Maintaining a healthy credit profile is crucial in today’s complex financial world. Credit repair apps empower individuals to take control of their finances. Let’s explore the top apps that can boost your credit score and brighten your financial future.

These tools help you monitor your credit report and address disputes efficiently. Many offer debt consolidation strategies and identity protection features. Some even provide credit counseling services and personalized guidance.

By using these apps, you can develop a holistic approach to rebuilding your credit. This focus on long-term financial health can lead to greater financial freedom.

Key Takeaways

- Discover the power of credit repair apps to improve your credit score and regain financial freedom.

- Understand the importance of monitoring your credit report and addressing disputes efficiently.

- Explore debt consolidation strategies and identity protection features to streamline your financial management.

- Leverage credit counseling services and personalized guidance for a smoother financial journey.

- Develop a holistic approach to credit rebuilding, focusing on long-term financial health.

Discover the Power of Credit Repair Apps

Credit repair apps are powerful tools for managing your financial health. These innovative solutions help you understand your credit profile and improve your score. With these apps, you can dispute inaccuracies and regain financial freedom.

Unlock Financial Freedom with Innovative Solutions

Credit repair apps simplify complex credit management processes. They provide real-time access to your credit reports and scores. This empowers you to identify and address discrepancies affecting your creditworthiness.

Regain Control of Your Credit Score

Credit repair apps help you develop strategies to boost your credit score. They offer features like credit monitoring and personalized dispute assistance. These apps also provide educational resources to help you understand credit-influencing factors.

By addressing report inaccuracies, you can improve your credit score. This opens up new opportunities for financial success.

| Feature | Benefit |

|---|---|

| Credit Monitoring | Gain real-time insights into your credit report and score, enabling you to identify and address issues promptly. |

| Dispute Assistance | Leverage the expertise and resources of credit repair apps to dispute inaccuracies and remove negative items from your credit report. |

| Educational Resources | Deepen your understanding of credit-building strategies and develop healthy financial habits for long-term success. |

Credit repair apps can lead you towards financial empowerment. They help you regain control of your credit score. With these tools, you can build a more secure and prosperous financial future.

Understanding Your Credit Score: The Vital First Step

Your credit score is a key number that shows how trustworthy you are with money. It’s based on info in your credit report. Knowing this score helps you build a good plan to fix your credit.

Credit repair apps offer a deep look at your credit report. They show what affects your score and where you need to focus. These tools help you spot areas to improve and take smart steps to boost your finances.

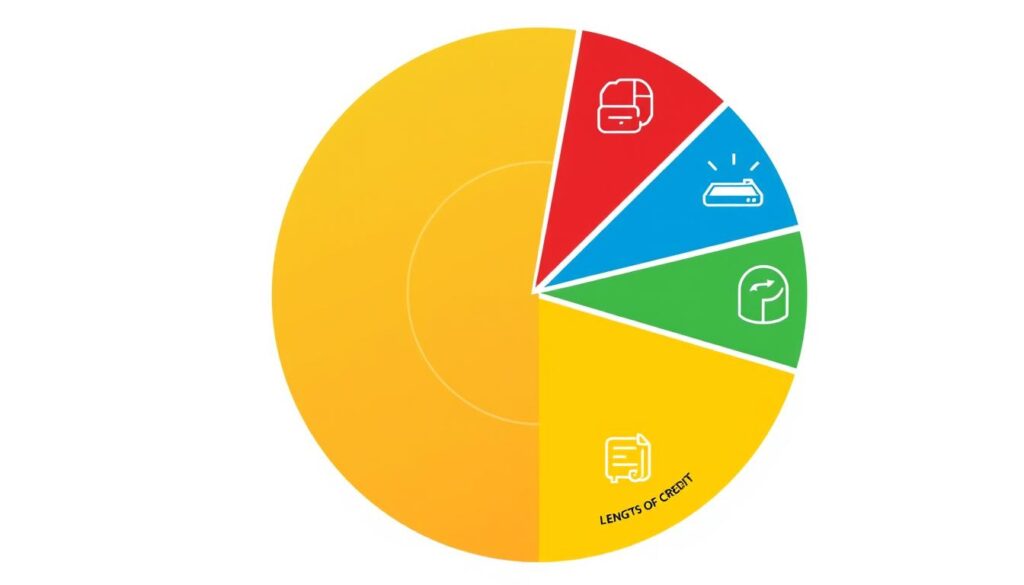

| Key Factors Influencing Credit Score | Percentage Contribution |

|---|---|

| Payment History | 35% |

| Credit Utilization Ratio | 30% |

| Length of Credit History | 15% |

| Types of Credit Used | 10% |

| New Credit Inquiries | 10% |

Knowing how each factor affects your credit score helps you make a solid plan. You can focus on the areas that need the most work. This knowledge is key to taking charge of your money future.

