When planning for international travel, securing the right insurance coverage is essential. Passport insurance provides crucial protection for travelers, ensuring access to medical care, trip cancellations, and other unexpected events while abroad. However, before setting off on your journey, it’s important to complete the passport insurance verification process.

This comprehensive guide will walk you through the necessary steps to verify your passport insurance, including gathering required documents, checking passport validity, and confirming your insurance coverage. By following these best practices, you can navigate the verification process smoothly and efficiently, giving you peace of mind as you embark on your international travels.

Key Takeaways

- Passport insurance is vital for protecting travelers during international trips

- Verification of passport insurance is necessary before traveling abroad

- Gathering required documents and confirming insurance coverage are key steps

- Online and in-person verification methods are available

- Completing verification ensures smooth travel and access to medical coverage

Understanding Passport Insurance Verification

When planning an international trip, it’s crucial to ensure that you have the proper travel protection in place. Passport insurance is a vital component of this protection, providing coverage for a range of potential issues that may arise during your journey. However, simply purchasing a passport insurance policy is not enough – it’s equally important to complete the verification process to ensure that your coverage is valid and reliable.

What is Passport Insurance?

Passport insurance is a specialized form of travel insurance designed to protect you from financial losses related to your passport and international travel. This type of insurance typically covers scenarios such as:

- Lost or stolen passports

- Emergency passport replacement

- Trip cancellations or interruptions due to passport issues

- Medical emergencies abroad

By investing in passport insurance, you can travel with peace of mind, knowing that you have a financial safety net in case of unexpected events.

Why is Verification Important?

While passport insurance offers valuable protection, it’s essential to verify your policy to ensure that it is active and valid. Verification is the process of confirming that your insurance coverage meets the necessary requirements and will be honored in the event that you need to file a claim. There are several key reasons why verification is so important:

- Ensuring coverage validity: Verification helps you confirm that your policy is active and covers the specific risks associated with your trip.

- Meeting travel requirements: Some countries may require proof of valid travel insurance before allowing entry, and verification ensures that your policy meets these requirements.

- Facilitating emergency assistance: In the event of an emergency abroad, having a verified passport insurance policy can expedite access to necessary services and support.

By taking the time to verify your passport insurance, you can travel with confidence, knowing that your policy will be there for you when you need it most.

“Passport insurance verification is a simple but essential step in the travel preparation process. It provides the assurance that your policy is valid and will offer the expected level of protection during your international journey.”

| Passport Insurance Feature | Importance of Verification |

|---|---|

| Emergency medical coverage | Ensures access to quality healthcare abroad |

| Trip cancellation protection | Confirms eligibility for reimbursement in case of cancellations |

| Lost or stolen passport assistance | Verifies coverage for replacement costs and support services |

In summary, understanding the importance of passport insurance and the verification process is crucial for any international traveler. By securing a valid policy and completing the necessary verification steps, you can embark on your journey with the confidence that you have the protection you need.

Preparing for Passport Insurance Verification

Before embarking on your international journey, it is essential to ensure that you have all the necessary documents and information ready for passport insurance verification. Taking the time to prepare in advance can save you from potential headaches and delays during your travels.

Gather Required Documents

To streamline the passport insurance verification process, make sure to collect all the required documents beforehand. These typically include:

- Valid passport

- Insurance policy documents

- Proof of travel (e.g., flight tickets, hotel reservations)

- Any additional forms or certificates required by your insurance provider or destination country

Having these documents organized and easily accessible will make the verification process much smoother.

Check Passport Validity

One of the most crucial aspects of preparing for passport insurance verification is ensuring that your passport is valid for the duration of your trip. Many countries require that your passport be valid for at least six months beyond your intended stay. Failure to meet this requirement could result in denied entry or complications with your insurance coverage.

“It is the traveler’s responsibility to ensure their passport meets the validity requirements of their destination country.” – U.S. Department of State

To avoid any issues, check your passport’s expiration date well in advance of your trip and renew it if necessary.

