Creditdetailer has been a top credit repair service for years. Now, many new options have emerged for consumers seeking financial wellness. This guide explores the best Creditdetailer alternatives to help you manage your credit reports effectively.

We’ll examine features, pricing, and user experiences of various services. Our goal is to assist you in finding the ideal solution for your financial health needs.

Key Takeaways

- Discover alternative credit repair services that may better fit your needs and budget.

- Explore financial management tools and identity theft protection solutions as Creditdetailer alternatives.

- Understand the benefits and features of top Creditdetailer alternatives to make an informed decision.

- Compare cost and pricing structures of various Creditdetailer alternatives.

- Learn how to choose the right alternative for your specific financial situation and goals.

What is Creditdetailer?

Creditdetailer is a top credit repair service. It helps people boost their credit by fixing errors on reports. This credit repair service uses smart tactics to raise credit scores.

Understanding the Popular Credit Repair Service

Creditdetailer finds and disputes credit report disputes that hurt credit score improvement. The company works hard to fix these errors. This leads to a more accurate Creditdetailer overview.

Creditdetailer offers credit monitoring and identity theft protection. They also create custom credit repair plans for each client. This approach helps people take charge of their credit.

Clients can work towards their desired credit score improvement. Creditdetailer’s complete services make this possible.

“Creditdetailer has been a game-changer for me. They were able to identify and resolve several inaccuracies on my credit report, leading to a significant boost in my credit score. I highly recommend their services to anyone looking to improve their financial standing.”

Creditdetailer has expert credit advisors who are committed to customer satisfaction. They’ve become a trusted credit repair services provider. Creditdetailer empowers clients to manage their credit and reach financial goals.

Why Consider a Creditdetailer Alternative?

There are compelling reasons to explore other credit repair options. These include personalized services, cost-effective solutions, and providers that align with your specific needs. Alternatives can address your unique financial situation and credit profile better.

Creditdetailer’s one-size-fits-all approach may not meet your specific challenges. Alternative credit repair options can provide customized support to improve your credit standing. They offer tailored solutions for your unique needs.

Creditdetailer’s services may not fit your budget. Cost-effective credit management solutions can offer similar or better results at lower prices. This makes it easier to control your finances without overspending.

Your individual needs and preferences should guide your choice. Personalized credit solutions can address current challenges and set you up for future success. The right provider can make a big difference in your financial journey.

Your credit journey is unique. The right Creditdetailer alternative can help you achieve your financial goals. Research and compare options to find the best fit for your needs and budget.

Top Creditdetailer Alternatives Worth Exploring

Looking for reliable, cost-effective alternatives to Creditdetailer? Several options can help you regain control of your finances. These services offer user-friendly tools and affordable solutions for credit management.

Reliable and Cost-Effective Options

The market offers many Creditdetailer alternatives for various budgets and credit repair needs. These services provide credit report monitoring, dispute management, and personalized guidance.

Options range from established leaders like Credit Karma and Lexington Law to innovative newcomers such as Credit Saint. Each offers unique features to help you navigate credit repair.

- Credit Karma: A free service offering detailed credit reports, score tracking, and personalized recommendations for credit improvement.

- Lexington Law: A reputable company using licensed attorneys to challenge credit report inaccuracies and negotiate with creditors.

- Credit Saint: A user-friendly service with affordable monthly plans, expert support, and a money-back guarantee.

These alternatives prioritize transparency, customer service, and value. They’re compelling choices for those seeking to boost their credit standing.

“Regaining control of your credit has never been easier, thanks to the innovative Creditdetailer alternatives available in the market.”

Creditdetailer Alternative: A Comprehensive Guide

Managing your credit can be tough. Creditdetailer is popular, but other options exist. Let’s explore Creditdetailer alternatives, their services, pricing, and user experiences.

Credit Saint offers personalized service and clear pricing. Lexington Law employs legal pros to boost credit scores. Sky Blue Credit provides an affordable, user-friendly option.

Compare features, services, and reviews of these alternatives. This will help you choose the best fit for your finances.

Exploring the Creditdetailer Alternative Landscape

The credit repair market offers many Creditdetailer alternatives. These range from industry leaders to innovative startups. They cater to various needs and budgets.

Key factors to consider include credit analysis and dispute management. Look for personalized strategies and transparent pricing. User-friendly tech and good support are also important.

- Comprehensive credit analysis and dispute management

- Personalized credit-building strategies

- Transparent pricing and cost-effectiveness

- User-friendly technology and customer support

- Proven track record of successful credit score improvements

Evaluate these factors to find the best comprehensive Creditdetailer alternative guide. This will help with your credit repair service comparison and financial management solution reviews.

