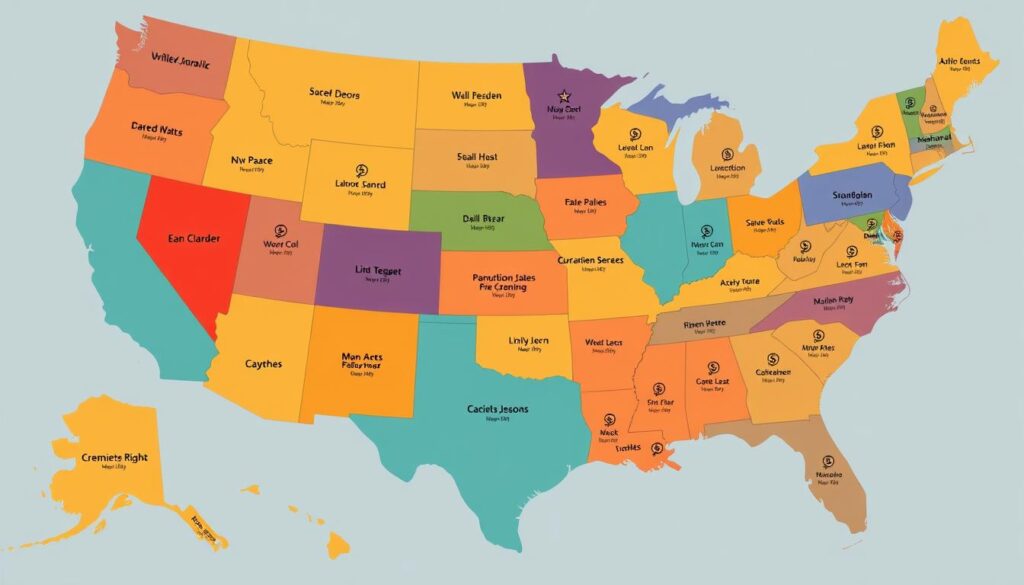

Credit repair laws vary across states, making the process complex. Understanding these laws is vital for improving your credit profile. This article explores credit repair regulations in the United States.

We’ll cover federal and state-specific credit repair rights. You’ll gain knowledge to effectively address credit issues in your state.

Key Takeaways

- Understand the variations in credit reporting regulations across different states

- Familiarize yourself with the important FCRA guidelines that apply to credit repair nationwide

- Discover your state-specific credit repair rights and dispute resolution procedures

- Learn about the licensing requirements for credit repair companies operating in your area

- Gain insights on navigating the credit repair process and identifying reputable service providers

Understanding Credit Repair Laws By State

Credit repair rules vary across states. Knowing these state-specific credit reporting laws is vital for improving credit scores. Understanding local state credit laws helps individuals take proper steps during credit repair.

These laws affect your credit repair rights. They guide you through the process of fixing your credit. Learning about them ensures you make informed decisions.

Variations in Credit Reporting Regulations

Each state has unique laws for credit reporting and repair practices. Some states enforce stricter rules for credit reporting agencies. Others offer more comprehensive consumer protections.

Staying informed about these differences is crucial. It helps you understand your rights and responsibilities better. This knowledge empowers you during the credit repair process.

Importance of Knowing Local Credit Laws

Understanding your state’s credit repair laws is key to successful credit repair. These laws set timelines for resolving credit disputes. They also limit fees credit repair companies can charge.

Local regulations outline steps for addressing credit report errors. Knowing these rules helps you navigate credit repair more effectively. It enables you to make smart choices throughout the process.

| State | Key Credit Reporting Regulations | Unique Consumer Protections |

|---|---|---|

| California | Requires credit reporting agencies to investigate disputes within 30 days | Allows consumers to sue credit reporting agencies for negligence |

| Texas | Mandates credit repair companies to register with the state | Prohibits credit repair organizations from charging upfront fees |

| New York | Imposes strict limits on the types of fees credit repair companies can charge | Requires credit repair firms to provide consumers with a written contract detailing their services |

“Understanding the nuances of state-specific credit laws can empower consumers to take control of their credit and achieve their financial goals.”

The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) sets rules for credit reporting and dispute resolution. It protects consumers by ensuring fair and accurate credit reporting practices. This federal law applies to credit bureaus and lenders nationwide.

Federal Guidelines for Credit Reporting

The FCRA requires credit reporting agencies to follow specific rules. These rules cover how they collect, maintain, and share consumer credit information.

- Verifying the accuracy of credit data before reporting it to lenders and other users

- Implementing procedures to investigate disputes from consumers about their credit reports

- Limiting the types of information that can be included in a consumer’s credit file

- Ensuring that negative information is removed from a credit report after the legally mandated time period

Consumers have the right to access their credit reports for free. They can also dispute any errors they find. The FCRA protects individuals’ fair credit reporting rights across the United States.

“The FCRA ensures that credit reporting agencies and lenders follow standardized procedures for credit data collection, maintenance, and dispute resolution.”

