Decoding healthcare costs can be tricky, especially when looking at itemized medical bills. Understanding charges, codes, and terms may seem puzzling. But with the right know-how, you can manage your healthcare expenses better.

You’ll be able to ensure you’re not overpaying for services. This guide will help you take charge of your medical billing.

Key Takeaways

- Learn to interpret medical billing codes, including CPT and HCPCS codes, to understand the services you received.

- Discover how to decipher hospital charges and identify any potential discrepancies.

- Understand your financial responsibility, including copays, deductibles, and coinsurance.

- Discover how to review your Explanation of Benefits (EOB) and dispute any inaccurate charges.

- Stay informed about healthcare cost transparency initiatives that can help you make more informed decisions.

This guide will empower you to navigate the complex world of medical billing. You’ll learn to decode various charges and understand your financial duties.

We’ll explore strategies for advocating accurate billing. By the end, you’ll have tools to control healthcare costs effectively.

Demystifying Medical Billing Codes

Medical billing can be complex, but understanding key codes is essential. These codes offer a standard way for healthcare providers to communicate services and procedures. They appear on your itemized statements.

Common CPT and HCPCS Codes

The Current Procedural Terminology (CPT) codes are five-digit codes. They describe specific medical, surgical, and diagnostic services performed by healthcare providers.

The Healthcare Common Procedure Coding System (HCPCS) codes serve a different purpose. They identify products, supplies, and services not covered by CPT codes. This includes ambulance services, durable medical equipment, and prosthetics.

Common CPT codes on your medical bills may include:

- 99213 – Office or other outpatient visit for the evaluation and management of an established patient

- 45378 – Colonoscopy, flexible, proximal to splenic flexure; diagnostic, with or without collection of specimen(s) by brushing or washing

- 82310 – Calcium; total

Decoding Diagnosis Codes

Your medical bills also include International Classification of Diseases (ICD-10) diagnosis codes. These codes provide information about your medical condition or reason for visiting. They typically have three to seven characters.

ICD-10 codes offer valuable insights into the healthcare services you’ve received. Here are some examples:

| ICD-10 Code | Description |

|---|---|

| I20.0 | Unstable angina |

| Z00.00 | Encounter for general adult medical examination without abnormal findings |

| E11.9 | Type 2 diabetes mellitus without complications |

Understanding these medical billing codes empowers you to interpret your bills effectively. You’ll gain clarity on the services and procedures you’ve received.

Familiarity with CPT codes, HCPCS codes, and diagnosis codes enhances your healthcare literacy. This knowledge helps you decode medical bills with confidence.

Hospital Charges Explained

Understanding hospital charges is key to managing your healthcare costs. Your medical bill has many parts. Each item shows a specific aspect of your care.

The cost of your hospital room is a main charge. It includes basic amenities, meals, and routine nursing care. These charges can vary based on your room type.

Medications are also listed on your bill. This includes drug costs and supplies for giving them. Labor for administering drugs is part of the charge too.

Specialized services have their own charges. These can be the biggest items on your bill. They reflect the expert skills and equipment needed for advanced treatments.

Knowing your hospital charges helps you manage healthcare costs better. You can spot areas to save money. It also helps when talking to your insurance provider.

Being familiar with your medical bill makes you an informed patient. This knowledge empowers you to handle the complex medical billing system.

Interpreting Itemized Statements

Understanding medical billing is key to ensuring accurate charges. Let’s explore how to interpret itemized statements effectively. We’ll cover service descriptions and comprehending charges and payments.

Identifying Service Descriptions

Itemized statements list the services you received during your healthcare visit. Service descriptions include procedure details, provider names, and service dates. Review these details to verify they match your experience.

Understanding Charges and Payments

Charges on your statement show the total cost of services provided. This includes fees for healthcare providers, facilities, and additional treatments. Review these charges to ensure they align with the services you received.

The payments section outlines insurance coverage and your out-of-pocket expenses. This includes copays, deductibles, and coinsurance. Understanding these elements helps you manage your medical billing effectively.

With knowledge and attention to detail, you can interpret itemized statements confidently. This skill helps you take control of your healthcare costs. Stay informed to ensure accurate billing.

Out-of-Pocket Expenses: Copays, Deductibles, and Coinsurance

Healthcare costs can be complex, but grasping out-of-pocket expenses is crucial. These include copays, deductibles, and coinsurance. They determine your share of medical care costs.