“Knowing your credit score is the first step towards financial empowerment. With this knowledge, you can make informed decisions and take the necessary actions to improve your credit profile.”

Top Credit Repair Apps for Comprehensive Monitoring

Keeping track of your credit health is crucial in our digital age. The best credit repair apps offer real-time monitoring of your credit profile. These tools help you spot and fix issues quickly, keeping your credit score on the right path.

Stay Informed and Proactive with Real-Time Updates

Top credit repair apps watch your credit reports and alert you to any changes. This lets you act fast if errors or fraud occur. You can take control of your finances and make smart choices to boost your credit score.

- Real-time credit monitoring and alerts

- Identification of errors and suspicious activities

- Customizable notification settings for personalized updates

- Comprehensive credit analysis and reporting

These powerful credit repair apps keep you informed and in charge of your financial health. They help you build a stronger credit profile and reach your money goals.

“Staying on top of your credit has never been easier with the right credit repair apps. These innovative tools empower you to take charge of your financial future.”

How Credit Repair Apps Simplify Dispute Resolution

Credit repair apps are powerful tools for disputing credit report inaccuracies. They offer user-friendly interfaces and guidance to challenge errors. These apps help improve credit profiles and boost scores.

Let’s explore how credit repair apps make dispute resolution more efficient:

- Automated Monitoring: These apps constantly monitor your credit reports. They alert you to changes or errors promptly. This helps minimize the impact on your credit score.

- Dispute Identification: Apps analyze your credit reports thoroughly. They spot inaccuracies or unwarranted negative items. Clear guidance is provided for disputing these items.

- Dispute Submission: Many apps can generate and submit dispute letters for you. This feature saves you time and effort. It streamlines the process significantly.

- Progress Tracking: Credit repair apps show the entire dispute resolution process. You can track dispute status and monitor credit score changes.

Credit repair apps help consumers navigate credit disputes easily. They empower individuals to control their financial futures. These tools assist in achieving various financial goals.

“Credit repair apps have been a game-changer for me. They’ve made the dispute process so much simpler and more efficient, allowing me to focus on improving my credit score rather than getting bogged down in paperwork.”

The right credit repair app can streamline your dispute resolution process. It ensures your credit report accurately reflects your financial history. Try these tools and improve your financial future today.

Credit Repair Apps: The Key to Boosting Your Credit Profile

Credit repair apps offer a powerful solution for improving your credit profile. These tools help identify and address credit issues, leading to a higher credit score. Advanced features make navigating the complex world of credit much easier.

Real-time credit monitoring is a key benefit of these apps. They track reports from major bureaus and alert you to changes or suspicious activity. This proactive approach helps maintain a healthy credit profile and protects your finances.

Credit repair apps also simplify dispute resolution. They guide you through steps to dispute errors in your credit reports. This streamlined process helps address negative items quickly, boosting your credit score.

These apps provide personalized strategies based on your unique credit profile. They offer tailored recommendations to tackle your specific credit challenges. This can include debt management plans, creditor negotiations, and credit-building techniques.

“Credit repair apps have been a game-changer for me. They’ve helped me uncover errors in my credit reports, dispute them effectively, and ultimately boost my credit score by over 50 points. I highly recommend them to anyone looking to take control of their financial future.”

Credit repair apps empower you to take charge of your financial future. They offer a comprehensive approach to credit improvement. With these tools, you can regain control of your credit profile and achieve your goals.

| Feature | Benefit |

|---|---|

| Real-Time Credit Monitoring | Stay informed and proactive about changes to your credit reports |

| Dispute Resolution Assistance | Streamline the process of addressing errors and inaccuracies in your credit reports |

| Personalized Strategies | Receive tailored recommendations to address your unique credit challenges |

Debt Consolidation: A Smart Strategy for Improving Credit

Credit repair apps offer debt consolidation as a powerful feature. This strategy can transform your credit profile and financial control. It combines multiple debts into one manageable payment, simplifying repayment and reducing interest rates.

Gain Clarity and Streamline Your Repayment Process

Managing multiple debts can be overwhelming. Debt consolidation through a credit repair app simplifies this process. You’ll have one fixed monthly payment, making it easier to avoid missed or late payments.

Many consolidation options offer lower interest rates than existing debts. This reduces overall repayment costs and helps you pay off obligations faster.