The FCRA promotes transparency in the credit reporting industry. It sets credit reporting laws to protect consumers from unfair practices. These rules help keep the credit reporting process fair and accurate.

State Credit Repair Rights

States can create additional credit repair laws beyond federal guidelines. These local regulations offer unique rights and resources for individuals. They help people navigate the credit repair process more effectively.

Credit repair rules can differ greatly between states. It’s vital to know your state’s specific rights. This knowledge helps you tackle issues in your credit profile.

Key State-Level Credit Repair Rights

- The right to access and review your credit report without cost

- Specific timelines for credit reporting agencies to investigate and resolve disputes

- Restrictions on the types of information that can be included in credit reports

- Limitations on the reporting of certain types of negative information, such as medical debt

- Provisions for recovering damages or penalties from credit reporting agencies or creditors for violations

Understanding your state’s credit repair rights is crucial. It helps you use legal protections effectively. You can ensure state credit laws are followed during credit repair.

“Knowledge is power when it comes to credit repair. Understanding your state’s specific rights and regulations can empower you to take control of your financial future.”

| State | Key Credit Repair Regulations |

|---|---|

| California | Requires credit reporting agencies to investigate disputes within 30 days and provide a written response. |

| New York | Prohibits the inclusion of certain types of medical debt in credit reports. |

| Texas | Allows consumers to recover actual damages and attorney’s fees for violations of state credit reporting laws. |

credit repair laws by state

Credit repair rules vary across states. Each state has unique dispute processes and credit score regulations. Knowing these differences is key to successful credit repair.

State-Specific Credit Dispute Processes

Credit dispute steps differ by location. Some states have special procedures for starting a credit dispute. California requires specific forms from credit repair companies.

New York mandates sending disputes via certified mail. Knowing your state’s requirements can make the process easier and more effective.

Credit Score Regulations by State

Credit score calculation and interpretation can vary by state. Some states set minimum credit scores for certain financial transactions. These may include mortgage approvals or insurance premiums.

Florida bans insurance companies from using credit scores as the only factor for rates. Understanding your state’s rules helps you make smart financial choices.

| State | Credit Dispute Process | Credit Score Regulations |

|---|---|---|

| California | Require credit repair companies to provide a specific dispute form | No state-specific credit score regulations |

| New York | Mandates consumers send disputes via certified mail | Prohibits insurance companies from using credit scores as the sole factor in determining rates or coverage |

| Florida | No state-specific credit dispute process | Prohibits insurance companies from using credit scores as the sole factor in determining rates or coverage |

Knowing your state’s credit repair laws, credit dispute process, and credit score regulations helps protect your rights. This knowledge allows you to navigate credit repair more effectively.

Navigating Credit Repair Companies

Choosing the right credit repair company is crucial for improving your credit score. These companies offer services to fix errors on your credit reports. It’s vital to ensure they’re licensed and follow state laws.

Licensing Requirements for Credit Repair Services

Laws for credit repair companies differ across states. Some have strict licensing rules, while others are more relaxed. Research your local laws to find a legally operating credit repair company.

Many states require these companies to get licenses before serving customers. Some demand surety bonds or insurance coverage. Always check a company’s licensing status before hiring them.

- Many states require credit repair companies to obtain a license or registration before offering their services to consumers.

- Some states have additional requirements, such as posting a surety bond or maintaining minimum levels of insurance coverage.

- Consumers should always verify a credit repair company’s licensing status and ensure they are in compliance with applicable state laws.

Understanding licensing rules helps you make smart choices. Work with trusted providers who follow ethical and legal practices. This ensures the best outcome for your credit repair journey.

“Choosing a licensed and compliant credit repair company is essential for protecting your rights and ensuring the best possible outcome for improving your credit.”

Credit History Laws in Your State

Grasping your state’s credit history laws is vital for credit repair. These laws vary by state and affect how credit histories are used. Knowing them helps protect your rights during credit repair.

State laws dictate how long credit info stays on your report. Some states have stricter rules than others. This knowledge helps you spot outdated or wrong information.

Some states limit credit history use in hiring or insurance. These rules protect consumers from unfair practices. Understanding them can be useful in credit repair.

| State | Credit History Retention Period | Restrictions on Credit History Use |

|---|---|---|

| California | 7 years for most negative items | Employers cannot use credit reports for hiring decisions, with some exceptions |

| New York | 6 years for most negative items | Insurers cannot use credit scores to determine insurance rates or eligibility |

| Texas | 7 years for most negative items | No state-specific restrictions on credit history use |

Knowing your state’s credit history laws helps you navigate credit repair better. This knowledge is key to improving your credit score. It ensures you’re on the right track.

Fair Credit Reporting Act (FCRA) Compliance

The Fair Credit Reporting Act (FCRA) sets rules for credit reporting. It protects consumers and guides credit bureaus and financial institutions. The FCRA ensures fair practices in managing credit information.

