Monitoring your credit report is vital for financial health. Hard inquiries can hurt your credit score. This guide shows how to remove incorrect hard inquiries fast.

You’ll learn to spot unauthorized inquiries and gather needed documents. We’ll also teach you to dispute them with credit bureaus. This process takes just 15 minutes.

Regular credit report checks help maintain a strong credit score. By following these steps, you can boost your score quickly.

Key Takeaways

- Hard inquiries can negatively impact your credit score

- Identifying unauthorized inquiries is crucial for credit report accuracy

- Gathering proper documentation strengthens your dispute case

- Disputing with credit bureaus can be done in about 15 minutes

- Regular credit report monitoring helps maintain good credit health

- Removing inaccurate hard inquiries can improve your credit score

Understanding Hard Inquiries and Their Impact

Lenders check your credit report when you apply for credit. This process is called a credit check. Let’s explore hard inquiries and their effect on your FICO score.

What is a Hard Inquiry?

A hard inquiry occurs when you submit a credit application. The lender reviews your credit report to make a decision. These inquiries can remain on your report for two years.

How Hard Inquiries Affect Your Credit Score

Hard inquiries can slightly lower your FICO score. The impact is usually minor and temporary. Your score might drop by a few points for several months.

However, don’t stress too much. A single inquiry won’t severely damage your credit.

Difference Between Hard and Soft Inquiries

Credit checks come in two types. Soft inquiries don’t affect your score. These happen when you check your own credit or receive pre-approval offers.

Hard inquiries occur when you actively apply for credit. They can impact your score temporarily.

“Multiple inquiries for auto loans or mortgages within a short time are often treated as one inquiry. This helps consumers shop for the best rates without hurting their credit scores.”

Being aware of hard inquiries helps you manage your credit wisely. Be careful about how often you apply for new credit.

This approach can help maintain a healthy FICO score. Remember, your credit health is in your hands.

The Importance of Monitoring Your Credit Report

Checking your credit report often is key to good money health. It helps you find mistakes and possible fraud early. By being watchful, you can guard against identity theft and keep your report correct.

Each big credit bureau gives you a free yearly report. Use this chance to check how you’re doing with money. Look for strange accounts, wrong balances, or odd actions that might mean identity theft.

Watching your credit score is just as vital. Quick drops could mean fraud. Finding issues early can stop bigger credit troubles later.

Credit monitoring is your first line of defense against financial fraud and errors.

Think about setting up alerts for big changes in your credit report. This active way of watching your credit can save you time and worry.

| Credit Monitoring Benefits | Frequency |

|---|---|

| Detect identity theft | Ongoing |

| Spot credit report errors | Quarterly |

| Track credit score changes | Monthly |

| Prevent financial fraud | Continuous |

By making credit checks a priority, you’re taking charge of your money health. It’s a small time investment that can greatly help your credit and money safety.

Identifying Unauthorized Hard Inquiries

Spotting unauthorized credit checks is vital to prevent fraud and identity theft. Let’s explore how to recognize suspicious inquiries. We’ll also learn how to verify their legitimacy.

Common Signs of Fraudulent Inquiries

Unfamiliar company names on your credit report can be a red flag. Some may be legitimate, while others could indicate unauthorized checks.

Be alert for multiple inquiries in a short time frame. Also, watch for inquiries from companies you’ve never dealt with.

Steps to Verify Unfamiliar Inquiries

If you spot suspicious inquiries, take these steps:

- Contact the company listed on the inquiry for clarification

- Check if the inquiry relates to recent credit applications

- Verify if the inquiry is from a financial service linked to a store credit card

- Look for signs of identity theft, such as accounts you didn’t open

| Inquiry Type | Potential Reason | Action Required |

|---|---|---|

| Car Dealership | Recent vehicle purchase inquiry | Confirm with dealership |

| Mortgage Company | Home loan application | Verify with lender |

| Retail Store | Store credit card application | Check recent purchases |

| Unknown Company | Possible unauthorized check | Investigate immediately |

Stay alert and address unfamiliar inquiries promptly. This helps protect you from credit fraud. It also helps maintain a healthy credit score.

