Facing an eviction can be a stressful and overwhelming experience for renters. Not only does it disrupt your current living situation, but it can also have long-lasting effects on your ability to secure housing in the future. When you apply for a new rental, landlords often conduct tenant screening and background checks, which include reviewing your rental history and any eviction records associated with your name. Understanding the duration of an eviction record and its impact on your housing application process is crucial for navigating the rental market effectively.

The length of time an eviction stays on your record depends on various factors, such as state laws, the type of eviction, and the landlord’s reporting practices. In most cases, an eviction can remain on your record for several years, making it challenging to find new housing opportunities. However, by familiarizing yourself with the factors that influence eviction record duration and exploring strategies to mitigate its effects, you can take proactive steps to rebuild your rental history and improve your chances of securing a new home.

Key Takeaways

- Eviction records can stay on your rental history for several years, impacting future housing applications

- The duration of an eviction record varies based on state laws, type of eviction, and landlord reporting practices

- Eviction records can appear on credit reports and rental history reports, influencing tenant screening decisions

- Challenging an eviction in court, negotiating with landlords, and seeking professional assistance may help remove an eviction from your record

- Rebuilding your rental history and preventing future evictions are essential for long-term housing stability

Understanding Eviction Records

When a landlord files an eviction lawsuit against a tenant, it creates an eviction record that can have long-lasting consequences for the tenant’s ability to secure housing in the future. These records are often included in tenant screening reports and public court records, which landlords may access when evaluating potential tenants. Understanding what eviction records are and the different types of evictions can help tenants navigate the rental process more effectively.

What is an Eviction Record?

An eviction record is a legal document that shows a landlord has filed an eviction lawsuit against a tenant. This record can appear on tenant screening reports and public court records, making it visible to future landlords when they conduct background checks on potential tenants. Even if the eviction case is ultimately dismissed or resolved in favor of the tenant, the record of the filing itself may still appear on these reports.

Types of Eviction Records

There are several different types of eviction records, each stemming from a specific reason for the landlord initiating the eviction process. Some of the most common types of eviction records include:

- Non-payment of rent: When a tenant fails to pay their rent on time, the landlord may file an eviction lawsuit to remove the tenant from the property.

- Violation of lease terms: If a tenant violates the terms of their lease agreement, such as by having unauthorized pets or causing excessive damage to the property, the landlord may pursue an eviction.

- Illegal activities: Landlords may evict tenants who engage in illegal activities on the rental property, such as drug use or distribution.

The table below summarizes the main types of eviction records and their causes:

| Type of Eviction Record | Cause |

|---|---|

| Non-payment of rent | Tenant fails to pay rent on time |

| Violation of lease terms | Tenant violates the terms of the lease agreement |

| Illegal activities | Tenant engages in illegal activities on the rental property |

Regardless of the type of eviction record, the presence of this information on a tenant screening report or in public court records can make it more challenging for a tenant to secure housing in the future. Landlords may view eviction records as a red flag, indicating a higher risk of problems with the tenant. As a result, understanding the potential impact of an eviction record is crucial for tenants seeking to maintain a positive rental history.

Factors Affecting the Duration of an Eviction Record

The length of time an eviction stays on your record can vary depending on several factors. Understanding these factors can help you better navigate the eviction process and its potential impact on your future housing prospects. Let’s take a closer look at the key elements that influence the duration of an eviction record.

