A healthy credit score is vital for individuals and businesses. Reporting non-payment to credit bureaus is a key part of credit management. This guide will help you report delinquent accounts accurately.

We’ll show you how to protect your creditworthiness. You’ll learn to ensure your credit reports reflect your true financial standing.

Key Takeaways

- Understand the importance of credit reporting and the role of credit bureaus.

- Learn when to report non-payment and gather the necessary documentation.

- Explore the different methods for contacting credit bureaus and providing the required information.

- Discover the impact of non-payment on credit scores and strategies for credit repair.

- Familiarize yourself with fair debt collection practices and consumer rights.

Understanding Credit Bureaus and Their Role

Credit reporting agencies, or credit bureaus, are vital in the financial world. They collect and store consumer credit information. This includes credit history, credit score, and other financial data.

What are Credit Bureaus?

Credit bureaus gather data on consumer credit activity. They compile information on credit card usage, loan payments, and other financial transactions. Experian, Equifax, and TransUnion are the three major U.S. credit bureaus.

These agencies collect information from various sources. They use data from creditors, lenders, and public records. This helps them create detailed credit reports for consumers.

The Importance of Accurate Credit Reporting

Accurate credit reporting is crucial for consumers. Your credit history and score can affect your ability to get loans and credit cards. It also impacts your chances of getting mortgages and other financial products.

Lenders and creditors rely on credit bureau information. They use it to assess creditworthiness and set loan terms. Inaccurate credit info can lead to unfair treatment and fewer financial opportunities.

Understanding credit bureaus helps consumers take control of their financial health. It allows them to monitor their credit effectively. They can ensure their credit reports are accurate and up-to-date.

When to Report Non-Payment to Credit Bureaus

Reporting non-payment to credit bureaus is crucial for managing delinquent accounts. It helps maintain the integrity of your credit reporting timeline. Understanding when to report protects your business and financial standing.

Generally, report non-payment when an account is 30 days past due. This allows for a grace period while ensuring timely reporting. Delayed reporting can harm your debt collection efforts.

Credit reporting requirements may vary by industry and location. Familiarize yourself with the Fair Debt Collection Practices Act and other relevant laws. These guidelines govern debt collection and credit reporting practices.

| Delinquency Timeline | Recommended Reporting Action |

|---|---|

| 30 days past due | Report non-payment to credit bureaus |

| 60 days past due | Report non-payment and late fees to credit bureaus |

| 90 days past due | Report non-payment, late fees, and potential legal action to credit bureaus |

Timely reporting of non-payment protects your business effectively. It encourages prompt payment from consumers. Following these guidelines helps maintain an accurate credit reporting timeline.

Gathering Necessary Documentation

Proper documentation is key for reporting non-payment to credit bureaus. You’ll need proof of debt and non-payment. Accurate consumer information and contact details are also vital.

Proof of Debt and Non-Payment

Evidence of debt and missed payments is crucial. This includes copies of loan agreements or contracts. Statements showing outstanding balances and missed payments are also important.

Keep records of debt collection attempts. These documents help validate the debt and update credit reports accurately.

- Copies of the original loan agreement or contract

- Statements or invoices showing the outstanding balance and missed payments

- Records of any communication or attempts to collect the debt

This documentation supports the debt validation process. It ensures credit bureaus have the right info to update consumer credit reports.

Consumer Information and Contact Details

Accurate consumer data is crucial for credit reporting. This includes full name, address, and contact details. Keep the most current consumer rights information on file.

Up-to-date info helps credit bureaus identify individuals correctly. It’s essential for compliance with the Fair Credit Reporting Act.

Proper documentation and verified details are the first steps. They help maintain the credit reporting system’s integrity.

“Accurate and complete credit reporting is essential for maintaining a fair and transparent credit system.”

Contacting Credit Bureaus for Reporting

Credit bureaus offer various methods to report non-payment. You can choose online platforms, traditional mail, or third-party services. Each option caters to different preferences and needs.

Different Reporting Methods

The credit bureau reporting process can be initiated through various channels:

- Online Reporting: Many credit bureaus offer user-friendly online portals where consumers can submit their reports of non-payment directly.

- Postal Mail: Consumers can also report non-payment by sending a written letter and supporting documentation to the credit bureaus via postal mail.

- Third-Party Services: There are specialized companies that can assist consumers with the credit bureau disputes and reporting process, handling the communication on their behalf.

Required Information for Reporting

Having the right consumer information accuracy documentation is crucial. This ensures a smooth reporting process.

- Proof of the debt and non-payment, such as billing statements or collection notices.

- Your personal contact details, including your full name, address, and any other relevant identifiers.

- Details about the creditor or company to whom the debt is owed, including their name and contact information.

Providing complete information helps credit bureaus report non-payment accurately. It also helps address potential credit bureau disputes that may arise.

