A healthy credit score is crucial for many aspects of life. It affects loan terms, apartment rentals, and even job opportunities. Our guide offers rapid methods to improve your credit rating quickly.

We’ll explore the basics of credit scores and the benefits of instant repair. You’ll learn strategies for disputing errors and negotiating with creditors. We’ll also compare professional services and DIY methods.

This guide will debunk common credit repair myths. You’ll discover your legal rights and protections. We’ll share success stories to inspire your journey to financial empowerment.

Key Takeaways

- Discover effective strategies for instant credit repair to quickly boost your credit score

- Understand the factors that influence your credit score and how to address them

- Explore the benefits of rapid credit improvement and its impact on your financial future

- Learn proven techniques for disputing errors and negotiating with creditors

- Understand the pros and cons of professional credit repair services versus DIY methods

Understanding Your Credit Score

Your credit score is a vital financial measure. Lenders use it to assess your creditworthiness. This three-digit number, from 300 to 850, shows how well you handle debt.

Grasping what affects your credit score is crucial. It helps you build a strong financial base. Your score reflects your ability to manage money wisely.

What is a Credit Score?

A credit score sums up your credit history and risk profile. It’s based on factors like payment history and credit use. Lenders rely on this score to gauge your likelihood of repaying debts.

Factors Affecting Your Credit Score

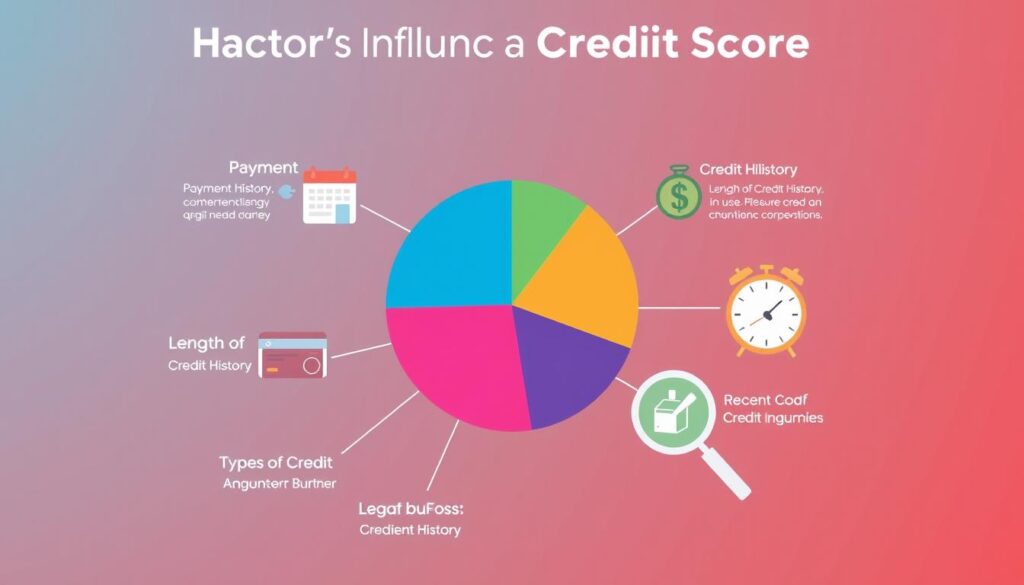

Several key elements influence your credit score:

- Payment History: This is the biggest part of your score. It shows how reliably you’ve paid your credit accounts.

- Credit Utilization: This compares your used credit to your total available credit. Aim to keep this ratio below 30%.

- Credit Mix: Having diverse credit accounts can boost your score. This includes credit cards, loans, and mortgages.

- New Credit: Opening new accounts may temporarily lower your score. It can signal increased credit risk.

- Credit Inquiries: Hard inquiries can slightly lower your score. Soft inquiries, like checking your own report, don’t affect it.

| Factor | Percentage Impact on Credit Score |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit Mix | 10% |

| New Credit | 10% |

| Credit Inquiries | 10% |

“Understanding the key factors that impact your credit score is the first step towards building and maintaining a strong financial profile.”

The Benefits of Instant Credit Repair

Instant credit repair can boost your financial health. A higher credit score opens doors to better loans, credit cards, and insurance rates. It can even improve your job prospects.

Rapid credit improvement helps you qualify for lower interest rates. Lenders see you as a responsible borrower. This leads to better financing terms and significant savings over time.

A strong credit profile can lower your insurance costs. Insurance companies use credit scores to assess risk. Higher scores often result in better rates for auto, home, and life insurance.

Good credit can give you an edge in job hunting. Many employers now check credit histories. A high score shows financial responsibility, making you a more attractive candidate.

“Investing in instant credit repair can open the door to a world of financial opportunities, from lower interest rates to better insurance premiums and improved employment prospects.”

Focusing on credit score improvement unlocks many financial benefits. It impacts loans, insurance, and job opportunities. The advantages of quick credit repair are clear and far-reaching.

Proven Strategies for Rapid Credit Improvement

Boosting your credit score doesn’t have to be overwhelming. With the right approach, you can see quick and significant results. Let’s explore two effective methods to enhance your creditworthiness fast.

Disputing Errors on Your Credit Report

Mistakes on your credit report can hurt your score. Finding and fixing these errors can rapidly improve your credit. The process involves contacting credit bureaus and providing proof to support your claim.

This step-by-step approach can lead to removing credit report errors. As a result, your credit dispute process can significantly boost your creditworthiness.