Consumer Protections Under the FCRA

The FCRA gives consumers important rights and safeguards. These protections help people manage their credit information effectively.

- The right to access their credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion) for free once a year.

- The ability to dispute any errors or inaccuracies found on their credit reports, and have them investigated and corrected by the credit bureaus.

- Limitations on the types of information that can be included in a consumer’s credit report, such as restricting the reporting of outdated negative items.

- Requiring credit bureaus to maintain reasonable procedures to ensure the maximum possible accuracy of the information in consumers’ credit reports.

- Providing consumers with the right to know when their credit report has been used against them, such as in the case of a denied loan or credit application.

The fair credit reporting act safeguards individuals’ credit histories. It ensures credit reporting laws are fair and responsible. Understanding these rights helps consumers navigate credit repair confidently.

Consumers can take proactive steps to maintain their consumer protections. This knowledge empowers them to manage their credit effectively.

| Key FCRA Consumer Protections | Description |

|---|---|

| Free Annual Credit Reports | Consumers have the right to access their credit reports from the three major credit bureaus for free once per year. |

| Dispute Errors | Consumers can dispute any errors or inaccuracies found on their credit reports, which must be investigated and corrected by the credit bureaus. |

| Restricted Information | The FCRA limits the types of information that can be included in a consumer’s credit report, such as restricting the reporting of outdated negative items. |

| Accurate Reporting | Credit bureaus are required to maintain reasonable procedures to ensure the maximum possible accuracy of the information in consumers’ credit reports. |

| Adverse Action Notice | Consumers have the right to know when their credit report has been used against them, such as in the case of a denied loan or credit application. |

Disputing Errors on Your Credit Report

Fixing mistakes on your credit report is vital for credit repair. Each state has its own rules for disputing errors. These include timelines, required documents, and steps for addressing disputes.

State-Specific Dispute Resolution Procedures

The credit dispute process varies across different state credit laws. Understanding your state’s requirements is key to disputing errors effectively.

Important factors include dispute timelines and response periods. You’ll also need to know what documents support your case. Lastly, learn how to file disputes with credit bureaus and creditors.

- Timelines for initiating and responding to disputes

- Documentation required to support your case

- Procedures for filing disputes with credit bureaus and creditors

- Rights and protections afforded to consumers under state laws

Knowing state-specific dispute resolution procedures helps you tackle credit report inaccuracies. This knowledge can improve your overall credit profile.

| State | Credit Dispute Timeline | Required Documentation | Dispute Filing Process |

|---|---|---|---|

| California | 30 days to respond | Copies of disputed items, proof of identity | File disputes directly with credit bureaus |

| Texas | 30 days to respond | Copies of disputed items, proof of identity | File disputes directly with credit bureaus |

| New York | 30 days to respond | Copies of disputed items, proof of identity | File disputes directly with credit bureaus |

Grasping the credit dispute process and state credit laws is crucial. It enables you to address credit report errors effectively. This knowledge can lead to an improved credit profile.

“Protecting your credit reputation is essential in today’s financial landscape. Knowing the state-specific dispute resolution procedures can empower you to take control of your credit history.”

Working with Credit Repair Services

Improving your credit can be challenging. Professional help is available through credit repair companies. Choosing the right one is crucial for success.

Evaluating companies carefully helps you make an informed decision. This increases your chances of achieving better credit.

Evaluating Reputable Credit Repair Companies

When choosing a credit repair service, consider these key factors:

- Licensing and Accreditation: Ensure that the company is licensed to operate in your state and is accredited by reputable organizations, such as the Better Business Bureau (BBB) or the National Association of Credit Services Organizations (NACSO).

- Transparency and Disclosure: Look for a provider that is upfront about their fees, services, and the expected timeline for the credit repair process. Avoid any companies that make unrealistic promises or lack clarity in their communication.

- Track Record and Reviews: Research the company’s history, client testimonials, and success rates. Seek out credit repair companies with a proven track record of helping clients improve their credit scores and resolve disputes effectively.

- Personalized Approach: The best credit repair companies will tailor their services to your specific credit situation and goals, providing a customized plan to address your unique credit challenges.

Carefully assess these factors to find trustworthy credit repair services. Look for companies that can guide you effectively.

Choose a service that aligns with your financial goals. This will help you achieve better credit.

“A good credit repair company should be transparent, proactive, and committed to your long-term financial success.”

Conclusion

This guide has delved into credit repair laws across the United States. You now have the tools to navigate credit repair effectively. Understanding state-specific rules and consumer rights is key.

The Fair Credit Reporting Act (FCRA) provides federal guidelines for credit reporting. It offers basic consumer protections. Many states have added laws to further protect their residents’ finances.

State laws cover credit dispute processes and score regulations. It’s vital to know your local laws’ details. This knowledge helps whether you’re using a company or fixing credit yourself.

Knowing credit repair laws by state and your credit repair rights empowers you. It helps you make smart choices and reach financial goals. Addressing credit report issues can open up new opportunities.