A good credit score is vital for getting better loan and credit card terms. Many find fixing their credit challenging. This guide will show you how to use DIY credit repair letters effectively.

You’ll learn to dispute errors and talk to creditors using these letters. By doing so, you can remove negative items from your credit report. Taking charge of your credit repair can boost your score and improve your finances.

Key Takeaways

- Understand the impact of credit scores on your financial well-being

- Discover the benefits of taking control of your credit repair process

- Learn about the different types of credit repair letters and their purpose

- Gain a step-by-step guide to effectively preparing and sending your credit repair letters

- Explore the credit dispute process and your rights as a consumer

Understanding the Power of DIY Credit Repair Letters

Your credit score shapes your financial future. It affects loans, credit cards, housing, and employment. Your credit report is crucial in many aspects of life.

DIY credit repair letters offer a cost-effective solution. They let you address inaccuracies in your credit report. This approach empowers you to take control of your finances.

The Impact of Credit Scores on Your Financial Well-being

A good credit score opens doors to better interest rates and opportunities. A poor score can limit your financial options. It may lead to higher costs and fewer choices.

Understanding your credit report is key to financial stability. It’s the first step towards achieving your financial goals.

The Benefits of Taking Control of Your Credit Repair Process

- Cost Savings: DIY credit repair letters eliminate the need for costly professional services, empowering you to take charge of your financial future.

- Personalized Strategies: By crafting your own letters, you can tailor your approach to address the specific issues in your credit report.

- Financial Empowerment: Actively managing your credit repair process instills a sense of control and confidence in your financial well-being.

DIY credit repair letters can transform your financial well-being. They help you secure new opportunities. Taking control of your credit repair process paves the way for a brighter future.

Types of Credit Repair Letters

DIY credit repair involves various letters to address inaccuracies and remove negative items. These letters help you exercise your rights under the Fair Credit Reporting Act (FCRA). Let’s explore debt validation letters, goodwill letters, and Section 609 letters.

Debt Validation Letters: Challenging Inaccurate Entries

Debt validation letters are crucial for credit repair. They allow you to request verification of disputed debts on your credit report. By challenging inaccurate entries, you can remove them and boost your credit score.

Goodwill Letters: Appealing for Removal of Negative Items

Goodwill letters help you appeal to creditors to remove negative items. They work best for one-time incidents where you’ve shown responsible credit management. Use them to explain the circumstances behind the negative entry.

Section 609 Letters: Leveraging the FCRA

The Section 609 letter is a powerful tool for credit repair. It lets you request deletion of inaccurate or unverifiable information from your report. Understanding your FCRA rights helps you challenge and remove harmful entries effectively.

Mastering these credit repair letters can transform your financial situation. By addressing inaccuracies and asserting your legal rights, you’ll take control of your credit. This paves the way for a brighter financial future.

Debt Validation Letters: Challenging Inaccurate Entries

Reviewing your credit report is crucial for spotting errors. These mistakes can harm your credit score. Identifying issues helps you take steps to improve your financial standing.

Identifying Potential Errors on Your Credit Report

Examining your credit report starts the debt validation process. Look for errors that may be hurting your credit:

- Accounts that do not belong to you

- Incorrect account balances or payment histories

- Accounts that have been closed but are still reported as open

- Duplicate entries for the same debt

- Accounts with incorrect or outdated personal information

Crafting an Effective Debt Validation Letter

After spotting inaccuracies, draft a detailed debt validation letter. This letter asks credit bureaus and creditors to verify information and fix errors.

Key elements of an effective debt validation letter include:

- Clearly identifying the specific items on your credit report that you are disputing

- Providing a clear explanation of why the information is inaccurate or incomplete

- Requesting that the credit bureaus and creditors investigate the disputed items and provide you with written proof of the validity of the debt

- Emphasizing your rights under the Fair Credit Reporting Act (FCRA) to have inaccurate information removed from your credit report

- Requesting that the credit bureaus and creditors provide you with copies of all documentation related to the disputed items

This process helps you challenge credit report errors effectively. It aids in resolving inaccurate debt validation letters that affect your credit dispute process.

Goodwill Letters: Appealing for Removal of Negative Items

Goodwill letters are a powerful tool in credit repair. They let you ask creditors to remove negative items from your credit report. These items can include late payments or charge-offs.

To write an effective goodwill letter, use a sincere and persuasive tone. Explain why the negative entry happened. Show that you’re committed to managing credit responsibly.

Politely ask the creditor to remove the blemish from your credit profile. Goodwill letters can be a game-changer in your credit repair journey, helping you remove negative entries and improve your overall creditor communication.