State Laws and Regulations

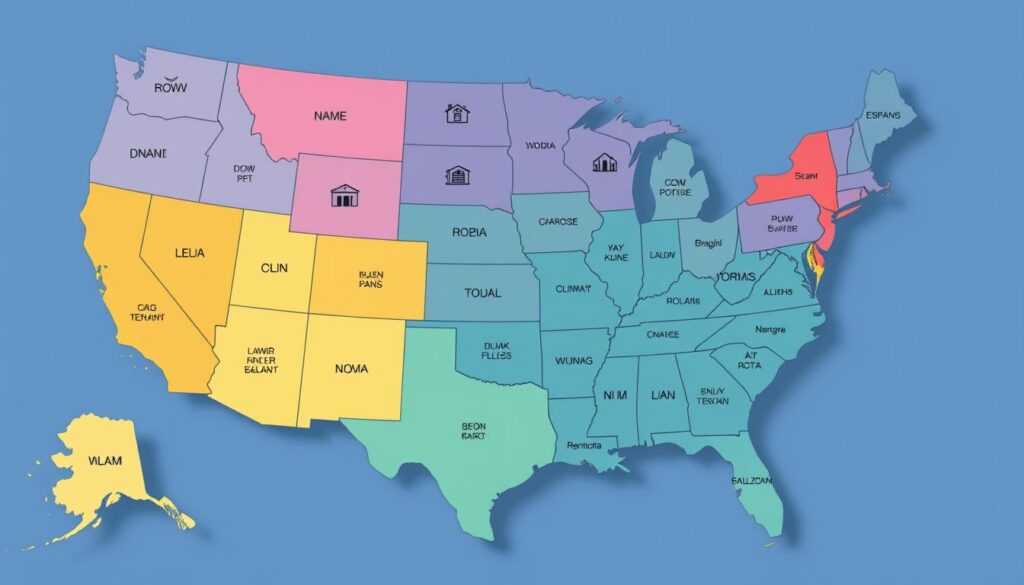

One of the most significant factors determining how long an eviction remains on your record is the state in which the eviction occurred. Each state has its own set of eviction laws and regulations, which can greatly impact the reporting and retention of eviction records. Some states may have shorter reporting periods, while others may allow eviction records to remain on credit reports and rental history reports for extended periods.

For example, in California, eviction judgments can remain on credit reports for up to seven years, while in New York, they may only be reported for up to five years. It’s crucial to familiarize yourself with the specific eviction laws in your state to better understand the potential longevity of an eviction record.

Type of Eviction

The type of eviction you experience can also play a role in determining how long the eviction stays on your record. Evictions resulting from non-payment of rent or violation of lease terms may be treated differently than those stemming from other circumstances, such as property damage or illegal activities.

| Type of Eviction | Potential Impact on Record Duration |

|---|---|

| Non-payment of rent | May remain on record for a standard reporting period (e.g., 7 years) |

| Violation of lease terms | Could lead to a shorter reporting period, depending on severity |

| Illegal activities | May result in longer reporting periods or permanent records |

It’s important to note that the specific impact of eviction type on record duration can vary by state and local jurisdiction. Consulting with a local legal expert or housing advocate can help you better understand the nuances of your particular situation.

Landlord’s Reporting Practices

Landlords’ reporting practices to credit bureaus and tenant screening companies can also influence the duration of an eviction record. While many landlords routinely report evictions to these entities, others may choose not to do so or may only report under certain circumstances.

“The decision to report an eviction often lies with the individual landlord or property management company. Some may prioritize reporting to protect their interests and inform future landlords, while others may opt not to report to avoid potential legal challenges or to maintain a positive relationship with the tenant.” – Sarah Thompson, Housing Advocate

If a landlord does not report an eviction to credit bureaus or tenant screening companies, the eviction may not appear on your credit report or rental history, potentially limiting its long-term impact. However, it’s essential to remember that the absence of a reported eviction does not guarantee a clean rental history, as future landlords may still discover the eviction through other means, such as court records or references from previous landlords.

Credit Reports and Eviction Records

When it comes to understanding how long an eviction stays on your record, it’s crucial to consider the impact on your credit score. Eviction records can appear on your credit report, which is a detailed document that reflects your credit history and financial behavior. The presence of an eviction on your credit report can have a significant negative effect on your credit score, making it more challenging to secure future housing or obtain credit.

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how credit reporting agencies collect, maintain, and distribute consumer credit information. Under the FCRA, eviction records can remain on your credit report for up to seven years from the date of the judgment. This means that even after you’ve resolved the eviction and moved on, the record may still be visible to potential landlords and lenders who review your credit report.

If you discover an inaccurate eviction record on your credit report, you have the right to dispute it with the credit bureaus. The FCRA mandates that credit reporting agencies investigate disputed items and remove any information that cannot be verified or is found to be inaccurate. To initiate a dispute, contact the credit bureau that is reporting the incorrect eviction record and provide supporting documentation to prove your case.

“Regularly reviewing your credit report and promptly addressing any errors or inaccuracies, including eviction records, is essential for maintaining a healthy credit score and improving your chances of securing housing in the future.”

It’s important to note that while eviction records can remain on your credit report for up to seven years, their impact on your credit score may diminish over time. As you take steps to rebuild your credit and demonstrate responsible financial behavior, such as making timely payments and maintaining low credit utilization, the negative effect of an old eviction record may become less significant.

Rental History Reports and Eviction Records

In addition to credit reports, landlords often rely on rental history reports to evaluate potential tenants. These reports provide a comprehensive overview of an applicant’s past rental experiences, including any eviction records. Tenant screening services, which are commonly used by landlords, compile these reports by gathering information from various sources, such as court records and previous landlords.

How Long Do Evictions Stay on Rental History Reports?

