Want to boost your finances and take charge of your credit? Our credit score increase calculator can help. This tool shows how different factors affect your credit score. It also gives tips to improve your creditworthiness.

A good credit score is vital in today’s money world. It matters when you apply for loans, rent homes, or even get jobs. Our calculator helps you understand your credit profile better.

It also teaches you how to raise your score effectively. With this knowledge, you can take control of your financial future.

Key Takeaways

- Understand the key factors that influence your credit score

- Discover personalized recommendations to boost your creditworthiness

- Learn effective strategies to maintain a healthy credit score

- Gain control over your financial future with our credit score increase calculator

- Unlock the benefits of a high credit score, from better loan rates to improved financial opportunities

Understanding Your Credit Score

Your credit score shows how trustworthy you are with money. It ranges from 300 to 850. Lenders use it to decide if they’ll give you loans or credit cards. Knowing about credit score definition and credit scores are calculated helps you boost your finances.

What is a Credit Score?

A credit score is a number that sums up your credit history. The two main scoring models are FICO score and VantageScore. These scores look at your payment history, credit use, and other factors.

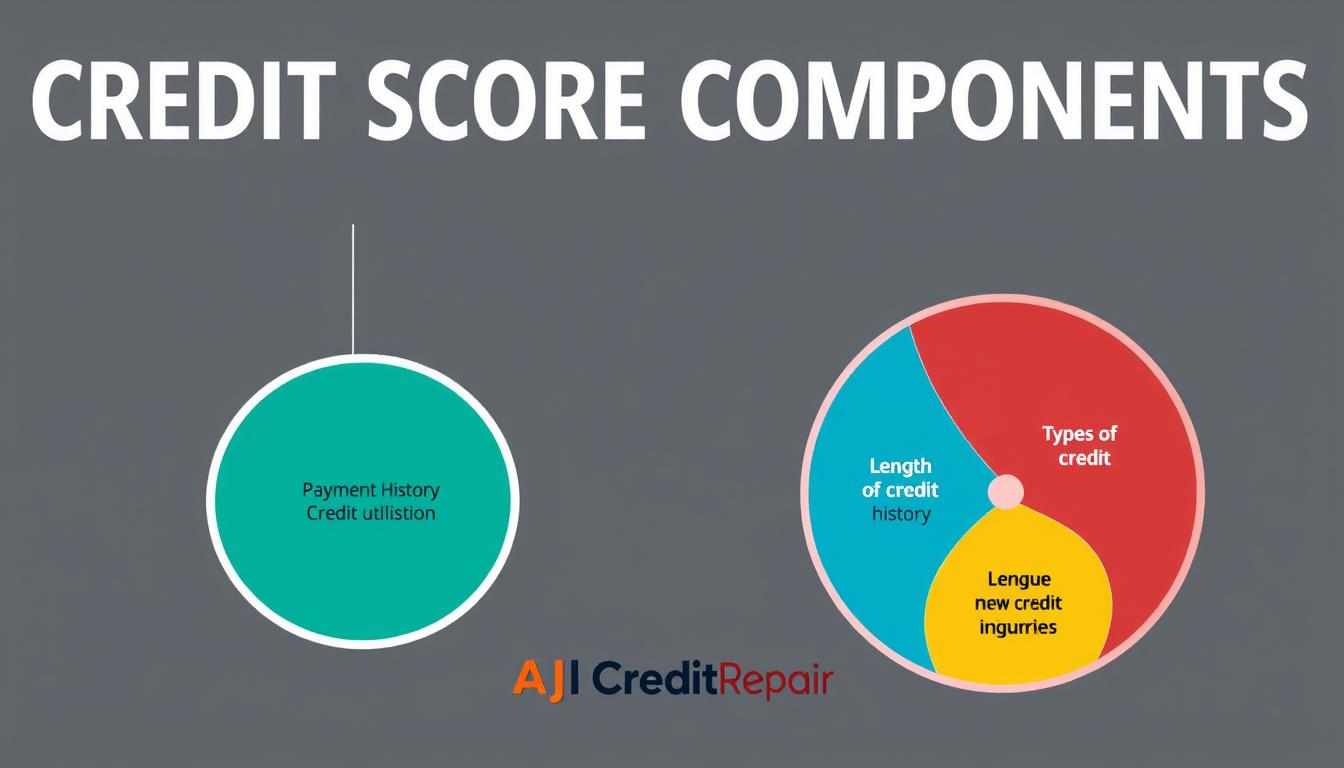

How Credit Scores are Calculated

Credit scores use a complex formula to assess your credit history. The main parts of credit score calculation include:

- Payment history (35% of the score)

- Credit utilization (30% of the score)

- Length of credit history (15% of the score)

- Types of credit used (10% of the score)

- New credit applications (10% of the score)

Knowing these factors can help you make smart money choices. It allows you to improve your financial health over time.