“Choosing the right Creditdetailer alternative can be a game-changer in your financial journey. It’s about finding a solution that not only delivers results but also provides the support and guidance you need.”

Explore all available options for credit management. Pick one that matches your needs and goals. The right guide can help you control your finances.

With effort, you can achieve the credit score you want. Take charge of your financial future today.

Choosing the Right Alternative for Your Situation

Finding the best Creditdetailer alternatives requires careful thought. Consider your credit goals, budget, and support needs. This approach helps you find a personalized credit management solution that fits your unique situation.

Factors to Consider for a Seamless Transition

When looking for Creditdetailer alternatives, keep these factors in mind:

- Credit Repair Expertise: Evaluate the alternative’s track record and the team’s expertise in resolving credit issues and improving credit scores.

- Personalized Approach: Look for a solution that offers a tailored experience, addressing your specific credit needs and goals.

- Transparent Pricing: Understand the pricing structure and any hidden fees to ensure you’re getting the best value for your investment.

- Customer Support: Assess the availability and responsiveness of the alternative’s customer support team, as they will be crucial during your transition from Creditdetailer.

- Integration with Credit Bureaus: Ensure the alternative has established relationships and seamless integration with the major credit bureaus for effective credit monitoring and dispute resolution.

These factors to consider Creditdetailer alternative will guide your decision. They’ll help you pick the right personalized credit management solution. You’ll enjoy a smooth transition from Creditdetailer to your new choice.

DIY Credit Repair: A Viable Creditdetailer Alternative

DIY credit repair offers a cost-effective way to manage your credit. It’s an empowering alternative to services like Creditdetailer. You can tailor the process to your specific needs.

DIY credit repair lets you manage your credit without professional services. This approach saves money and allows active participation in improving your credit profile. With the right tools, you can dispute errors and negotiate with creditors.

To begin DIY credit repair, follow these steps:

- Obtain and review your credit reports from the three major bureaus.

- Dispute any errors with the credit bureaus, providing supporting documentation.

- Create a plan to address outstanding debts and negative items.

- Develop good credit habits, like timely payments and low credit card balances.

- Regularly monitor your credit reports for accuracy and new issues.

DIY credit repair requires more effort than hiring a professional service. However, the long-term benefits can be substantial. You can improve your credit score and secure better financing options.

“Empowering yourself through DIY credit repair can be a transformative experience, putting you in the driver’s seat of your financial future.”

Credit management without professional services may have challenges. With the right strategies and dedication, you can achieve credit improvement and financial freedom.

Creditdetailer Alternative for Businesses

Creditdetailer mainly serves individual consumers. However, alternatives exist for businesses. These options offer tailored credit management services for enterprises. They address the unique needs of corporate clients.

Tailored Solutions for Corporate Clients

Unlike Creditdetailer’s approach, these alternatives understand corporate credit management complexities. They offer customized credit repair solutions for enterprises. Their services are designed to meet specific business needs.

- Comprehensive credit analysis and monitoring for businesses

- Corporate credit management services to help maintain and improve the credit profile of the company

- Tailored dispute strategies to address any discrepancies or errors in the business’s credit reports

- Personalized guidance and support to navigate the credit repair process for enterprises

These alternatives recognize that Creditdetailer alternative for businesses needs a specialized approach. They provide expert resources to help corporate clients achieve credit-related goals.

| Feature | Creditdetailer | Creditdetailer Alternative |

|---|---|---|

| Target Audience | Individual consumers | Businesses and corporate clients |

| Credit Management Approach | One-size-fits-all | Customized and tailored solutions |

| Credit Repair Strategies | General dispute tactics | Specialized dispute strategies for enterprises |

| Ongoing Support | Limited assistance for consumers | Comprehensive guidance and support for corporate clients |

Corporate clients can find customized credit repair solutions for enterprises through these alternatives. These options help manage and improve credit profiles effectively. They support the long-term financial health and success of organizations.

