Eviction can greatly impact your credit score and financial future. It’s a complex issue with both short-term and long-term effects. Let’s explore how eviction affects creditworthiness and ways to minimize its impact.

We’ll look at strategies to rebuild your credit after an eviction. Understanding these aspects can help you navigate this challenging situation more effectively.

Key Takeaways

- Evictions can have a significant and long-lasting impact on your credit score and credit history.

- An eviction record can remain on your credit report for up to 7 years, negatively affecting your ability to secure future housing, loans, and other financial opportunities.

- Communicating with your landlord, understanding your legal rights, and taking proactive steps can help mitigate the credit impact of an eviction.

- Rebuilding your credit after an eviction is possible through responsible financial management, dispute resolution, and seeking professional credit counseling.

- Preventing eviction in the first place is the best strategy to protect your credit and overall financial well-being.

What is an Eviction and How Does it Work?

An eviction is a legal way for landlords to remove tenants from rental properties. This happens when tenants don’t pay rent or break lease rules. Evictions can create public records and affect credit scores.

Understanding the Eviction Process

The eviction process typically involves the following steps:

- The landlord serves the tenant with a written notice, such as a “pay or quit” notice, informing them of the violation and the deadline to remedy the situation.

- If the tenant fails to resolve the issue, the landlord files an eviction lawsuit with the local court.

- The court schedules a hearing, where both the landlord and the tenant have the opportunity to present their case.

- If the court rules in favor of the landlord, the tenant is ordered to vacate the property within a specified timeframe.

- If the tenant refuses to leave, the landlord can obtain a writ of possession, which allows law enforcement to physically remove the tenant from the property.

Legal Grounds for Eviction

Landlords can legally evict a tenant for a variety of reasons, including:

- Nonpayment of rent

- Violation of the lease agreement

- Illegal activities on the premises

- Expiration of the lease term

- The landlord’s desire to use the property for personal use or a different purpose

Tenants should know their rights and duties under the law. This knowledge can help avoid the negative effects of eviction. Understanding lease terms is crucial for maintaining good tenant-landlord relations.

The Relationship Between Eviction and Credit Scores

Eviction can severely impact your credit score. This crucial factor affects future housing, loans, and financial opportunities. Landlords often report evictions to credit bureaus, which becomes part of your credit history.

An eviction can lower your credit score by 100 points or more. This drop makes it hard to secure housing, get loans, or apply for jobs.

The eviction credit score impact depends on several factors. These include reporting timing, existing credit history, and landlord’s reporting practices. An eviction may stay on your credit report for up to seven years.

“An eviction can have a significant and lasting impact on a person’s credit score, making it more difficult to secure housing, obtain loans, or even find employment in the future.”

Understanding this relationship is vital for tenants facing potential eviction. It’s also crucial for those rebuilding credit after an eviction. Being proactive can help mitigate long-term consequences.

Addressing the issue head-on can lead to a more financially secure future. Take steps to protect your credit score and financial well-being.

does eviction affect your credit

An eviction can severely impact your credit score and financial future. It’s vital to understand these effects if you’re facing eviction. The consequences can be both immediate and long-lasting.

Short-Term Impact on Credit Scores

Evictions are reported to credit bureaus as negative items. This can cause your credit score to plummet by 100 points or more. Such a drop makes it hard to secure housing or get loans.

Long-Term Consequences of Eviction on Credit

Eviction effects don’t fade quickly. They can stay on your credit report for up to seven years. This long-lasting impact can hinder your ability to rent, buy a car, or get a mortgage.