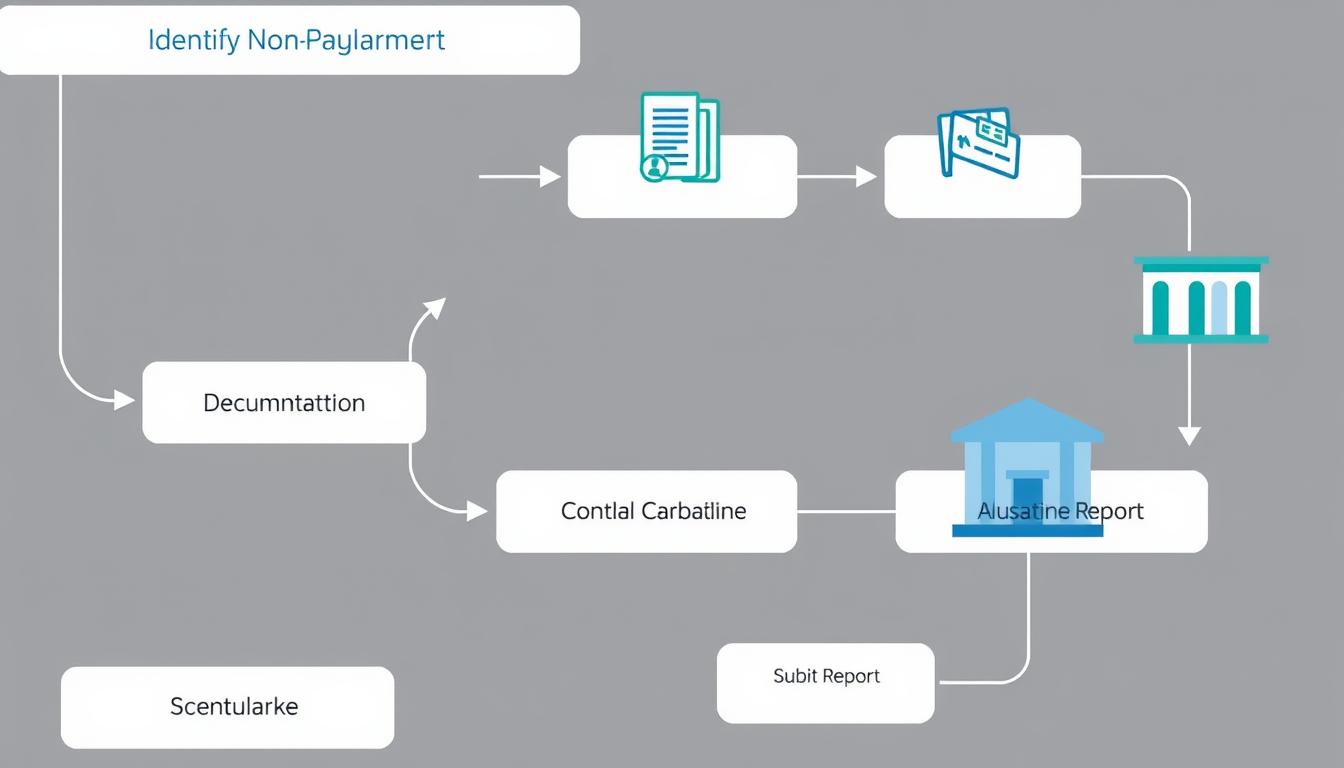

How to Report Non-Payment to Credit Bureaus

Reporting non-payment to credit bureaus helps maintain accurate credit records. This process protects your financial standing and reflects your payment behavior. Let’s explore how to report non-payment to credit bureaus.

Gather Necessary Documentation

First, collect all relevant documentation. This includes proof of debt, like billing statements or contracts. Also, gather evidence of non-payment and any related correspondence.

Contact the Credit Bureaus

Next, reach out to Experian, Equifax, and TransUnion. You can contact them by mail, phone, or online. Be ready to provide customer details and non-payment specifics.

Follow the Credit Bureau Reporting Process

Each credit bureau has its own reporting process. Learn their requirements and follow them carefully. You may need to submit documents, fill out forms, or use online tools.

The credit bureau reporting process helps maintain your credit records’ integrity. It protects your business from financial losses due to non-payment. Understanding how to report non-payment to credit bureau allows you to address delinquent accounts effectively.

“Accurate and timely credit reporting is essential for maintaining a healthy credit profile and protecting your business from financial risks.”

Disputing Inaccurate Credit Reports

Errors on your credit report can harm your financial health. The Fair Credit Reporting Act (FCRA) lets you challenge mistakes on your credit reports. Learn your rights and the dispute process to maintain an accurate credit profile.

Understanding Consumer Rights

The FCRA gives you the right to dispute incorrect or incomplete information. This includes credit bureau disputes, account details, and personal info. Credit bureaus must investigate your dispute and respond in writing.

Disputing Process and Timelines

- Obtain a copy of your credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion.

- Carefully review your reports for any credit report errors or inaccuracies.

- Gather any supporting documentation that proves the information is incorrect.

- Submit your dispute to the relevant credit bureau either online, by mail, or by phone.

- The credit bureau has 30 days to investigate your dispute and provide you with a written response.

- If the credit bureau agrees that the information is inaccurate, they must correct or delete it from your report.

Disputing credit bureau disputes and credit report errors is crucial for your financial health. The Fair Credit Reporting Act protects your consumer rights. By following the proper steps, you can ensure your credit report is accurate.