“Your credit score is a window into your financial life, reflecting your creditworthiness and financial responsibility.”

| Credit Score Range | Credit Rating |

|---|---|

| 800-850 | Excellent |

| 740-799 | Very Good |

| 670-739 | Good |

| 580-669 | Fair |

| 500-579 | Poor |

| 300-499 | Very Poor |

Factors that Impact Your Credit Score

Your credit score reflects your financial health. It’s shaped by various factors. Understanding these components can help you improve your financial standing.

Key factors affecting your credit score include:

- Payment History: This is the most crucial factor, making up 35% of your score. It shows how well you’ve paid bills and loans on time.

- Credit Utilization: This is the amount of credit you’re using compared to your limit. Keeping balances below 30% of your limit helps your score.

- Length of Credit History: A longer credit history benefits your score. Lenders see it as a sign of financial responsibility.

- Credit Mix: Having different types of credit accounts shows you can manage various debts responsibly.

- Recent Credit Applications: Too many new credit requests can lower your score. It may signal higher risk to lenders.

By grasping these factors that affect credit score, you can take steps to improve your credit profile.

Knowing these credit score components and credit score determinants helps you maintain healthy credit.

| Factor | Contribution to Credit Score |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| Credit Mix | 10% |

| Recent Credit Applications | 10% |

“Understanding the key components of your credit score is the first step towards building and maintaining a strong financial foundation.”

The Importance of a Good Credit Score

Your credit score greatly affects your financial life. It’s key when applying for loans, renting homes, or seeking jobs. A good score brings many perks, while a bad one can cause problems.

Benefits of a High Credit Score

A high credit score (700+) offers many financial advantages. It can help you get lower interest rates on loans. You may also enjoy better credit card terms.

Good credit can lead to better job and housing options. These benefits can save you money over time. This makes it easier to reach your money goals.

Consequences of a Low Credit Score

A poor credit score can cause serious issues. You might face higher costs when borrowing money. Finding a place to live or a job could be harder.

Bad credit may even increase your insurance costs. These risks of bad credit show why maintaining good credit is vital.

| Benefit of Good Credit | Consequence of Bad Credit |

|---|---|

| Lower interest rates on loans | Higher borrowing costs |

| Favorable credit card terms | Difficulty securing housing or employment |

| Better employment and rental opportunities | Higher insurance premiums |

Your credit score is crucial for financial success. Keeping tabs on it can unlock many opportunities. By improving your credit, you can secure a brighter financial future.

Credit Score Increase Calculator

A higher credit score can greatly impact your financial health. It can help you get better loan rates and improve credit card approvals. The credit score increase calculator is a tool that can help you boost your score.

This calculator estimates how specific actions might affect your credit score. You input details about your current credit profile. Then, it gives personalized advice to help you reach your target score.

A credit score boost calculator can be a game-changer for improving your creditworthiness. It spots weak areas in your credit profile. It also helps you prioritize steps for maximizing your credit score increase.

A credit score improvement calculator is a valuable tool for financial success. It can help you get better loans or credit cards. It’s also useful for improving your overall financial well-being.

| Feature | Benefit |

|---|---|

| Personalized Recommendations | The calculator analyzes your unique credit profile and provides tailored suggestions to boost your score. |

| Projected Score Increase | The tool estimates the potential increase in your credit score based on the actions you take. |

| Tracking Progress | By using the calculator repeatedly, you can monitor your progress and measure the impact of your efforts. |

Take charge of your financial future with a credit score increase calculator. Don’t let a low credit score hold you back. Start improving your score today.