“Goodwill letters can be a powerful tool in your credit repair arsenal, allowing you to take control of your financial future.” – Jane Doe, Credit Repair Expert

When writing a goodwill letter, be sure to:

- Clearly explain the reasons for the negative entry, such as a temporary financial hardship or an oversight on your part

- Highlight your history of responsible credit management and your commitment to improving your credit profile

- Politely request that the creditor remove the negative item as a gesture of goodwill

- Provide any supporting documentation or evidence that strengthens your case

A well-crafted goodwill letter can boost your chances of success. It can help remove negative items from your credit report.

This step can significantly improve your financial standing. It empowers you to take control of your credit future.

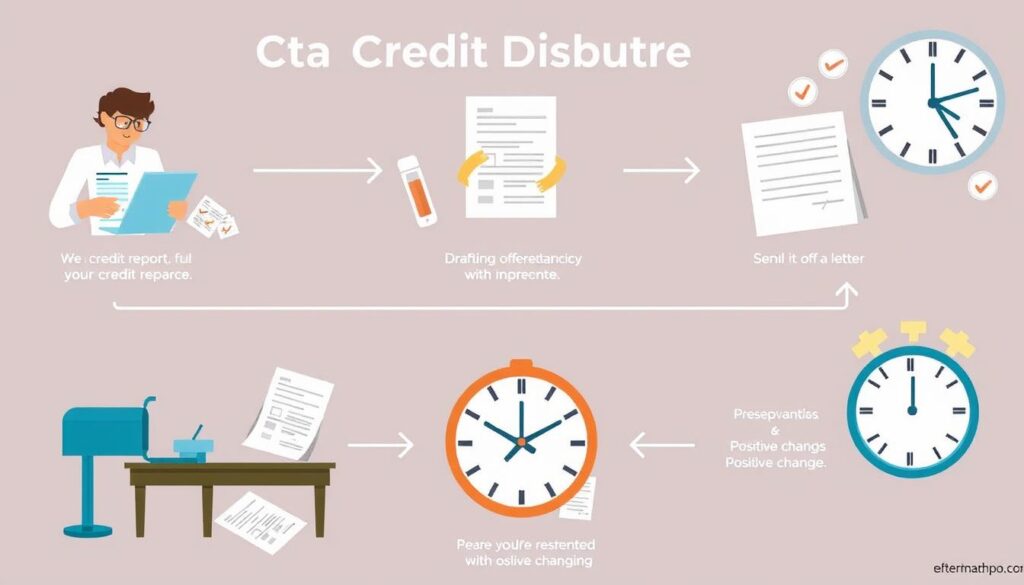

DIY Credit Repair Letters: A Step-by-Step Guide

Boost your credit score with DIY credit repair letters. These can fix errors in your credit reports. Let’s explore how to start this process.

Obtaining Your Free Credit Reports

Start by getting free credit reports from Equifax, Experian, and TransUnion. You can get one free report yearly from each bureau.

Review these reports to spot any issues. This is crucial for improving your credit history.

Analyzing Your Credit Reports for Errors and Discrepancies

Carefully check each report for mistakes. Look for wrong personal info, account details, and unfair negative items.

Make a list or spreadsheet of your findings. This helps track issues and ensures you address everything.

| Credit Bureau | Potential Errors Identified | Negative Items to Address |

|---|---|---|

| Equifax | Incorrect personal information, incorrect account balance | Late payments, collections, charge-offs |

| Experian | Duplicate accounts, incorrect credit limit | Foreclosure, bankruptcy |

| TransUnion | Incorrectly reported closed accounts, incorrect account status | Repossession, tax liens |

Thorough analysis of your credit reports is key. It helps you spot errors and take control of your credit repair process.

Preparing Your Credit Repair Letters

Crafting effective credit repair letters is key to DIY credit repair. These letters express your disputes and requests to improve your credit profile. Well-written letters can help you achieve a favorable outcome and control your financial future.

Understanding the essential parts of a good credit repair letter is crucial. This knowledge will help you create impactful correspondence and boost your chances of success.

Essential Components of an Effective Credit Repair Letter

Successful credit repair letters share key elements that make them impactful and persuasive. Consider these essential components when preparing your credit repair correspondence:

- Clear and Concise Language: Use simple, easy-to-understand words. Avoid technical jargon. Present your case clearly and compellingly.

- Specific Details: Provide exact information about your dispute or request. Include the credit report items needing attention and your reasons for disagreement.

- Polite and Firm Tone: Keep a professional and courteous tone. Assert your rights firmly. Clearly state the actions you expect from the credit bureau or creditor.

- Organized Structure: Structure your letter logically. Include a clear introduction, body, and conclusion. This helps the recipient understand and respond to your case.