Copays are fixed amounts for specific services, like doctor visits or prescriptions. Deductibles are what you pay before insurance kicks in. Coinsurance is your percentage of costs after meeting your deductible.

| Out-of-Pocket Expense | Definition | Example |

|---|---|---|

| Copay | Fixed amount paid for a specific service | $20 for a doctor’s visit |

| Deductible | Amount paid out-of-pocket before insurance coverage begins | $1,000 deductible for the year |

| Coinsurance | Percentage of the cost you’re responsible for after meeting the deductible | 20% coinsurance for hospital stays |

Knowing these terms helps you calculate your patient financial responsibility. This knowledge empowers you to plan for healthcare costs. You can make smarter choices about medical care and budgeting.

How To Understand Itemized Medical Bills

Understanding itemized medical bills is crucial for managing healthcare costs. By decoding billing codes and charges, you can spot errors and discrepancies. This knowledge helps ensure accurate billing and better control over expenses.

Familiarize yourself with common billing codes used in healthcare. CPT codes describe specific medical services or procedures. HCPCS codes cover additional healthcare items and services.

Recognize different types of charges on your bill. These may include facility fees, professional fees, and ancillary services. Understanding these charges helps assess cost reasonableness and identify potential concerns.

| Billing Code | Description | Average Cost |

|---|---|---|

| 99203 | Office/outpatient visit for new patient, moderate complexity | $110-$150 |

| 82550 | Creatine kinase (CK), (CPK); total | $12-$20 |

| 73700 | Computed tomography, lower extremity; without contrast material | $300-$500 |

Understanding your itemized medical bill empowers you to advocate for yourself. It allows you to negotiate with providers and manage your healthcare costs effectively. This knowledge is key to healthcare cost transparency.

“Knowledge is power when it comes to healthcare costs. Understanding your itemized medical bills is the first step in taking control of your healthcare expenses.”

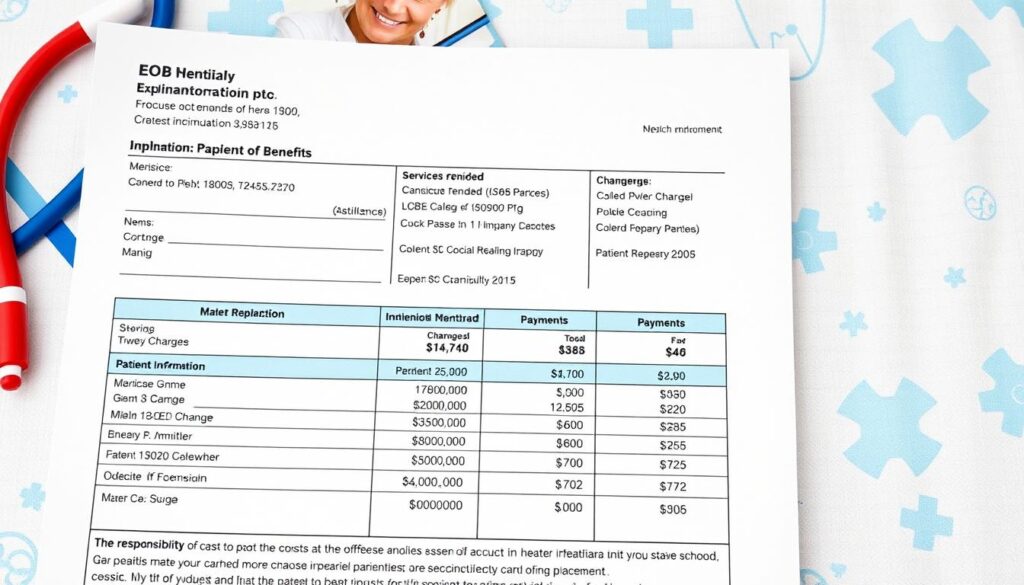

Patient Financial Responsibility

Understanding your healthcare costs is vital. Your Explanation of Benefits (EOB) reveals your share of expenses. Review it to avoid overcharges and manage your healthcare budget effectively.

Reviewing Explanation of Benefits (EOB)

An EOB details your medical claim from your insurance company. It shows services, charges, insurance coverage, and your patient financial responsibility.

This document helps track healthcare expenses. It ensures you’re not billed incorrectly. Reviewing your EOB regularly keeps you informed about your medical costs.

- Carefully review the EOB to understand the charges for each service or procedure.

- Identify your copay, deductible, and coinsurance amounts, as these will determine your out-of-pocket costs.

- Verify that the information on the EOB matches the services you received and the amounts you were billed.