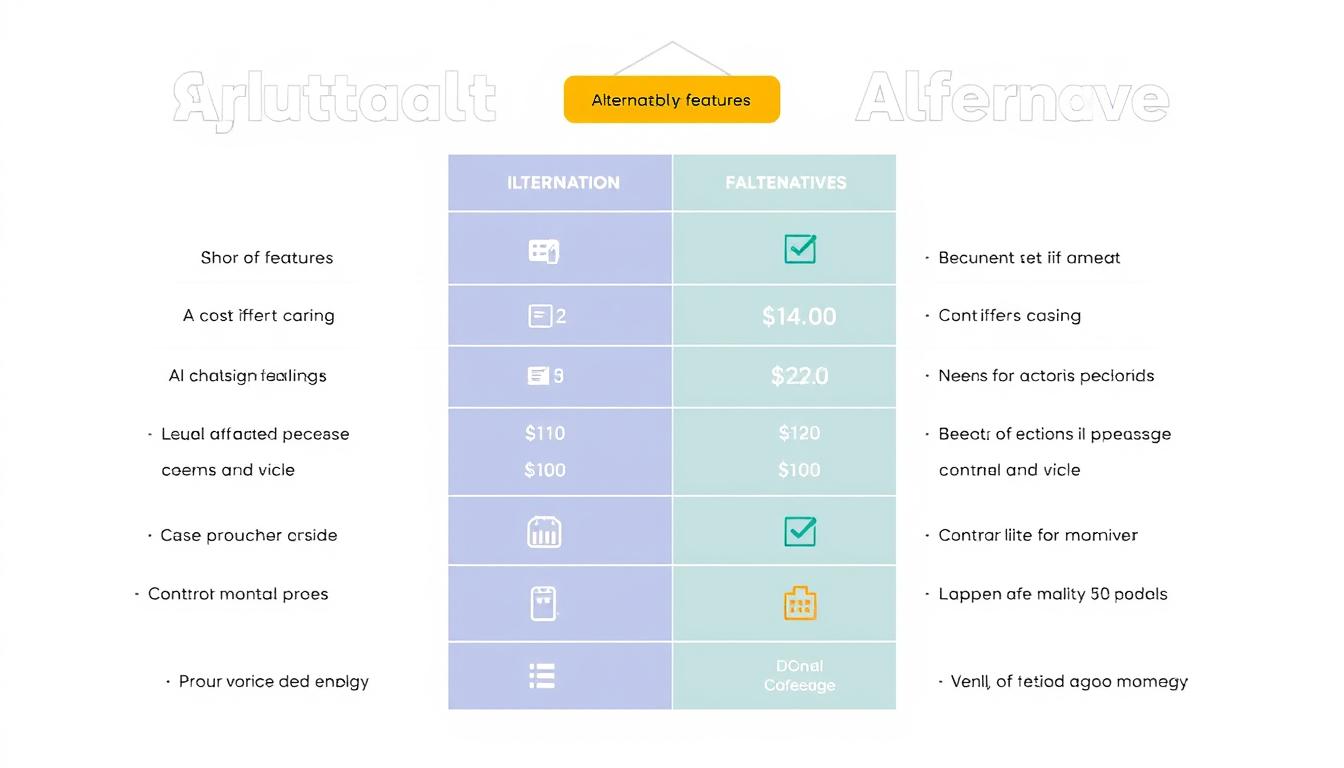

Comparing Cost and Features of Top Alternatives

Finding the best Creditdetailer alternative requires comparing costs and features. This guide will help you make an informed decision aligned with your budget and goals.

Let’s examine the pricing of top Creditdetailer alternatives. CreditFix offers a monthly subscription starting at $99. CreditAssist provides a budget-friendly option starting at $59 per month.

For businesses, CreditBoost offers tailored solutions with pricing based on specific organizational needs.

| Service | Monthly Cost | Key Features |

|---|---|---|

| CreditFix | $99+ |

|

| CreditAssist | $59+ |

|

| CreditBoost (for businesses) | Customized |

|

Features and services are crucial factors to consider. Some providers focus on basic credit repair. Others offer comprehensive tools including credit monitoring and identity theft protection.

Evaluate these factors to find a solution that fits your budget and needs.

“By comparing the cost and features of Creditdetailer alternatives, you can find a budget-friendly solution that delivers the credit management support you need.”

Your choice should be based on your specific requirements and financial constraints. Consider the level of service you expect from a Creditdetailer alternative.

A thorough comparison will help you make an informed decision. Take steps towards improving your credit health and financial well-being.

Conclusion: Finding the Best Creditdetailer Alternative for You

Choosing a credit management solution can feel overwhelming. But don’t worry! By evaluating your needs and budget, you can find the perfect fit. The right tool will help improve your financial well-being.

There are many options available. Lexington Law offers comprehensive services. DIY approaches provide user-friendly solutions. Business-focused tools cater to specific needs. Pick the one that matches your goals and situation.

Remember, there’s no one-size-fits-all solution for better credit. Take time to explore the alternatives presented here. By choosing wisely, you’ll take control of your financial future.