Confirm Insurance Coverage

Before seeking verification, it is essential to review your insurance policy details to confirm that you have the appropriate coverage for your trip. Pay close attention to the following aspects:

- Effective dates of coverage

- Covered events and situations

- Exclusions or limitations

- Coverage amounts for medical expenses, emergency evacuation, and other key areas

If you have any questions or concerns about your coverage, reach out to your insurance provider for clarification. It is better to address any issues before your trip rather than facing surprises during an emergency abroad.

| Coverage Area | Key Considerations |

|---|---|

| Medical Expenses | Ensure your policy covers hospital stays, doctor visits, and prescription medications in your destination country. |

| Emergency Evacuation | Verify that your policy includes coverage for emergency medical evacuation and repatriation. |

| Trip Cancellation/Interruption | Check if your policy offers coverage for trip cancellations or interruptions due to unforeseen events, such as illness or natural disasters. |

By gathering the required documents, checking your passport validity, and confirming your insurance coverage, you’ll be well-prepared for the passport insurance verification process and can embark on your international travels with greater peace of mind.

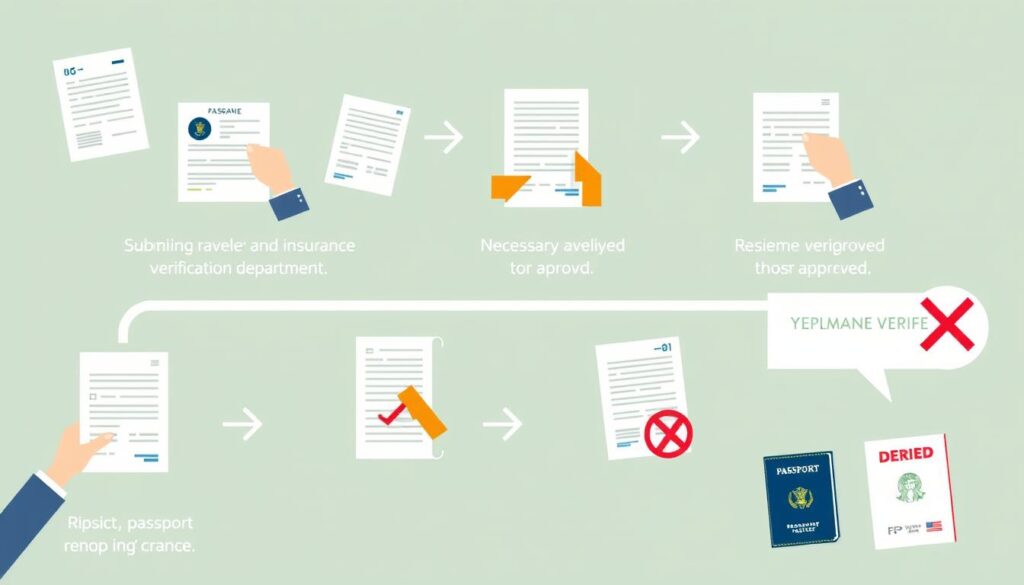

Steps to Complete Passport Insurance Verification

Completing the passport insurance verification process is crucial to ensure your coverage is valid and active during your travels. Follow these steps to verify your policy:

- Contact your insurance provider using the customer service number or email provided in your policy documents.

- Provide your policy number and personal information, such as your full name, date of birth, and passport details, to the representative.

- If required, complete any necessary verification forms or submit additional documentation, such as proof of travel or medical history.

- Wait for the insurance provider to process your verification request and confirm the validity of your policy.

- Once verified, obtain any necessary documents or instructions from the insurance provider for your records and reference during your trip.

It’s essential to initiate the verification process well in advance of your travel dates to allow sufficient time for the insurance provider to review your information and address any potential issues.