- Relevant Legislation: Know the Fair Credit Reporting Act (FCRA) and other relevant laws. Reference them to show you understand your rights.

Include these elements in your credit repair letters for better results. They’ll help you craft persuasive correspondence that addresses errors and disputes effectively.

Your well-crafted letters can increase your chances of fixing negative items on your credit report. This approach empowers you to take charge of your financial future.

Sending Your Credit Repair Letters

Effective credit repair letters are crucial for success. Sending them correctly ensures they reach the right people quickly. Follow these tips to boost your DIY credit repair efforts.

Choose the Appropriate Delivery Method

Certified mail is often the best choice for sending credit repair letters. It provides a paper trail and delivery confirmation. You can also use fax or upload letters through the creditor’s online portal.

Maintain Detailed Records

Keep copies of all letters and supporting documents you send. This helps if you need to follow up later. Good records are key to tracking your credit repair progress.

Follow Up Diligently

Don’t just wait for a response after sending your letters. Stay active in the process. Track your disputes and be ready to follow up if needed.

| Delivery Method | Pros | Cons |

|---|---|---|

| Certified Mail |

|

|

| Fax |

|

|

| Online Portal |

|

|

These best practices will help streamline your credit dispute process. They can improve your chances of success in creditor communication. Following these steps is key to effective credit repair letters.

Following Up on Your Credit Repair Letters

Following up on credit repair letters is vital for success. It ensures timely resolution of credit report issues. Active tracking and communication with creditors and bureaus are key.

Best Practices for Effective Follow-Up

Use these tips to get the best results from your credit repair letters:

- Establish a Tracking System: Record details of each letter sent. Include date, recipient, and issues addressed. This helps you stay organized and track your dispute timeline.

- Request Regular Updates: Contact creditors and bureaus every 30-45 days. Ask politely for written updates on actions taken. Inquire about progress in resolving credit report errors.

- Escalate if Necessary: If responses are slow or unsatisfactory, consider escalating. Contact supervisors or management teams. You can also file a complaint with the CFPB.

- Document Everything: Keep a thorough paper trail of all communications. Save copies of letters, responses, and notes from follow-up calls. This documentation is crucial for potential legal action.

Diligent follow-up on credit repair letters boosts your chances of success. It helps remove inaccurate or unfair negative items. This improves your credit repair letters, credit dispute process, and overall financial health.

Credit Dispute Process: Understanding Your Rights

The credit dispute process protects your financial health. The Fair Credit Reporting Act (FCRA) gives you rights to dispute incorrect information on your credit report.

To start, get reports from Equifax, Experian, and TransUnion. Review them for errors that might hurt your credit score.

Next, follow these steps:

- Identify the specific items you wish to dispute, such as late payments, erroneous account information, or fraudulent activities.

- Prepare a detailed, well-written letter outlining the issues and requesting an investigation by the credit bureau(s).

- Submit your dispute letter, along with any supporting documentation, to the relevant credit bureau(s) within the prescribed timeline.

- Monitor the credit bureau’s response and any updates to your credit report.

Credit bureaus must investigate within 30 days under FCRA rules. They must remove unverified information from your report.

You can request a free report if information is fixed or deleted. Take charge of your finances by understanding your credit repair rights.

Stay persistent when dealing with the credit dispute process. Pay attention to details to ensure your credit report is accurate.

Communicating with Creditors and Credit Bureaus

Good communication is key in credit repair. When talking to creditors and credit bureaus, be professional and polite. This helps address your concerns quickly and effectively.

Maintaining Professional and Courteous Correspondence

When dealing with creditors and credit bureaus, keep these tips in mind:

- Be clear and concise in your writing. Provide all relevant details and documentation.

- Avoid angry or confrontational language, even if you’re frustrated.

- Follow up on your inquiries and requests regularly.

- Keep detailed records of all communications. Include dates, times, and names of people you’ve talked to.

A professional approach helps you navigate the credit repair process effectively. It aids in resolving inaccuracies or negative items on your credit report.

“Effective communication is the key to successfully navigating the credit repair journey.”

Stay positive and proactive when talking to creditors and credit bureaus. With patience and hard work, you can improve your credit score.

Addressing Credit Report Errors and Negative Entries

A healthy credit score is vital for your financial well-being. Fixing credit report errors and negative entries is key to credit repair. Taking action can boost your credit profile and open new financial doors.

Start by reviewing your credit reports from Equifax, Experian, and TransUnion. Look for any mistakes or items that don’t belong. If you find credit report errors, dispute them with the credit bureaus.

Provide proof to support your claims. Gather all relevant info, including account numbers and dates. Write a detailed dispute letter outlining the errors.