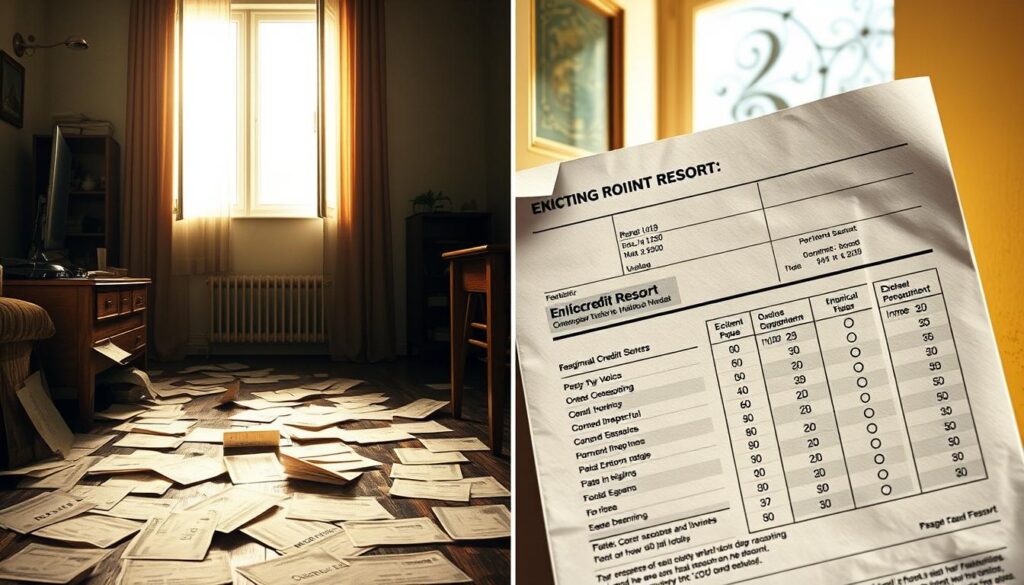

| Impact on Credit | Short-Term | Long-Term |

|---|---|---|

| Credit Score | Immediate drop of up to 100 points | Eviction can remain on credit report for up to 7 years |

| Securing Future Housing | Difficulty renting a new home | Ongoing challenges in finding suitable housing |

| Access to Loans and Credit | Difficulty obtaining loans or credit cards | Continued obstacles in accessing credit and financing |

The effects of eviction on your credit can be far-reaching. It’s crucial to take steps to address the issue and rebuild your credit. Proactive measures can help mitigate these long-term consequences.

Factors That Influence the Credit Impact of an Eviction

Several factors affect how an eviction impacts your credit. Understanding these can help you handle the process better. You can also reduce potential damage to your credit score.

Public Records and Credit Reporting

Public records and credit reporting greatly influence how evictions affect credit. Eviction public records and eviction credit reporting can significantly impact your credit history and score.

Landlords often file eviction notices with local courts. These notices become public records. Credit agencies can access this information and add it to your credit report.

The timing and accuracy of reporting can affect the eviction’s long-term credit impact. Quick reporting may cause an immediate, significant impact on your credit score.

- Timely reporting: If the eviction is reported to credit bureaus soon after the process is completed, the impact on the credit score may be more immediate and significant.

- Inaccurate reporting: In some cases, errors or discrepancies in the reporting of an eviction can lead to a more negative impact on a person’s credit than necessary.

Learn about the eviction process and its documentation. This knowledge can help you manage potential credit consequences. It also helps you take steps to minimize long-term impact.

Eviction and Your Rental History

Your rental history significantly affects your eviction credit impact. An eviction can make finding future housing difficult. Landlords closely examine rental applications, flagging any tenant eviction credit issues.

Getting a new rental after an eviction is challenging. Landlords might avoid tenants with landlord eviction credit history. This can create a cycle where finding housing becomes increasingly hard.

- Landlords may conduct thorough background and credit checks, scrutinizing your rental history for any signs of eviction credit impact.

- Prospective landlords may deny your application or request higher security deposits or monthly rent if they discover an eviction on your record.

- In some cases, an eviction can remain on your rental history for several years, continuing to impact your ability to secure future housing.

Understanding the consequences of rental eviction credit is crucial. Take proactive steps to lessen its impact. Address the eviction on your credit report openly.

Communicate clearly with potential landlords about your situation. This can help in your search for a new home.

“An eviction can leave a lasting stain on your rental record, making it harder to secure future housing. Landlords often view it as a red flag, even if the circumstances were beyond your control.”

Steps to Take After an Eviction

An eviction can be stressful and overwhelming. However, taking proactive steps can help address the issue and rebuild your credit. Understanding the impact and taking action can minimize long-term consequences.