To streamline the verification process, gather all relevant documents beforehand, including your passport, insurance policy details, and any supporting materials requested by the provider. Having this information readily available will help expedite the verification steps and ensure a smooth experience.

“Verifying your passport insurance coverage before traveling is a simple yet essential step to protect yourself and your loved ones during your journey abroad.”

Remember, completing passport insurance verification is not only a requirement for many international destinations but also a proactive measure to safeguard your health, finances, and overall travel experience.

Online Passport Insurance Verification Methods

In today’s digital age, verifying your passport insurance has become more convenient than ever. Many countries and insurance providers now offer online verification methods, allowing travelers to confirm their coverage quickly and easily from the comfort of their own homes. These digital verification processes save time and effort compared to traditional in-person verification, making them an attractive option for busy travelers.

Using Official Government Websites

One of the most reliable ways to verify your passport insurance online is through official government websites. Many countries have dedicated portals where travelers can enter their passport and insurance details to confirm their coverage. These government websites are secure and up-to-date, ensuring that the information provided is accurate and trustworthy.

To use an official government website for passport insurance verification, simply navigate to the relevant portal and follow the instructions provided. You may need to enter your passport number, insurance policy details, and personal information to complete the verification process. Once submitted, the system will confirm your coverage, giving you peace of mind before your trip.

Verifying Through Insurance Provider Portals

Another convenient option for online passport insurance verification is through your insurance provider’s portal. Many insurers now offer dedicated websites or mobile apps where policyholders can manage their coverage, view policy details, and complete the verification process.

To verify your passport insurance through your provider’s portal, log in using your credentials and navigate to the verification section. You may need to provide your passport number and other relevant information to confirm your coverage. Once verified, you can download or print a confirmation document to keep with your travel documents.

Using insurance provider portals for verification offers several benefits, such as:

- Easy access to your policy details and coverage information

- Ability to update personal information or make changes to your coverage

- Quick and secure verification process

- Access to additional resources and support from your insurance provider

Whether you choose to verify your passport insurance through an official government website or your insurance provider’s portal, online verification methods offer a convenient and efficient way to confirm your coverage. By taking advantage of these digital verification processes, you can save time and enjoy a stress-free travel experience.

In-Person Passport Insurance Verification

While online verification methods are convenient, there are instances where travelers may need to complete passport insurance verification in person. This process involves visiting a designated verification center or embassy to present the necessary documents and confirm insurance coverage.

Locating Verification Centers

To begin the in-person verification process, travelers must first locate their nearest verification center. These centers can typically be found at:

- Embassies or consulates of the traveler’s home country

- Designated government offices or agencies

- Insurance company branches or partnered locations

It is essential to check with the relevant authorities or insurance providers to determine the exact location and operating hours of the verification center.

Required Documents for In-Person Verification

When preparing for in-person passport insurance verification, travelers must gather all the necessary documents. These typically include:

- A valid passport

- Proof of insurance coverage, such as a policy document or certificate

- Any additional forms or certificates required by the verification center or insurance provider

It is crucial to ensure that all documents are up to date and meet the specific requirements of the verification center to avoid any delays or complications during the process.

Scheduling an Appointment

To streamline the in-person verification process and minimize waiting times, many verification centers require travelers to schedule an appointment in advance. This can often be done online or by contacting the center directly.

When scheduling an appointment, travelers should consider the following:

| Factor | Consideration |

|---|---|

| Processing Time | Ensure sufficient time for verification before travel dates |

| Required Documents | Prepare and organize all necessary documents beforehand |

| Appointment Availability | Book well in advance to secure a convenient time slot |

By carefully planning and preparing for the in-person passport insurance verification process, travelers can ensure a smooth and efficient experience, minimizing the risk of any last-minute issues or delays.

Common Issues with Passport Insurance Verification

When it comes to passport insurance verification, travelers may encounter several obstacles that can hinder the process. Being aware of these common issues can help you better prepare and avoid potential setbacks. Let’s explore some of the most frequent problems that arise during the verification process.