“Consolidating my debts using a credit repair app was a game-changer. It helped me streamline my payments, save on interest, and take control of my financial situation.” – Emily, a satisfied credit repair app user.

Credit repair apps with debt consolidation features can boost your credit score. They simplify repayment and offer better terms. This helps you show responsible financial behavior and build a brighter future.

Identity Protection: A Crucial Feature of Modern Credit Repair Apps

Protecting your personal info is vital in our digital world. Credit repair apps now offer robust identity protection features. These tools help maintain your credit profile’s integrity and prevent identity theft.

These apps provide tools to monitor your credit activity. They alert you to suspicious changes. Features include real-time credit monitoring and dark web surveillance.

Credit repair apps also guide you if you suspect identity fraud. They help with disputing fraudulent accounts and restoring your credit. This support aids in reclaiming your financial well-being.

Combining identity protection with credit repair is a game-changer. It addresses the root cause of credit issues. This approach helps you regain control over your finances.

| Feature | Benefits |

|---|---|

| Credit Monitoring | Receive alerts on changes to your credit report, helping you stay informed and proactive. |

| Dark Web Surveillance | Scan the dark web for any signs of your personal information being compromised. |

| Identity Theft Assistance | Guidance on steps to take if you suspect identity fraud, including dispute resolution and credit restoration. |

Credit repair apps with identity protection boost your financial health. They safeguard your personal information and bring peace of mind. Try this innovative solution to secure your credit and identity.

Leveraging Credit Counseling Services for Personalized Guidance

Credit repair apps often include access to credit counseling services. These services offer guidance from experienced financial experts. They provide personalized advice to improve your credit score and financial well-being.

Experts by Your Side for a Smoother Financial Journey

Credit counselors help develop custom plans for your specific credit challenges. They can guide you through complex credit reporting issues and dispute errors. These experts also create roadmaps for achieving your long-term financial goals.

Credit counseling services keep you motivated throughout the credit repair process. Your counselor offers valuable insights and practical strategies. They support you as you work to improve your credit score.

“The guidance of a credit counselor has been invaluable in helping me understand my credit report and take the necessary steps to improve my score. Their expertise has made the process much less daunting.”

Credit repair apps with integrated counseling services can transform your financial journey. They’re helpful if you’re dealing with debt or identity theft. These apps also assist in building a stronger financial foundation.

Bad Credit Loans: A Temporary Solution with Credit Repair Apps

Credit repair apps can help people with poor credit get bad credit loans. These tools find lenders for borrowers with low credit scores. They also guide you on improving your creditworthiness for better loan terms.

These apps offer access to bad credit loans not available through traditional lenders. Such loans can help with urgent financial needs. Meanwhile, you can work on rebuilding your credit score.

- Credit repair apps can help you find lenders that specialize in bad credit loans, offering more flexibility and potentially lower interest rates compared to predatory options.

- The apps provide valuable insights into your credit report, helping you identify and address any errors or negative items that may be dragging down your score.

- With the guidance of credit repair apps, you can develop a personalized plan to improve your credit over time, transitioning from bad credit loans to more favorable financing options.

Credit repair apps can help you get bad credit loans and improve your finances. These tools empower you to manage your credit better. They pave the way for long-term financial stability.

“Credit repair apps have been a game-changer for me. They helped me find a bad credit loan when I needed it, and then guided me through the process of improving my credit score. Now, I’m in a much better position to access traditional financing options.”

Credit Rebuilding Strategies: A Holistic Approach for Long-Term Success

Credit success requires a comprehensive approach beyond quick fixes. Credit repair apps help develop healthy financial habits. These tools can set you up for a brighter financial future.

Develop Healthy Financial Habits for a Brighter Future

Effective credit repair starts with sound financial practices. Credit repair apps can guide you through creating a sustainable budget. They also help manage payment history and optimize credit utilization.

Applying these strategies improves your credit score. It also instills positive habits that serve you well long-term.

- Budgeting: Gain a clear understanding of your income and expenses, allowing you to make informed financial decisions and avoid overspending.

- Payment History Management: Ensure timely and consistent payments to demonstrate your creditworthiness to lenders.

- Credit Utilization Optimization: Keep your credit card balances low to maintain a favorable credit utilization ratio.

Credit repair is an ongoing process, not a final destination. Credit repair apps and credit rebuilding strategies can unlock financial freedom.

These tools help you take control of your credit. They build a solid foundation for long-term success.

“Developing healthy financial habits is the key to sustainable credit improvement. With the right tools and guidance, you can take control of your credit and build a solid foundation for long-term success.”

