scores

Vantage scores are an alternative developed by the three major credit bureaus. Like FICO, they range from 300 to 850. However, the weight given to each factor can differ.

Vantage scores focus on different aspects. They consider credit utilization, recent credit behavior, and available credit.

| Comparison | FICO Scores | Vantage Scores |

|---|---|---|

| Range | 300-850 | 300-850 |

| Scoring Factors |

|

|

| Lender Acceptance | More widely accepted | Less widely accepted |

Both FICO vs Vantage scores offer valuable insights into your creditworthiness. Monitoring scores from multiple sources can help you understand your financial standing better. This knowledge can guide you in managing your credit wisely.

“Understanding the differences between FICO and Vantage scores can help you navigate the complex world of credit and make more informed financial decisions.”

Credit Score Factors and Their Weightings

Your credit score is vital for a strong financial profile. It’s calculated using a complex algorithm based on several key elements. Let’s explore the main credit score factors and their importance.

These factors help determine your FICO or VantageScore. Understanding them can help you maintain good credit. Focus on these areas to improve your overall creditworthiness.

- Payment History (35%): This is the most crucial factor. Paying bills on time shows responsible money management. Consistent on-time payments significantly boost your credit score.

- Credit Utilization (30%): This shows how much available credit you’re using. Keep your credit card balances low compared to your limit. This helps maintain a healthy credit score.

- Credit History Length (15%): A longer credit history is better. Lenders prefer seeing an established record of responsible credit use. This factor takes time to improve.

- Credit Mix (10%): Having different types of credit can help. This includes credit cards, loans, and mortgages. It shows you can handle various credit types responsibly.

- New Credit (10%): Be cautious about opening new accounts. Too many new credit applications can lower your score. It may signal financial trouble to lenders.

Knowing these credit score factors helps you prioritize your efforts. Focus on the areas with the biggest impact. This way, you can improve your overall credit score effectively.

“Your credit score reflects your financial responsibility. Understand what influences it and maintain a healthy credit profile.”

Maintaining Good Credit Habits

Healthy credit score factors are vital for aligning your Credit Karma score with your actual credit score. Let’s explore responsible credit repair strategies, including proper credit card use and regular monitoring.

Responsible Credit Card Usage

Using credit cards responsibly is key to maintaining good credit. This includes making timely payments and keeping credit utilization low.

Avoid closing unused cards, as this can impact your credit utilization ratio. Try to diversify your credit types for a better credit mix.

Monitoring Credit Reports Regularly

Regularly reviewing your credit reports is crucial for maintaining good credit. It helps you spot and dispute errors that may lower your score.

You can also detect signs of identity theft or fraud. This knowledge empowers you to make informed decisions about your credit repair strategies.

Good credit habits ensure your Credit Karma score aligns with your actual credit score. This alignment helps you access better rates for loans and credit cards.

Conclusion

Credit Karma is useful for monitoring credit, but its scores may differ from those used by lenders. Understanding these discrepancies helps you maintain good credit habits. You can take steps to ensure your creditworthiness is accurately represented.

Knowing the differences between Credit Karma and real credit scores is crucial for financial decisions. Monitor your credit reports regularly. Manage your credit utilization wisely. Practice responsible credit behaviors to build a strong credit profile.

Remember, lenders primarily use scores from major credit bureaus. These scores reflect your true financial reliability. Understanding credit score differences is key. Proactive credit management will help you navigate the financial landscape confidently.