Expired Passports

One of the most prevalent verification issues is an expired or soon-to-expire passport. Many insurance providers require a valid passport for coverage, and an expired document can lead to denial of benefits. To prevent this, always check your passport’s expiration date well in advance of your travel plans. If necessary, renew your passport promptly to ensure a smooth verification process and uninterrupted coverage.

Insufficient Insurance Coverage

Another common problem is insufficient coverage. Some travelers may opt for policies with low limits or exclusions for certain events, which can cause verification issues. When selecting passport insurance, carefully review the policy details to ensure adequate protection for your specific needs. Consider factors such as medical emergencies, trip cancellations, and lost or stolen belongings. Opting for comprehensive coverage can help you avoid insufficient coverage issues during verification.

Inconsistent Personal Information

Discrepancies in personal information can also delay or prevent successful passport insurance verification. Inconsistencies such as mismatched names, incorrect birthdates, or outdated addresses can raise red flags during the verification process. To minimize these issues, double-check that all personal details on your insurance application match those on your passport and other official documents. If any information has changed, be sure to update it with the relevant authorities and your insurance provider.

“Ensuring consistency in personal information is crucial for a seamless passport insurance verification process. Taking the time to review and update your details can save you from potential headaches down the road.” – Emily Thompson, Travel Insurance Expert

By being mindful of these common passport insurance verification issues and taking proactive steps to address them, you can significantly reduce the likelihood of encountering problems during the verification process. Remember to keep your passport up to date, select adequate coverage, and maintain accurate personal information to ensure a worry-free travel experience.

Passport Insurance Verification for International Travel

When embarking on international travel, it is crucial to ensure that your passport insurance is verified and meets the specific requirements of your destination country. Failing to do so can lead to travel disruptions and potential legal issues upon arrival.

Before departing, thoroughly research the passport insurance verification process for each country on your itinerary. Some destinations may have mandatory insurance coverage levels or require travelers to undergo a verification process to prove their compliance with local regulations.

In addition to destination-specific requirements, it is essential to stay informed about current travel advisories that may impact your plans. Regularly check updates from reliable sources, such as government websites and international news outlets, to ensure you have the most accurate information regarding your intended destinations.

Proper passport insurance verification is not only a legal requirement for many countries but also provides peace of mind and protection in case of unexpected events during your international travel.

If you have any questions or concerns about the passport insurance verification process for your specific destination, do not hesitate to reach out to your local embassy or consulate. They can provide valuable guidance and assist you in navigating the requirements for each country on your travel itinerary.

By taking the time to thoroughly verify your passport insurance and stay informed about destination-specific requirements and travel advisories, you can minimize the risk of disruptions and ensure a smooth, enjoyable international travel experience.

Benefits of Completing Passport Insurance Verification

Completing passport insurance verification is a crucial step for any traveler planning an international trip. By taking the time to ensure that your insurance coverage is properly verified and up-to-date, you can enjoy numerous benefits that will help make your travel experience smoother and more enjoyable. Verifying your passport insurance offers peace of mind, knowing that you have the necessary travel protection in place should any unexpected situations arise during your journey.

Avoiding Travel Disruptions

One of the primary benefits of completing passport insurance verification is the ability to avoid potential travel disruptions. When you have verified insurance coverage, you can rest assured that you will not be denied entry into your destination country due to insufficient or invalid insurance. This travel disruption prevention measure can save you time, money, and stress, allowing you to focus on enjoying your international experience without worrying about any last-minute complications.

