Healthcare costs can be confusing, especially when it comes to hospital and physician bills. These bills differ in structure, coding, and fees. Understanding these differences can help you manage your healthcare expenses better.

By learning about hospital and physician billing practices, you can navigate the healthcare system more effectively. This knowledge may also help you find ways to save money on medical costs.

Key Takeaways

- Hospital and physician medical bills have distinct billing practices, coding, and fee structures.

- Understanding the differences can help patients better manage their healthcare costs and identify potential areas for savings.

- Hospital chargemaster rates and physician fee schedules play a significant role in determining the final costs.

- Surprise medical bills and balance billing practices can significantly impact patient costs, making price transparency a crucial concern.

- Navigating complex medical bills and understanding Explanation of Benefits (EOBs) can help patients make informed decisions about their healthcare spending.

Understanding Medical Billing Practices

Healthcare billing can be complex and confusing for patients. It’s important to understand hospital and physician billing differences. These differences can greatly impact patient costs.

Hospital Billing vs. Physician Billing

Hospitals use a “chargemaster” system for pricing medical services and supplies. Physicians use standardized Current Procedural Terminology (CPT) codes for billing.

Hospital bills cover a wide range of charges. These include room and board, nursing care, and diagnostic tests. Physician bills focus only on professional services provided.

The Impact on Patient Costs

- Hospital billing practices can lead to higher overall costs for patients. Chargemaster rates are often inflated compared to actual service costs.

- Physician billing is more transparent and predictable. It uses established CPT codes, helping patients understand potential out-of-pocket expenses.

- Medical coding complexities can cause variations in patient costs. Incorrect coding or billing errors may result in unexpected charges.

Knowing about hospital and physician billing helps patients make informed healthcare decisions. It allows them to manage medical expenses effectively. Patients can better advocate for their financial well-being with this knowledge.

Hospital Chargemaster Rates

Hospital chargemaster rates are a key factor in medical billing confusion. A chargemaster lists prices for hospital services and supplies. These rates are often inflated and vary across healthcare facilities.

The chargemaster is the starting point for medical billing. However, its lack of standardization makes it hard for patients to understand healthcare costs.

Hospital chargemaster rates can vary widely, even for the same procedure or treatment. This makes it difficult for patients to compare prices and make informed decisions about their care.

The opacity of hospital chargemaster rates hinders healthcare price transparency. This issue has gained attention as healthcare costs rise. Patients and policymakers are pushing for greater transparency to empower consumers.

“The lack of transparency around hospital chargemaster rates is a significant contributor to the overall complexity of medical billing and the difficulties patients face in understanding the true costs of their healthcare.”

Understanding hospital chargemaster rates is crucial for navigating the healthcare system. It helps in advocating for more affordable and transparent medical services. By addressing this issue, we can work towards a fairer healthcare system.