Gathering Necessary Documentation

Collecting the right documents is key when disputing hard inquiries. Get your credit reports from all three major bureaus. These reports help identify errors and build your case.

Gather personal ID documents like your driver’s license and social security card. Include recent utility bills or bank statements to confirm your address.

If you suspect fraud, compile supporting documentation. This may include police reports, identity theft affidavits, or creditor correspondence about unauthorized accounts.

Create a file of all interactions related to disputed inquiries. Save emails, letters, and phone call notes with lenders or credit bureaus. These records can prove invaluable in your case.

| Document Type | Purpose | Examples |

|---|---|---|

| Identification | Prove identity | Driver’s license, passport |

| Address Verification | Confirm current address | Utility bills, lease agreement |

| Fraud Evidence | Support fraud claims | Police reports, affidavits |

| Communication Records | Document dispute process | Emails, letters to creditors |

Make copies of all documents for each credit bureau you’ll contact. Keep originals safe and send only copies. This organized approach helps remove inaccurate inquiries and fix your credit report.

How to Remove Hard Inquiries in 15 Minutes

Removing hard inquiries from your credit report can be quick. This guide shows you how to use the online dispute process. You’ll learn steps for fast credit repair.

Preparing Your Dispute

Check your credit reports for unknown hard inquiries. Find any you didn’t allow. Gather proof that shows the inquiry was made without your permission.

This could include emails with lenders or proof of identity theft. These documents will support your case.

Contacting Credit Bureaus

Go to each credit bureau’s online dispute center. Equifax, Experian, and TransUnion have easy-to-use platforms. Pick the option to dispute a hard inquiry.

Clearly explain why you think the inquiry is wrong. Be brief but thorough in your explanation.

- Select the specific inquiry you’re disputing

- Explain why you believe it’s an error

- Upload any supporting documents

- Submit your dispute

Following Up on Your Request

Mark your calendar for 30 days after you submit. If you don’t hear back, contact the bureau. They might need more info to finish their investigation.

Stay active in your communication for a quick solution. Keep pushing for results.

Persistence is crucial in fast credit repair. Use the online dispute process well. You could remove unauthorized inquiries and boost your credit score quickly.

Disputing Hard Inquiries with Credit Reporting Agencies

Spotting unauthorized hard inquiries on your credit report requires swift action. Filing a dispute with major credit bureaus is your best defense. Let’s explore how to challenge these inquiries effectively.

Contact Experian, TransUnion, and Equifax individually. Each bureau has its own dispute process. Use their online portals or send certified mail requests for a paper trail.

Be clear and concise when filing your dispute. Explain why you believe the inquiry is incorrect or unauthorized. Include supporting documents that back up your claim.

Evidence could include proof of identity theft or that you didn’t apply for the credit.

| Credit Bureau | Online Dispute Center | Mailing Address |

|---|---|---|

| Experian | experian.com/dispute | P.O. Box 4500, Allen, TX 75013 |

| TransUnion | transunion.com/dispute | P.O. Box 2000, Chester, PA 19016 |

| Equifax | equifax.com/personal/disputes | P.O. Box 740256, Atlanta, GA 30374 |

Don’t give up if your initial dispute fails. You can submit more information or escalate your case. Stay proactive by checking your reports regularly and addressing issues promptly.

Addressing Inquiries Resulting from Identity Theft

Identity theft can cause unauthorized hard inquiries on your credit report. Early detection and quick action are vital to safeguard your credit score. Protect your financial health by staying alert.