The duration of an eviction record on a rental history report can vary depending on several factors, including state laws and the reporting practices of tenant screening services. In most cases, evictions remain on rental history reports for a period of 3 to 7 years. This means that even after an eviction has been removed from your credit report, it may still be visible to landlords who request a rental history report as part of their tenant screening process.

Impact of Eviction Records on Future Rental Applications

Having an eviction record on your rental history report can significantly impact your ability to secure housing in the future. Landlords often view applicants with past evictions as higher-risk tenants, as they may be more likely to default on rent payments or violate landlord-tenant laws. As a result, many landlords may choose to deny rental applications from individuals with eviction records, even if the eviction occurred several years ago.

A recent survey found that 85% of landlords consider eviction records a major red flag when reviewing rental applications.

To minimize the risk of rental application denial due to an eviction record, it is essential to take proactive steps to address the issue. This may involve:

- Providing a written explanation of the circumstances surrounding the eviction

- Offering additional security deposits or rent in advance

- Securing a co-signer or guarantor for the lease

- Demonstrating steady employment and income

- Building a positive rental history by making timely payments and maintaining a good relationship with your current landlord

By taking these steps, you can increase your chances of successfully securing a rental property, even with an eviction record on your rental history report.

How Long Does an Eviction Stay on Your Record?

The length of time an eviction stays on your record can vary depending on several factors, including state laws, the type of eviction, and the landlord’s reporting practices. Understanding the average duration of an eviction record and the potential exceptions can help you navigate the rental market more effectively, especially if you have experienced an eviction in the past.

Average Duration of an Eviction Record

In most cases, an eviction will remain on your record for a period of 3 to 7 years. This timeframe is based on the typical reporting practices of credit bureaus and tenant screening companies. During this period, potential landlords may be able to access information about your eviction history when conducting background checks, which could impact your ability to secure a new rental property.

It’s important to note that even after the eviction record is removed from your credit report or rental history, some landlords may still ask about previous evictions on rental applications. In such cases, it’s crucial to be honest and provide a clear explanation of the circumstances surrounding the eviction, along with any steps you’ve taken to address the issue and improve your financial stability.

Exceptions and Special Cases

While the average duration of an eviction record is 3 to 7 years, there are some exceptions and special cases that may affect how long an eviction stays on your record. These include:

- Eviction record expungement: In certain situations, you may be able to have your eviction record expunged or sealed. This process can remove the eviction from public records, making it less visible to potential landlords. The availability and requirements for eviction record expungement vary by state, so it’s essential to research the specific laws and procedures in your area.

- Eviction moratorium: During the COVID-19 pandemic, many states and local governments implemented eviction moratoriums to protect tenants facing financial hardship. These moratoriums temporarily halted evictions and may have affected the reporting of eviction records during the specified period. As a result, some evictions that occurred during the moratorium may not appear on credit reports or rental history databases.

- COVID-19 eviction protections: In addition to eviction moratoriums, some jurisdictions have introduced special protections for tenants affected by the pandemic. These protections may include programs to help tenants catch up on rent payments, as well as measures to prevent evictions from being reported to credit bureaus or tenant screening companies. If you faced eviction due to COVID-19-related circumstances, it’s worth investigating whether any such protections apply to your situation.

By understanding the average duration of an eviction record and the potential exceptions, you can better assess your rental prospects and take steps to mitigate the impact of a past eviction on your ability to secure housing in the future.

Removing an Eviction from Your Record

If you have an eviction on your record, it can make it difficult to secure housing in the future. However, there are steps you can take to potentially remove an eviction from your record. By understanding your rights as a tenant and exploring various options, you may be able to improve your chances of finding a new place to call home.

Challenging an Eviction in Court

One way to remove an eviction from your record is to challenge the eviction in court. If you believe that the eviction was unjust or that your landlord did not follow proper legal procedures, you may have grounds to appeal the decision. The eviction appeals process varies by state, but generally involves filing a motion with the court and presenting evidence to support your case. If the court rules in your favor, the eviction may be removed from your record.

To challenge an eviction in court, it’s important to gather all relevant documentation, such as your lease agreement, rent payment records, and any correspondence with your landlord. You may also want to consider seeking legal aid from a tenant rights organization or an attorney specializing in landlord-tenant law. They can provide guidance on the eviction appeals process and help you build a strong case.

Negotiating with Landlords

Another option for removing an eviction from your record is to negotiate with your landlord. If you can reach an agreement with your landlord, such as paying any outstanding rent or voluntarily moving out, they may agree to not report the eviction to credit bureaus or rental history databases. This can help prevent the eviction from appearing on your record and damaging your ability to secure future housing.