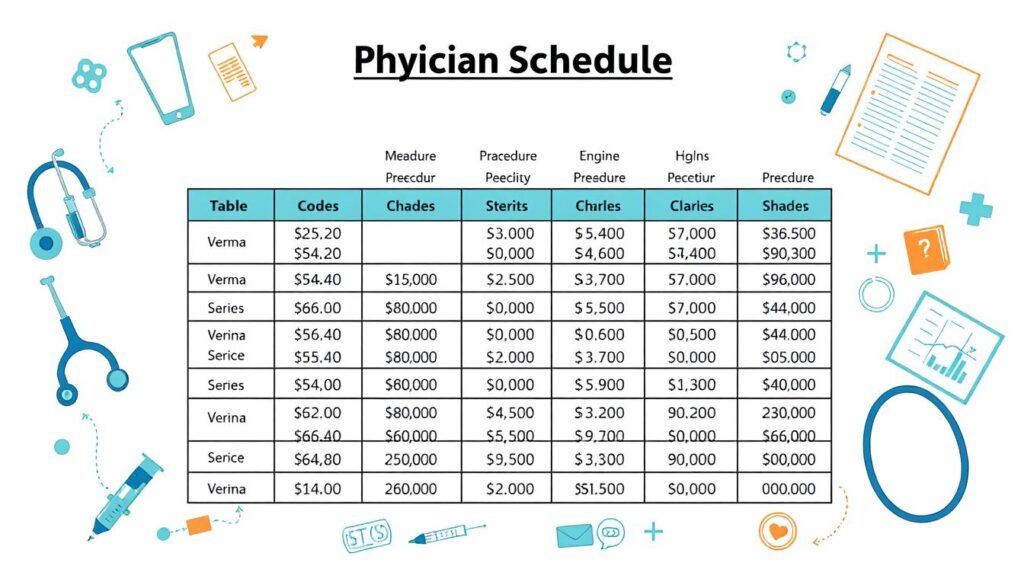

Physician Fee Schedules

Physician fee schedules are vital in medical billing. They set reimbursement rates for healthcare services. These schedules list fees for medical procedures, tests, and consultations.

Both Medicare and commercial insurance providers use these schedules. They ensure fair payment for healthcare services.

Medicare Physician Fee Schedule

The Medicare Physician Fee Schedule is created by the Centers for Medicare and Medicaid Services. It lists fees for Medicare-covered healthcare services. The schedule updates yearly.

It aims to provide fair reimbursement for physicians treating Medicare patients. Factors like time, skill, and resources are considered when setting fees.

Commercial Insurance Fee Schedules

Private insurance companies have their own commercial insurance fee schedules. These are negotiated with healthcare organizations. They often differ from Medicare rates.

Commercial fee schedules impact patient costs. They determine how much patients pay out-of-pocket for medical services.

| Procedure | Medicare Rate | Commercial Insurance Rate |

|---|---|---|

| Office Visit (Level 3) | $74.16 | $120.00 |

| Colonoscopy | $642.46 | $1,200.00 |

| Hip Replacement Surgery | $13,205.46 | $30,000.00 |

This table shows how rates differ between Medicare and commercial insurance. The gap can greatly affect patients’ out-of-pocket costs.

Understanding these differences is crucial. Patients should know their insurance coverage and applicable fee schedules.

Differences Between Hospital And Physician Medical Bills

Medical billing is complex. Understanding hospital and physician bills is crucial for patients. These bills differ in structure and impact on patient finances.

Hospital and physician charges are determined differently. Hospital chargemaster rates are often higher than physician fee schedules. This can lead to significant cost differences in care.

| Hospital Billing | Physician Billing |

|---|---|

| Based on hospital chargemaster rates | Based on physician fee schedules |

| Includes facility fees and other overhead costs | Focused on professional services and procedures |

| May have higher overall costs | Generally lower overall costs |

Hospital bills include facility fees, room charges, and overhead costs. Physician bills focus on professional services and procedures. This results in higher costs for hospital-based care.

Knowing these differences helps patients make informed healthcare decisions. It allows them to manage medical expenses effectively. Patients can navigate the healthcare system better with this knowledge.

Medical Coding and Billing

Medical coding and billing are vital in healthcare. They ensure accurate reimbursement and patient care. These practices bridge medical procedures and healthcare finances.

Inpatient vs. Outpatient Coding

Inpatient and outpatient coding affect final medical bills differently. Inpatient coding applies to hospital stays requiring overnight admission. Outpatient coding covers treatments without admission.

Coding assigns specific codes to medical diagnoses and procedures. These codes use ICD and CPT systems. They convey the nature and complexity of healthcare services.

| Inpatient Coding | Outpatient Coding |

|---|---|

| Focuses on the patient’s primary diagnosis and any complications or comorbidities that may have arisen during the hospital stay. | Concentrates on the specific procedures and services performed during the outpatient visit, such as diagnostic tests, consultations, and minor surgical interventions. |

| Often results in higher reimbursement rates due to the increased complexity and resource utilization involved in inpatient care. | Generally leads to lower reimbursement rates, as outpatient services are typically less resource-intensive. |

| Requires detailed documentation of the patient’s condition, treatment, and outcomes. | Relies on accurate coding of the specific procedures and services provided during the outpatient visit. |

Grasping inpatient and outpatient coding differences is crucial. It ensures accurate billing and proper reimbursement. Correct coding impacts final medical bills and overall patient healthcare costs.