Recognizing Signs of Identity Theft

Be alert for these red flags:

- Unfamiliar accounts or charges on your credit report

- Unexpected drops in your credit score

- Bills or collection notices for services you didn’t use

- Denied credit applications for unknown reasons

Additional Steps for Fraud-Related Inquiries

If you suspect identity theft, take these steps:

- File an FTC identity theft report at IdentityTheft.gov

- Submit a police report with local law enforcement

- Place a credit fraud alert with all three major credit bureaus

- Contact creditors linked to fraudulent inquiries to close unauthorized accounts

- Consider implementing a credit freeze for extra protection

Swift action can reduce damage and help remove fake hard inquiries. Keep an eye on your credit often. This helps you catch and fix issues quickly.

| Action | Purpose | Time Frame |

|---|---|---|

| File FTC identity theft report | Official documentation of theft | Immediately |

| Place credit fraud alert | Notify potential creditors | 90 days (initial alert) |

| Implement credit freeze | Prevent new account openings | Until lifted by you |

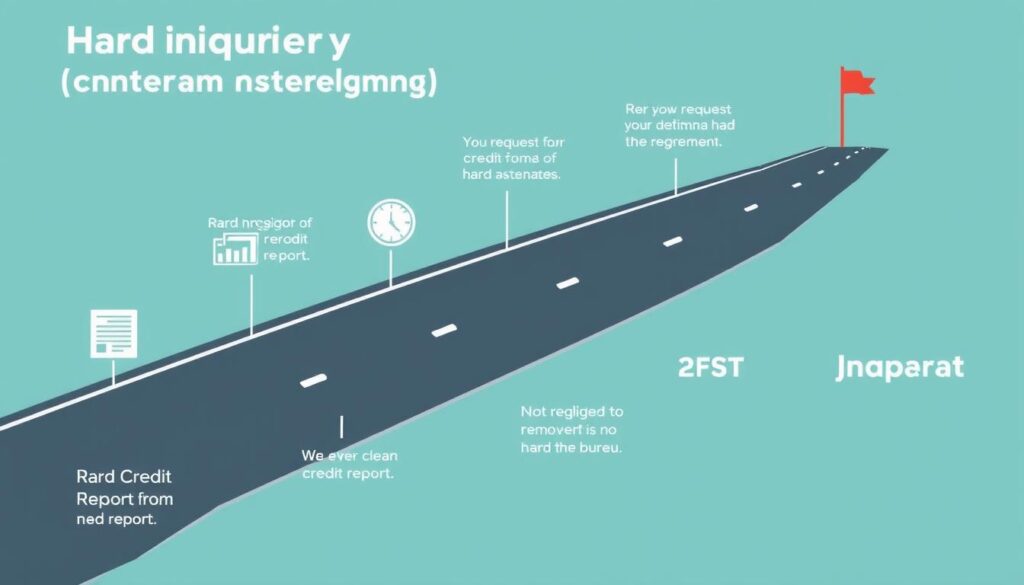

Timeline for Hard Inquiry Removal

Managing your credit report requires knowing how long hard inquiries stay. Credit bureaus take up to 30 days to investigate disputes. They review your claim and check with the creditor during this time.

Valid hard inquiries remain on your credit report for two years. Their effect on your credit score lessens over time. Most scoring models only count inquiries from the last 12 months.

Fraudulent or wrong inquiries should be removed quickly after verification. That’s why you need to check your credit report often. Look for updates after the removal process.

| Timeline | Action |

|---|---|

| Day 1 | Submit dispute to credit bureaus |

| Days 1-30 | Credit bureau investigation period |

| Day 30-45 | Receive results of investigation |

| Day 45+ | Monitor credit report for updates |

The inquiry removal process may take up to 45 days. However, your credit score can improve right away once it’s removed. Regular updates help keep your credit profile accurate.

Checking your report ensures your score shows your true creditworthiness. Stay on top of your credit to maintain a healthy financial profile.