Impact of Non-Payment on Credit Scores

A healthy credit score is vital for your financial well-being. Non-payment of debts can severely impact your credit score. This can affect your ability to get loans, credit cards, or rent apartments.

Late payments are reported to major credit bureaus like Experian, Equifax, and TransUnion. These delinquent accounts can stay on your credit report for seven years. The longer an account remains unpaid, the more it harms your credit history.

| Credit Score Impact | Delinquent Accounts | Credit History |

|---|---|---|

| A single late payment can cause your credit score to drop by as much as 100 points. | Delinquent accounts can remain on your credit report for up to seven years, making it difficult to secure new credit. | A strong credit history, with on-time payments, is essential for maintaining a high credit score and demonstrating your creditworthiness to lenders. |

Non-payment can have long-lasting effects on your credit score. It’s crucial to make payments on time. Address any delinquent accounts quickly to minimize damage to your credit history.

A good credit score is not just a number – it’s a reflection of your financial responsibility and trustworthiness. Protecting your credit score should be a top priority.”

Understanding non-payment consequences is key to protecting your creditworthiness. Take proactive steps to maintain a positive credit history. This will ensure a brighter financial future and better loan opportunities.

Best Practices for Debt Collection

Debt collection requires ethical and legal practices to protect businesses and consumers. The Fair Debt Collection Practices Act (FDCPA) provides guidelines for fair and responsible debt collection methods.

Fair Debt Collection Practices Act

The FDCPA protects consumers from abusive, deceptive, and unfair debt collection practices. It sets standards for debt collectors to follow when collecting debts.

Key provisions of the FDCPA include:

- Prohibiting the use of threats, harassment, or false representations to collect a debt

- Requiring debt collectors to provide consumers with written notice of the debt and their rights

- Limiting the times and methods by which debt collectors can contact consumers

- Allowing consumers to dispute the validity of a debt and request verification

Following the FDCPA ensures ethical collection practices and protects consumer rights. This safeguards consumers and maintains the credibility of the debt collection industry.

| Best Practices for Debt Collection | Benefits |

|---|---|

| Comply with the Fair Debt Collection Practices Act | Ensures ethical and legal debt collection methods, protects consumer rights, and preserves the credibility of the debt collection industry |

| Communicate clearly and respectfully with consumers | Builds trust, facilitates open dialogue, and increases the likelihood of successful debt resolution |

| Offer flexible payment options and work with consumers | Demonstrates empathy, fosters cooperation, and increases the chances of debt repayment |

| Maintain accurate records and documentation | Supports fair and transparent debt collection practices, and helps resolve disputes |

These best practices help debt collectors fulfill their duties effectively. They also foster positive relationships with consumers. This contributes to the overall well-being of the debt collection industry.

Credit Repair Services and Their Role

Credit repair services help fix errors on credit reports. They offer a thorough approach to credit reporting issues. These services empower consumers to reclaim their financial standing.

Experts review credit reports to spot mistakes. They identify errors ranging from wrong account info to fraud. Their training helps them address these issues effectively.

Credit repair pros work with clients to dispute errors. They know how to file complaints with credit bureaus. This process can be tough for most people, but experts handle it smoothly.

These services also help with other credit problems. They can deal with debt collectors and negotiate with creditors. Their expertise helps consumers build stronger credit profiles.

Credit repair services are valuable for those with report errors. They help protect consumer rights and ensure accurate credit information. Consumers can take charge of their financial future with these professionals.

The Benefits of Credit Repair Services

- Identify and address credit report errors

- Dispute inaccuracies with credit bureaus

- Negotiate with creditors to remove negative items

- Improve credit scores and financial standing

- Provide guidance and support throughout the process

| Service | Description | Potential Benefits |

|---|---|---|

| Credit Report Review | Comprehensive analysis of credit report to identify errors and discrepancies | Improved accuracy and transparency of credit information |

| Dispute Resolution | Assistance in filing disputes with credit bureaus to correct inaccuracies | Removal of negative items and improved credit score |

| Creditor Negotiation | Negotiating with creditors to remove or modify negative items on credit report | Reduced impact of past financial issues on credit profile |

| Credit Monitoring | Ongoing monitoring of credit report to identify and address any new issues | Proactive management of credit health and prevention of future problems |

Credit repair services offer expert help for better credit profiles. They provide tools to achieve financial goals. Consumers can take control of their credit health with these services.

Credit repair services can be a game-changer for individuals struggling with credit report errors or negative items. They provide the knowledge and tools to help consumers reclaim their financial power.”

Conclusion

Reporting non-payment to credit bureaus is vital for a healthy credit profile. It helps protect your financial well-being. Understanding credit reporting agencies and accurate reporting is key.

We’ve covered steps to report non-payment effectively. This includes gathering documents and contacting credit bureaus. We’ve also discussed consumer rights and how non-payment affects credit scores.

Fair debt collection practices are important. Credit repair services can offer potential benefits. Taking action ensures your credit report is accurate.

Accurate reporting can boost your credit score. It may lead to better financial opportunities. Stay proactive in managing your credit.