When negotiating with your landlord, it’s important to approach the conversation calmly and professionally. Explain your situation and express your willingness to find a mutually beneficial solution. If you can demonstrate that you have the means to pay any owed rent or that you’re taking steps to address the issues that led to the eviction, your landlord may be more likely to work with you.

Professional Assistance for Eviction Removal

If you’re struggling to remove an eviction from your record on your own, you may want to seek professional assistance. There are various organizations and services that specialize in helping tenants navigate the eviction process and protect their rights.

Tenant rights organizations can provide valuable resources and support, such as information on state and local landlord-tenant laws, referrals to legal aid services, and guidance on negotiating with landlords. These organizations often offer free or low-cost services to tenants facing eviction or dealing with the aftermath of an eviction.

Legal aid services, such as legal clinics or pro bono attorneys, can provide representation and advice throughout the eviction appeals process. They can help you understand your rights, build a strong case, and navigate the legal system to increase your chances of successfully removing the eviction from your record.

When seeking professional assistance for eviction removal, it’s important to do your research and choose a reputable organization or service. Look for organizations with experience in landlord-tenant law and a track record of helping tenants achieve positive outcomes.

| Option | Description | Benefits |

|---|---|---|

| Challenging Eviction in Court | Appeal the eviction decision by filing a motion and presenting evidence | May result in eviction being removed from record if successful |

| Negotiating with Landlords | Reach an agreement with landlord to prevent eviction from being reported | Can help avoid eviction appearing on record and damaging future housing prospects |

| Professional Assistance | Seek help from tenant rights organizations or legal aid services | Provides guidance, resources, and representation to navigate eviction removal process |

Rebuilding Your Rental History After an Eviction

Recovering from an eviction can be challenging, but it’s not impossible. One of the most effective ways to rebuild your rental history is by securing positive rental references from previous landlords or employers who can vouch for your character and reliability as a tenant. These references can help demonstrate to potential landlords that despite the eviction, you have a history of being responsible and trustworthy.

Another strategy to consider is offering a larger security deposit or finding a co-signer for your lease agreement. By putting more money upfront or having someone with a strong credit history and stable income co-sign your lease, you can show potential landlords that you are committed to being a responsible tenant and mitigating any perceived risks associated with your eviction record.

“Honesty and open communication are key when trying to rent after an eviction. Being upfront about your situation and demonstrating a willingness to work with the landlord can go a long way in building trust and increasing your chances of securing housing.”

When applying for rentals, it’s essential to be proactive, honest, and communicative with potential landlords. Be prepared to explain the circumstances surrounding your eviction and the steps you’ve taken to address any issues that led to it. Demonstrating personal growth, financial stability, and a commitment to being a reliable tenant can help build trust and improve your chances of finding a landlord willing to give you a second chance.

Here are some additional tips for rebuilding your rental history:

- Provide proof of stable income and employment

- Offer to pay rent in advance or set up automatic payments

- Get letters of recommendation from employers, community leaders, or past landlords

- Be willing to compromise on location or amenities to find a landlord open to working with you

Remember, rebuilding your rental history after an eviction takes time and effort, but by being proactive, honest, and persistent, you can eventually overcome this obstacle and secure the housing you need.

Preventing Future Evictions

While having an eviction on your record can be a significant obstacle when seeking new housing, there are proactive steps you can take to prevent future evictions and maintain a stable rental history. By focusing on tenant responsibilities, effective financial management, and utilizing available resources, you can minimize the risk of facing eviction proceedings in the future.

Maintaining Open Communication with Landlords

One of the most crucial aspects of preventing evictions is maintaining open and honest communication with your landlord. If you encounter any issues or concerns related to your rental unit or your ability to pay rent, it’s essential to address them promptly. By keeping your landlord informed and working together to find solutions, you can often avoid escalating problems that could lead to eviction.

Prioritizing Rent Payments

Another key factor in preventing evictions is prioritizing your rent payments. Create a budget that accounts for your monthly rent and other essential expenses, and make sure to allocate your income accordingly. If you find yourself struggling to make ends meet, consider cutting back on non-essential expenses or exploring additional sources of income to ensure you can consistently pay your rent on time.

Seeking Assistance When Facing Financial Hardship

If you find yourself facing financial hardship that threatens your ability to pay rent, don’t hesitate to seek assistance. Many communities offer rent assistance programs, either through local government agencies or non-profit organizations, which can provide temporary financial support to help you stay current on your rent payments. Additionally, some landlords may be willing to work out a payment plan or temporarily defer rent if you communicate your situation openly and demonstrate a commitment to fulfilling your obligations as a tenant.