Preventing Future Unauthorized Hard Inquiries

Your credit needs protection in today’s financial world. Taking action can shield you from unauthorized credit applications. Let’s look at ways to stop unwanted hard inquiries on your credit report.

Best Practices for Credit Applications

Be careful when sharing personal info for credit applications. Only give details to trusted financial institutions. Check if the lender is legitimate before applying.

Implementing Credit Freezes and Locks

Credit freezes are a strong defense against identity theft. They stop new accounts from being opened in your name. Contact each credit bureau to set up a freeze.

Credit locks offer similar protection with more flexibility. They allow quicker access to your credit file when needed.

- Set up fraud alerts with credit bureaus

- Regularly review your credit reports

- Use strong, unique passwords for financial accounts

- Be wary of phishing attempts seeking personal information

These practices create a strong defense against unauthorized hard inquiries. Stay alert about your credit status. Act fast if you spot any suspicious activity.

Legal Rights and Protections Regarding Hard Inquiries

The Fair Credit Reporting Act (FCRA) protects consumer rights in credit reporting. It ensures credit bureaus inform you about hard inquiries on your report. Understanding FCRA rights is key to managing your credit profile.

The FCRA allows you to dispute inaccurate information on your credit reports. This includes unauthorized or incorrect hard inquiries. Credit bureaus must investigate your claim and fix any mistakes.

Key consumer rights protected by the FCRA include:

- Free access to your credit report once a year from each major credit bureau

- The right to dispute inaccurate information

- The right to be informed if information in your file has been used against you

- The right to know what’s in your file

Credit laws shield consumers from unfair practices. Understanding these laws helps you control your credit health. It ensures your credit report accurately shows your financial history.

“Knowledge of your rights under the Fair Credit Reporting Act empowers you to maintain a healthy credit profile.”

Knowing your rights is crucial for protecting your credit score. It safeguards your financial well-being. Act on these rights if you spot issues with hard inquiries.

Conclusion

Removing wrong hard inquiries can boost your credit score significantly. Act fast to dispute unauthorized checks on your credit. Regular monitoring helps catch issues early and keeps your credit healthy.

You can’t erase valid hard inquiries, but knowing their impact is vital. Be careful when applying for credit to minimize negative effects. Use tools like credit freezes to protect your score.

Managing hard inquiries is key to financial health. Stay alert and take action to keep your credit score high. This can lead to better loans, lower rates, and more financial opportunities.

FAQ

What is a hard inquiry?

How long do hard inquiries stay on my credit report?

What’s the difference between a hard inquiry and a soft inquiry?

How can I identify unauthorized hard inquiries on my credit report?

What documentation do I need to dispute hard inquiries?

How do I remove inaccurate hard inquiries from my credit report?

What steps should I take if hard inquiries result from identity theft?

How long does it take for credit bureaus to investigate disputes?

How can I prevent unauthorized hard inquiries in the future?

What are my legal rights regarding hard inquiries on my credit report?

Source Links

- Remove Inquiries From a Credit Report in 24 Hours or Less! – https://www.creditrepaircloud.com/blog/remove-inquiries-from-a-credit-report-in-24-hours-or-less

- How to Remove Hard Inquiries from Your Credit Report in 15 Minutes – https://pyramidcreditrepair.com/how-to-remove-hard-inquiries-from-your-credit-report-in-15-minutes/

- How to Remove Hard Inquiries From Your Credit Report – https://www.experian.com/blogs/ask-experian/how-to-remove-hard-inquiries-from-credit-report/

how to remove hard inquiries from my credit report, how to remove hard inquiries from credit report fast, how to remove hard inquiries from credit score, how to remove inquiries from credit report fast, remove inquiries from credit report fast, does credit freeze stop soft inquiries, how do you remove hard inquiries on your credit report, how to remove hard inquiries from credit reports, how to remove inquiries fast, remove credit inquiries in 24 hours, remove hard inquiries fast, remove hard inquiries from credit report, unknown hard inquiry on credit report