In-Depth Credit Report Analysis: The Foundation of Effective Repair

Credit report analysis is vital for successful credit repair. Apps use data analytics to help you understand your credit history. They identify areas for improvement and guide you towards practical solutions.

These tools empower you to make informed decisions. They help you address discrepancies or negative items affecting your credit score. With their help, you can take targeted actions to enhance your credit profile.

- Detailed Credit History Review: Credit repair apps scan your report thoroughly. They uncover factors impacting your score, like late payments and high credit utilization.

- Personalized Recommendations: Apps provide customized advice based on your credit report analysis. They help with disputing errors, negotiating with creditors, and managing debt strategically.

- Ongoing Monitoring and Updates: These apps continuously monitor your credit report. They alert you to changes that may affect your score, helping you maintain good credit health.

| Feature | Benefit |

|---|---|

| Comprehensive Credit Report Analysis | Uncover the root causes of your credit challenges and identify areas for improvement |

| Personalized Recommendations | Receive tailored strategies to address negative items and boost your credit score |

| Continuous Monitoring and Alerts | Stay informed about changes in your credit profile and take proactive steps to maintain a healthy credit score |

Credit repair apps offer powerful credit report analysis capabilities. They help you improve your financial well-being proactively. With their help, you can achieve the credit score you deserve.

“Empowering individuals to take control of their financial future through comprehensive credit report analysis and personalized repair strategies.”

Choosing the Right Credit Repair App: Key Factors to Consider

Credit repair apps can boost your credit score effectively. Picking the right app is crucial for your financial needs. Let’s explore key factors to find the perfect app for your financial freedom journey.

Finding the Perfect Fit for Your Unique Needs

To choose the best credit repair app, evaluate these factors:

- Comprehensive credit monitoring: Look for an app that provides real-time updates on your credit score, as well as detailed insights into the factors affecting it.

- Dispute management: Efficient dispute resolution is a hallmark of effective credit repair apps. Ensure the app you select simplifies the process of challenging inaccuracies on your credit report.

- Personalized guidance: The best apps offer personalized recommendations and strategies to help you improve your credit score and maintain financial health.

- Transparent pricing: Compare the pricing structures of various apps to find one that fits your budget and provides value for your investment.

- User-friendly interface: An intuitive and easy-to-navigate app will make your credit repair journey more seamless and engaging.

These key factors will help you pick the right credit repair app. You’ll find one that supports your financial goals best.

The app you choose should empower you to take control of your credit profile. It will guide you towards better financial health.

| Feature | App A | App B | App C |

|---|---|---|---|

| Credit Monitoring | ✓ | ✓ | ✓ |

| Dispute Management | ✓ | ✓ | ✓ |

| Personalized Guidance | ✓ | ✓ | – |

| Pricing | $9.99/month | $14.99/month | $7.99/month |

| User-friendly Interface | ✓ | ✓ | – |

“Choosing the right credit repair app can be a game-changer in your financial journey. By taking the time to evaluate the key features and your unique needs, you can find a solution that empowers you to improve your credit score and achieve your goals.”

Success Stories: Real People, Real Results with Credit Repair Apps

Credit repair apps have helped many people boost their credit scores. These apps empower users to take charge of their financial futures. Let’s look at some inspiring success stories.

Sarah, a young professional, once had a low credit score. She used a credit repair app to spot and challenge errors on her report. Her score improved quickly, helping her get a better car loan rate.

“The credit repair app was a game-changer for me. It provided the tools and guidance I needed to take control of my credit and achieve my financial goals.”

John, a small business owner, faced loan rejections due to poor credit. He used a credit repair app to address his credit issues. After a few months, John’s credit score improved significantly.

These stories show how credit repair apps can change lives. They offer personalized insights and tools to help users improve their finances. Both individuals and business owners can benefit from these innovative solutions.

Conclusion: Embracing Credit Repair Apps for Financial Empowerment

Credit repair apps are powerful tools that can transform your financial well-being. These innovative solutions help you take control of your credit. They address past financial challenges and build a brighter financial future.

These apps provide real-time insights and dispute resolution assistance. They offer strategies to boost your credit score. Through proactive monitoring, they help you navigate credit management with confidence.

Credit repair apps can be a game-changer for financial empowerment. They unlock doors to better loan rates and improved insurance premiums. These tools enhance access to essential financial services.

By using credit repair apps, you can achieve your personal and professional goals. Take the first step towards financial freedom and prosperity. Embrace the power of these apps for a secure financial future.