- If you notice any discrepancies or inaccuracies, contact your insurance provider or the healthcare provider to resolve the issue.

| Service | Charges | Insurance Paid | Patient Responsibility |

|---|---|---|---|

| Office Visit | $200 | $150 | $50 |

| Lab Test | $100 | $80 | $20 |

| Prescription | $50 | $40 | $10 |

Reviewing your EOB helps you manage healthcare costs effectively. You can spot and address insurance claims issues promptly. Taking an active role in understanding your bills leads to better financial health.

Disputing Inaccurate Medical Bills

Medical billing can be complex and confusing. Errors and inaccuracies on your itemized bills are possible. You have the right to dispute any charges that seem questionable or incorrect.

Review your medical bills carefully. This helps you identify and address any discrepancies. By doing so, you avoid overpaying for healthcare services.

Appealing Denied Insurance Claims

Appealing denied insurance claims can be daunting. However, it’s crucial to secure the coverage you deserve. Don’t give up if your insurance provider denies a claim.

Start by reviewing the Explanation of Benefits (EOB). This helps you understand why the claim was denied. Follow your insurance company’s instructions to submit an appeal.

Gather all relevant documentation to support your appeal. This includes medical records, treatment plans, and evidence of medical necessity. Consider getting help from a healthcare advocate or attorney.

Disputing bills and appealing claims takes time and effort. But it’s important to avoid overpaying for healthcare. Take a proactive approach and know your rights.

“Addressing inaccuracies on your medical bills can lead to significant savings and ensure you’re not paying for services you never received.”

Healthcare Cost Transparency Initiatives

Healthcare cost transparency has become a crucial concern for patients, providers, and policymakers. New initiatives and regulations aim to empower patients and improve understanding of healthcare costs. These efforts seek to make medical billing more transparent and understandable.

The No Surprises Act is a federal law that prohibits unexpected medical bills. It protects patients from high-cost bills for emergency services and certain non-emergency care. This law aims to eliminate “balance billing” for out-of-network providers at in-network facilities.

Many states have introduced their own healthcare cost transparency laws. These laws require providers and insurers to disclose pricing information openly. Patients can now compare costs for common medical procedures and make informed decisions.

The Hospital Price Transparency rule requires hospitals to publish their standard charges. This includes negotiated rates with insurance companies. Patients can now better understand their care costs and potentially negotiate better prices.

| Initiative | Purpose | Key Provisions |

|---|---|---|

| No Surprises Act | Protect patients from surprise medical bills | Prohibits surprise billing for emergency services and certain non-emergency services at in-network facilities |

| State Healthcare Cost Transparency Laws | Increase pricing transparency | Require providers and insurers to disclose average charges for common procedures |

| Hospital Price Transparency Rule | Mandate hospital price transparency | Requires hospitals to publish standard charges, including negotiated rates with insurers |

These initiatives empower patients and improve medical billing practices. They foster a more transparent healthcare system. Patients can now take an active role in managing their healthcare expenses.

Navigating Medical Billing Challenges

Medical billing can be complex and frustrating. Luckily, there are ways to navigate the healthcare system. As a patient, it’s vital to know your rights and manage your healthcare costs.

Start by reviewing your itemized medical bills carefully. Learn about medical billing codes like CPT, HCPCS, and diagnostic codes. Check if charges match the services you received. If you spot issues, communicate with your healthcare providers for clarification.

Know your health insurance coverage details. This includes deductibles, copays, and coinsurance. Review your Explanation of Benefits (EOB) statements regularly. Make sure your insurance has processed claims correctly.

- Understand your health insurance coverage, including deductibles, copays, and coinsurance, to anticipate your out-of-pocket expenses.

- Review your Explanation of Benefits (EOB) statements to verify that your insurance provider has processed the claims correctly.

- If you encounter any inaccuracies or denied claims, be proactive in appealing the decision with your insurance company.

Use healthcare cost transparency initiatives to your advantage. These can help you understand the true cost of healthcare services. With this knowledge, you can make better decisions about your care.

You are your best advocate for managing healthcare costs. Stay informed and communicate effectively. Use available resources to navigate medical billing complexities. This ensures fair and affordable care.

“Empowered patients are better able to make informed decisions about their healthcare and manage their medical expenses effectively.”

Conclusion

You’ve gained valuable insights into understanding itemized medical bills and healthcare cost transparency. You’re now equipped to decipher hospital charges and interpret itemized statements. This knowledge empowers you to take control of your healthcare expenses.

You’ve learned about out-of-pocket costs, copays, deductibles, and coinsurance. This understanding helps you make informed financial decisions. You now know how to review your Explanation of Benefits (EOB) and dispute inaccurate bills.

Stay informed, proactive, and persistent in managing your medical expenses. Use the tools and strategies from this guide to enhance your understanding. Take an active role in your healthcare journey and make the most of it.