“I always make sure to verify my passport insurance before traveling. It gives me the confidence to explore new destinations without the fear of being turned away at the border.” – Sarah Thompson, frequent international traveler

Ensuring Medical Coverage Abroad

Another significant advantage of verifying your passport insurance is the guarantee of access to emergency medical coverage while traveling abroad. In the event of an unexpected illness or injury, having verified insurance ensures that you can receive the necessary treatment without incurring substantial out-of-pocket expenses. This financial protection can be invaluable, especially in countries where medical costs are high or where your regular health insurance may not provide adequate coverage.

| Benefit | Description |

|---|---|

| Emergency Medical Treatment | Access to necessary medical care without incurring substantial costs |

| Medical Evacuation | Transportation to a suitable medical facility in case of a severe illness or injury |

| Repatriation | Arrangement and coverage of transportation back to your home country if medically necessary |

By completing passport insurance verification, you can travel with the peace of mind that comes from knowing you have the necessary medical coverage in place. This assurance allows you to fully immerse yourself in your international experience, without the added stress of worrying about potential medical expenses.

In summary, completing passport insurance verification offers numerous benefits to international travelers, including the prevention of travel disruptions and the assurance of emergency medical coverage abroad. By taking the time to verify your insurance, you can enjoy greater peace of mind and make the most of your international adventure.

Frequently Asked Questions about Passport Insurance Verification

As you prepare for your international travel, it’s natural to have questions about the passport insurance verification process. In this section, we’ll address some of the most common FAQs to help you navigate the verification timeline, understand country-specific requirements, and explore online verification options.

How Long Does Verification Take?

The passport insurance verification timeline can vary depending on several factors, such as the method you choose and the specific requirements of your insurance provider and destination country. On average, the process can take anywhere from a few days to several weeks. To ensure a smooth verification process, it’s essential to start early and allow ample time for any potential delays or additional documentation requests.

Is Verification Required for All Countries?

While many countries require passport insurance verification, the specific requirements can vary significantly from one destination to another. Some countries may have more stringent policies, while others may have more relaxed guidelines. To determine the country-specific requirements for your destination, it’s crucial to research and consult with official government websites, travel agents, or your insurance provider.

“Before traveling, always check the passport insurance verification requirements for your specific destination to avoid any last-minute surprises or complications.” – Sarah Thompson, Travel Expert

Can I Verify My Passport Insurance Online?

In recent years, online verification options have become increasingly popular, offering travelers a convenient and efficient alternative to traditional in-person verification methods. Many insurance providers and government agencies now offer secure online portals where you can submit your documents, track your verification status, and receive updates throughout the process.

To explore online verification options, consider the following steps:

- Check with your insurance provider to see if they offer an online verification portal.

- Visit the official government website of your destination country to find out if they accept online submissions for passport insurance verification.

- Gather all the necessary documents in digital format, ensuring they are clear and legible.

- Follow the instructions provided by the online portal to complete the verification process.

By leveraging online verification options, you can save time, reduce paperwork, and enjoy a more streamlined experience as you prepare for your international travel.

Alternatives to Traditional Passport Insurance

While passport insurance is a popular choice for international travelers, there are alternative options available that may better suit your specific needs and budget. One such option is standalone travel medical insurance, which focuses primarily on providing coverage for unexpected medical expenses incurred while abroad. These policies often offer more comprehensive coverage than traditional passport insurance, including emergency medical evacuation and repatriation.

Another alternative to consider is international health insurance, which is designed for those who frequently travel or live abroad for extended periods. These plans provide ongoing coverage for both routine and emergency medical care, ensuring that you have access to quality healthcare no matter where your travels take you. When comparing insurance alternatives, it’s essential to carefully evaluate the coverage options and ensure that they align with your unique requirements and the specific risks associated with your destination.

For those who are comfortable with a higher level of risk, self-insuring may be a viable option. This approach involves setting aside a designated fund to cover potential emergency expenses, rather than purchasing a separate insurance policy. While self-insuring can offer greater flexibility and potential cost savings, it’s crucial to ensure that you have sufficient funds to cover worst-case scenarios, such as emergency medical evacuation or extended hospital stays. Ultimately, the decision between traditional passport insurance and alternative coverage options depends on your individual circumstances, risk tolerance, and travel plans.