Negotiating with Creditors

Effective creditor negotiation can be a game-changer for credit repair. You can work with creditors to settle debts or reduce credit utilization.

Another option is becoming an authorized user on someone else’s account. These strategies can quickly enhance your credit score.

| Strategy | Potential Benefits |

|---|---|

| Disputing Credit Report Errors | Removal of inaccurate information, improved credit score |

| Creditor Negotiation | Debt settlement, reduced credit utilization, authorized user addition |

These proven strategies can help you take charge of your credit. By using them, you’ll likely see a quick improvement in your overall creditworthiness.

Instant Credit Repair

Many reputable credit repair companies offer specialized services for quick credit improvements. These include credit dispute assistance, debt management plans, and credit monitoring. They also provide personalized credit-building strategies to boost your credit profile.

Reputable Credit Repair Services

Choose a credit repair service with a proven success record. Look for companies offering a wide range of services.

- Thorough credit report analysis and identification of errors or inaccuracies

- Effective credit dispute assistance to challenge and remove negative items from your credit report

- Personalized debt management plans to help you regain control of your finances

- Ongoing credit monitoring and credit-building strategies to maintain a healthy credit score

These services can help you achieve instant credit repair. They empower you to take control of your financial future.

“Working with a credit repair company was a game-changer for me. They were able to identify and dispute inaccuracies on my credit report, helping me raise my score by over 100 points in just a few months.”

Success in instant credit repair depends on choosing the right partner. Find a trustworthy credit repair company that fits your unique financial needs.

DIY Credit Repair vs. Professional Services

Improving your credit score offers two paths: DIY credit repair or professional services. Each option has its pros and cons. Let’s explore the key factors to help you decide.

Cost-Effectiveness

DIY credit repair can save you money since you don’t pay for services. But it demands more time and effort. Your success rate might be lower than with experts.

Time Commitment

DIY credit repair requires extensive research, disputing errors, and negotiating with creditors. Professional services have the tools to speed up the process. They can often achieve faster results.

Expertise and Success Rate

Credit repair services employ experts who know the credit system inside out. They use proven strategies to boost credit scores. While costlier, their expertise often leads to better outcomes.

| Factors | DIY Credit Repair | Professional Credit Repair Services |

|---|---|---|

| Cost-Effectiveness | More Cost-Effective | Higher Costs |

| Time Commitment | Time-Consuming | More Efficient |

| Expertise and Success Rate | Lower Expertise, Variable Success Rate | Higher Expertise, Potentially Higher Success Rate |

Your choice depends on your budget, preferences, and urgency. Weigh the pros and cons carefully. This will help you boost your credit score effectively.

Credit Monitoring and Maintenance

Keeping a healthy credit score requires ongoing attention and good financial habits. Regular credit monitoring is crucial for long-term improvement. This includes checking your credit reports and tracking changes in your profile.

Establishing Good Credit Habits

Building a strong credit profile involves several key behaviors:

- Making timely payments on all your credit accounts to keep your payment history positive.

- Keeping your credit utilization ratio low by using only a small portion of your available credit limits.

- Diversifying your credit mix by having a variety of account types, such as credit cards, personal loans, and mortgages.

- Limiting the number of new credit applications to avoid multiple hard inquiries that can temporarily lower your credit score.

Consistently practicing these habits ensures your credit score stays strong. It also helps your score improve over time.

| Credit Habit | Impact on Credit Score |

|---|---|

| Timely Payments | Positive |

| Low Credit Utilization | Positive |

| Diverse Credit Mix | Positive |

| Limited New Credit Applications | Positive |

Credit monitoring and maintenance keep your score in top shape. They ensure your credit repair efforts have a lasting impact.

“Maintaining a healthy credit score is a lifelong journey, not a one-time destination.”

Common Credit Repair Myths Debunked

Many myths surround credit score improvement. Let’s uncover the truth behind these misconceptions. We’ll provide facts to help you achieve real, lasting credit score gains.

A common myth is that removing all negative items boosts your score. This isn’t the only solution. Your credit score depends on various factors. These include credit utilization, credit history length, and credit mix.

Another myth suggests closing unused credit cards improves creditworthiness. This can actually harm your score. It may increase your credit utilization ratio and shorten your credit history length.

- Myth: Removing all negative items is the only way to improve your credit score.

- Myth: Closing unused credit cards will boost your credit score.

- Fact: Your credit score is influenced by a variety of factors, including credit utilization, credit history length, and credit mix.

- Fact: Closing unused credit cards can sometimes hurt your credit score by increasing your credit utilization ratio and shortening your credit history length.

Dispelling these credit repair myths is crucial. Focus on strategies that truly improve your credit score. Maintain a healthy credit report and practice responsible credit management.

Legal Rights and Protections

Understanding your legal rights is crucial for instant credit repair. The Fair Credit Reporting Act (FCRA) and Fair Debt Collection Practices Act (FDCPA) protect you. These laws provide recourse against inaccuracies and unfair practices.

The FCRA ensures credit reporting agencies maintain accurate information in your reports. It grants you the right to dispute errors. Credit bureaus must investigate and correct any verified inaccuracies.

The FDCPA regulates debt collectors’ behavior. It prohibits abusive, deceptive, or unfair practices when collecting debts. You can take action against collectors who violate your rights.

Credit repair companies must follow specific regulations. They need to provide a written contract outlining services and fees. These businesses can’t make false claims about removing negative items from your credit report.

Being informed about your rights helps you navigate credit repair confidently. You can ensure your interests are protected throughout the process.