Healthcare Revenue Cycle Management

Healthcare revenue cycle management (RCM) is crucial for providers to get paid for their services. It involves several steps in billing, collecting, and managing payments for medical care.

RCM starts with patient registration and checking insurance eligibility. Next comes accurate coding and documenting services. Then, claims go to insurance providers for reimbursement.

This complex system contributes to the intricacy of medical bills. Both hospital and physician charges follow RCM’s unique processes.

Key Steps in the Healthcare Revenue Cycle

- Patient registration and eligibility verification

- Coding and documentation of services

- Claims submission to insurance providers

- Reimbursement and payment processing

- Accounts receivable management and follow-up

Hospital and physician medical bills differ due to their distinct RCM practices. Hospitals use a complex billing system based on chargemaster rates.

Physician practices often use standardized fee schedules. Understanding these differences helps patients navigate healthcare finances better.

| Hospital Billing | Physician Billing |

|---|---|

| Chargemaster-based rates | Fee schedule-based rates |

| Facility and ancillary service fees | Professional service fees |

| Inpatient and outpatient billing | Outpatient billing |

Knowing about healthcare revenue cycle management helps patients understand their medical bills better. This knowledge empowers them to make smart decisions about their healthcare costs.

Surprise Medical Bills

Surprise medical bills occur when patients get care from out-of-network providers. These unexpected costs can create heavy financial burdens for many people. This issue has become a hot topic in recent years.

Balance billing is at the core of this problem. It happens when out-of-network providers charge patients more than their insurance covers.

Balance Billing Practices

Balance billing can leave patients with large medical bills they didn’t expect. This often happens when patients can’t choose their provider. It’s a common practice that leads to surprise medical bills.

Some states have laws to protect patients from balance billing practices. The federal No Surprises Act also offers nationwide safeguards. However, healthcare complexities and varying state rules still leave patients at risk.

“Surprise medical bills can be a significant financial burden for patients, often leading to difficult choices about their healthcare.”

Knowing about medical billing and surprise medical bills helps patients navigate healthcare better. It allows them to make smart choices about their care. Being aware of these issues and protections can help manage unexpected medical costs.

Healthcare Price Transparency

Healthcare price transparency has become a hot topic recently. Patients want to know more about medical service costs. Healthcare providers are now required to share their standard charges.

This change aims to empower patients. It could also affect the differences between hospital and physician bills.

Hospital Price Transparency Rules

The Centers for Medicare and Medicaid Services (CMS) have created new rules. Hospitals must now publicly show their standard charges for healthcare services.

This includes several types of information:

- Gross charges: The full, undiscounted price for each healthcare service or item

- Payer-specific negotiated charges: The discounted rates negotiated with private insurance companies

- De-identified minimum and maximum negotiated charges: The range of negotiated rates for each service

- Discounted cash prices: The price a hospital offers to patients who pay in cash

These rules aim to help patients make better healthcare decisions. They can now compare hospital and physician medical bills more accurately.

| Key Benefits of Hospital Price Transparency | Potential Challenges |

|---|---|

|

|

Hospital price transparency rules are a big step forward. They empower patients and create a more informed healthcare system.

This change supports a consumer-driven approach to healthcare. It’s part of the ongoing evolution in the healthcare industry.

Navigating Complex Medical Bills

Decoding medical bills can be overwhelming. Understanding Explanation of Benefits (EOBs) can help patients navigate these complexities. EOBs outline medical claim details, including services, approved costs, and patient responsibilities.

Reviewing EOBs helps patients spot potential errors or discrepancies. This ensures they’re not overpaying for healthcare services. It involves understanding codes and terminology used in the document.

EOBs may include details about deductibles, copayments, and insurance coverage. With proper guidance, patients can interpret EOB information effectively. This empowers them to make informed decisions about healthcare expenses.

By staying proactive, individuals can manage their medical bills better. Regular review of EOBs helps avoid unexpected financial burdens. Taking an active role in understanding these documents is crucial.