Addressing Eviction on Credit Reports

Start by reviewing your credit report for inaccuracies related to the eviction. Eviction credit repair may involve disputing errors with credit bureaus. This can help reduce the negative impact on your credit score.

Rebuilding Your Credit After an Eviction

After addressing credit report issues, focus on rebuilding your credit. This may involve several steps:

- Establishing a new rental history by finding a new place to live and making timely payments

- Applying for a secured credit card to help build your credit history

- Focusing on making all of your payments on time, including bills and other financial obligations

- Monitoring your credit report regularly to ensure it remains accurate and up-to-date

Eviction credit repair takes time and patience. Significant improvements in your credit score won’t happen overnight. Stay dedicated and consistent to work towards a stronger financial future.

Preventing Eviction and Protecting Your Credit

An eviction can harm your credit score and history. But you can take steps to prevent it and safeguard your credit.

Communication with Your Landlord

Talk openly with your landlord to prevent eviction. If money’s tight, reach out right away. Explain your situation and explore options, such as a payment plan, to resolve the issue before it escalates.

Your landlord might work with you if you’ve been reliable. Document all interactions and agreements with your landlord.

Addressing Rental Assistance and Legal Aid

- Explore rental assistance programs in your area that may be able to help cover rent payments or provide other financial support.

- Seek legal aid if you believe your landlord is not following proper eviction procedures or if you have a valid defense against the eviction.

Act quickly to avoid eviction. Working with your landlord can help protect your credit. This approach can lessen the impact on your eviction credit impact, eviction credit score, and eviction credit history.

Understanding Tenant Rights and Legal Protections

Tenants facing eviction must know their legal rights and protections. Understanding eviction public records and credit reporting can be challenging. However, being informed empowers tenants to navigate these issues effectively.

Tenants have the right to due process during eviction. Landlords must follow specific legal steps to evict a tenant. This includes serving notice and allowing tenants to address any issues.

If needed, landlords must go through the court system for a formal eviction order. Tenants can defend themselves against eviction and present their case in court.

- Landlords cannot unilaterally change the locks or remove a tenant’s belongings without a court order.

- Tenants have the right to defend themselves against an eviction and present their case in court.

- In some cases, tenants may have legal protections against eviction, such as the right to a reasonable accommodation for a disability or protection under the Fair Housing Act.

Knowing these tenant rights can help lessen the impact of eviction on credit reporting. It also protects overall financial well-being. Armed with knowledge, tenants can take steps to shield themselves from long-term consequences.

“Knowing your rights as a tenant can make all the difference in navigating the eviction process and protecting your financial future.”

Eviction Credit Impact vs. Other Rental-Related Credit Issues

An eviction can severely damage your credit for years. It’s reported as a public record, unlike late or missed rental payments. This makes evictions more visible and impactful on your credit history.

Late payments hurt your credit score less severely. They’re easier to fix over time. An eviction, however, is a formal legal process recorded in public court records.

| Rental-Related Credit Issue | Impact on Credit Score | Duration on Credit Report |

|---|---|---|

| Eviction | Significant drop in credit score | Up to 7 years |

| Late or Missed Rental Payments | Moderate drop in credit score | Up to 7 years |

Evictions and late payments differ in how they’re reported and viewed by lenders. An eviction is seen as a more serious sign of financial trouble. This can make it harder to get future housing or credit.

Knowing these differences helps tenants and landlords navigate credit and rental history. It’s crucial to understand how these issues affect the housing market.

Resources for Tenants Facing Eviction

Eviction threats can be overwhelming. Fortunately, various resources and organizations offer support during this difficult time. They help with legal processes, financial aid, and eviction credit repair.

Legal aid organizations provide free or low-cost representation for tenants. They explain your rights and negotiate with landlords. Some even defend you in court if needed.

Many state and local governments offer rent relief programs. These can help you stay in your home during financial hardships.

Credit counseling services are valuable for those who’ve faced eviction. They advise on addressing credit report issues and rebuilding your score. These experts help create plans for eviction credit repair and financial stability.