Send the letter to the credit bureau(s) and keep track of your correspondence. Follow up to ensure they investigate and make needed corrections.

- Gather all relevant information, including account numbers, dates, and any correspondence with creditors.

- Draft a detailed dispute letter, clearly outlining the errors and requesting their removal from your credit report.

- Submit the dispute letter to the credit bureau(s) and keep track of your correspondence.

- Follow up regularly to ensure the credit bureaus investigate your claims and make the necessary corrections.

Tackling negative entries like late payments or collections requires a different approach. Try negotiating with creditors directly. Propose a settlement or payment plan to remove or reduce damaging items.

| Type of Negative Entry | Negotiation Strategies |

|---|---|

| Late Payments | Offer a lump-sum payment or agree to a payment plan to have the late payment removed. |

| Charge-Offs | Negotiate a settlement agreement to have the charge-off deleted from your credit report. |

| Collections | Attempt to reach a pay-for-delete agreement, where the collection agency agrees to remove the item from your credit report in exchange for payment. |

Fixing credit report errors and negative entries takes time and effort. Stay persistent in your credit repair process. Your hard work will pay off with a stronger credit foundation.

Section 609 Letters: A Powerful Tool for Credit Repair

Section 609 letters can transform your credit repair process. They help address inaccuracies, incomplete info, or unverifiable entries on your credit report. These letters draw power from the Fair Credit Reporting Act (FCRA).

Understanding the Fair Credit Reporting Act (FCRA)

The FCRA is a federal law that sets strict guidelines for credit reporting agencies. It ensures the accuracy and integrity of consumer credit information. Section 609 outlines consumers’ rights to access and dispute their credit reports.

Section 609 letters can make credit bureaus investigate and remove inaccurate information. This can significantly impact your credit score. Better credit opens doors to favorable loan terms and credit card approvals.

| Key Provisions of the FCRA | Relevance to Section 609 Letters |

|---|---|

| Right to access credit reports | Allows consumers to obtain and review their credit reports for errors |

| Dispute process for inaccurate information | Enables consumers to initiate disputes and request the removal of erroneous data |

| Obligation for credit bureaus to investigate and respond | Compels credit bureaus to investigate and provide a response within a specified timeframe |

Understanding Section 609 letters and the FCRA empowers you to control your credit repair. You can build a stronger, more accurate credit profile. This knowledge is a powerful tool for your financial journey.

Building and Maintaining a Healthy Credit Score

A strong credit score is key to your financial health. It shows how trustworthy you are with money. Good credit can lead to better loan terms and job chances.

Here are ways to build a healthy credit score:

- Responsible Credit Utilization: Keep credit card balances under 30% of your limit. This shows lenders you manage debt well.

- Timely Payments: Pay all bills on time. This includes credit cards, loans, and utilities.

- Proactive Monitoring: Check your credit reports often for errors. Use DIY credit repair letters to fix issues quickly.

- Diversifying Credit Mix: Have different types of credit accounts. This proves you can handle various debts responsibly.

- Patience and Persistence: Building great credit takes time. Stick to your plan for better financial health.

Use these tips and DIY credit repair letters to boost your credit score. A good score opens doors to new chances.

It shows you’re good with money. Your future self will thank you for the effort.

| Credit Score Range | Credit Rating | Implications |

|---|---|---|

| 800-850 | Excellent | Qualify for the best interest rates and loan terms |

| 700-799 | Good | Eligible for favorable credit and loan offers |

| 600-699 | Fair | May face higher interest rates and stricter lending criteria |

| 500-599 | Poor | Struggle to obtain credit or secure favorable terms |

| 300-499 | Very Poor | Extremely limited credit options and high-interest rates |

Your credit score can change over time. Focus on good money habits to improve it. Use DIY credit repair letters to fix issues.

Take charge of your finances today. Build a credit profile that leads to a brighter future.

Conclusion: Embrace DIY Credit Repair for Financial Empowerment

DIY credit repair through strategic letters can unlock your financial well-being. By taking control, you can dispute inaccuracies and negotiate with creditors. This approach helps you achieve the credit score you deserve.

Your credit score greatly impacts your financial life. Understanding various credit repair letters is crucial. These include debt validation letters and goodwill appeals.

Our guide provides step-by-step help for credit repair. You’ll learn to communicate with creditors and credit bureaus effectively. This ensures your credit report accurately reflects your financial history.

Take charge of your financial future with DIY credit repair. Persistence and the right strategies can improve your credit score. Better interest rates and financial security await you.

Start your journey to a healthier credit profile today. A strong credit score opens doors to numerous financial opportunities.