How to Improve Your Credit Score

Boosting your credit score takes time and smart money habits. By using key strategies, you can build a stronger credit profile. Here are some practical tips to help you improve your score.

Pay Bills on Time

Your payment history greatly impacts your credit score. Paying bills on time shows lenders you’re reliable. Set up automatic payments to avoid missing due dates.

Reduce Credit Card Balances

Your credit utilization ratio affects your score. It compares your card balances to your total credit limit. Keep balances low, under 30% of your limit.

This shows lenders you manage credit well. It proves you’re not overspending.

Use these credit score improvement tips and credit building strategies to improve your credit score. They’ll help you access better financial opportunities.

“Developing good credit habits is the key to unlocking a world of financial possibilities.”

| Credit Score Improvement Tips | Credit Building Strategies |

|---|---|

|

|

Using a Credit Score Increase Calculator

A credit score increase calculator helps you understand how to boost your credit score. It analyzes your credit profile, including credit utilization and payment history. By inputting your information, you’ll get personalized estimates for improving your score.

How Does a Credit Score Increase Calculator Work?

When using a credit score increase calculator, you’ll provide details about your current credit situation. This includes your credit score, card balances, and credit limits.

You’ll also need to share the number of credit inquiries on your report. Any late or missed payments in your history are important too.

The calculator will analyze your data and suggest steps to increase your credit score. These may include paying down balances or reducing credit inquiries. You’ll learn specific actions to improve your overall financial well-being.

“A credit score increase calculator can be a game-changer for anyone looking to improve their financial health.”

Strategies for Boosting Your Credit Score

Improving your credit score is key to financial stability. Paying bills on time and reducing credit card balances are essential. However, there are other methods to boost your score.

One approach is becoming an authorized user on someone else’s credit card. This can significantly impact your credit score.

Becoming an Authorized User

As an authorized user, the primary cardholder’s account history affects your credit report. This benefits you if they have a long, positive history and low credit utilization.

Piggybacking on good credit can potentially boost your score. It’s especially helpful for those with limited credit history.

- By piggybacking on the primary cardholder’s good credit, you can potentially see a boost in your credit score and improve your credit score improvement methods.

- This strategy can be especially advantageous for individuals with a limited credit history or those looking to strategies to boost credit score.

- However, it’s important to note that the primary cardholder’s credit management habits will also impact your credit score as an authorized user. Ensure that the primary cardholder has a strong, responsible credit history before becoming an authorized user to maximize the authorized user credit score benefits.

Becoming an authorized user can be a valuable tool for boosting your credit score. Understanding these methods helps you build a stronger credit profile.

Implement these strategies wisely to improve your overall financial well-being. Every step counts towards a healthier credit score.

Monitoring Your Credit Report

Monitoring your credit report regularly is crucial for a healthy credit score. By reviewing it closely, you can spot errors or suspicious activities. This proactive approach helps address issues quickly and ensures accurate credit information.

A thorough credit report review helps catch and fix inaccuracies. These may include wrong account details, false late payments, or identity theft. Staying vigilant allows you to take swift action and protect your finances.

Checking your report often reveals areas for improvement. You might find ways to lower card balances or enhance payment history. Addressing these factors can strategically boost your credit score and open up financial opportunities.

- Regularly review your credit report to check for errors or suspicious activity

- Correct any inaccuracies in your credit report to ensure it reflects your true creditworthiness

- Identify areas for improvement, such as reducing credit card balances or improving payment history

- Take proactive steps to maintain a healthy credit report and boost your credit score

Make credit report monitoring a habit to stay on top of your finances. This practice can help improve your credit score over time. A good credit history unlocks better loan rates and increased access to credit.

Tips for Maintaining a Healthy Credit Score

A good credit score brings many rewards. Responsible credit habits can keep your score strong. Let’s explore some key strategies for maintaining a healthy credit score.

Avoid Applying for Too Much Credit

Too many credit applications can hurt your score. Each application causes a hard inquiry on your credit report. This can lower your score temporarily.

Only apply for credit when necessary. Space out your applications over time to minimize impact.

Keep Credit Card Balances Low

Your credit utilization ratio is crucial for your credit score. It compares your used credit to your total available credit.

Try to keep your credit card balances below 30% of your limit. This shows lenders you can manage credit wisely.