A healthy credit profile is vital for good financing terms and achieving financial goals. Closed accounts on credit reports can harm your credit score. It’s crucial to understand how to remove these outdated entries.

Removing closed accounts can improve your credit profile. This guide will help you through the process. We’ll cover understanding your credit report and your rights under the Fair Credit Reporting Act.

Key Takeaways

- Closed accounts can negatively impact your credit score, even if the accounts were closed in good standing.

- The Fair Credit Reporting Act (FCRA) provides consumers with rights to dispute inaccurate or outdated information on their credit reports.

- Identifying and removing closed accounts through the dispute process can help improve your credit profile.

- Developing effective credit repair strategies, including monitoring your credit reports, can ensure your credit history reflects your true creditworthiness.

- Understanding your rights and taking proactive steps to maintain a healthy credit report are crucial for financial well-being.

We’ll explore effective strategies for disputing inaccurate information with credit bureaus. You’ll learn how to improve your credit score by removing closed accounts. This guide will equip you with tools to maintain a healthy credit report.

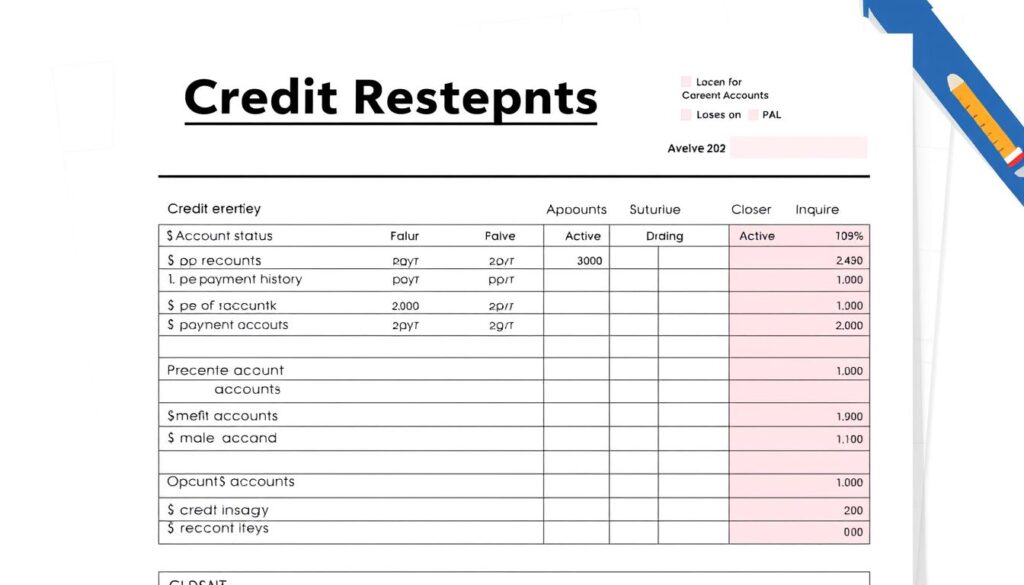

Understanding Credit Report Entries

Your credit report shows your financial history. It gives insights into your creditworthiness. Understanding the types of credit accounts and how closed accounts affect your score is crucial.

Types of Credit Accounts

The types of credit accounts on your report include:

- Credit cards (e.g., Visa, Mastercard, American Express)

- Installment loans (e.g., auto loans, student loans, personal loans)

- Mortgage loans

- Retail accounts (e.g., store credit cards)

- Utility accounts (e.g., electricity, gas, water, cable/internet)

Impact of Closed Accounts on Credit Scores

Closed accounts can significantly impact your credit score. They affect your credit utilization ratio, history length, and overall mix. This can lead to a decrease in your credit score.

Check your credit report often for errors. Look for closed accounts that shouldn’t be there. Understanding closed accounts’ impact helps you improve your creditworthiness.

Take action to remove them from your credit report. This can boost your overall credit score.

Why Remove Closed Accounts?

Removing closed accounts from your credit report can boost your financial health. It can positively impact your credit score and overall financial wellbeing.

Let’s explore the main reasons for removing these outdated entries. Understanding these benefits can help you make informed decisions about your credit profile.

Reasons to Remove Closed Accounts:

- Improved Credit Score: Closed accounts can negatively impact your credit score. Removing them can boost your overall credit profile.

- Increased Credit Utilization Ratio: Closed accounts reduce total available credit. Removing them can lower your credit utilization ratio.

- Enhanced Credit History: Removing closed accounts streamlines your credit report. This makes it easier for lenders to assess your creditworthiness.

- Reduced Identity Theft Risk: Outdated closed accounts can be targets for identity thieves. Removing them protects your financial identity.

Benefits of Removing Closed Accounts:

- Better Loan Approvals: A cleaner credit report may increase your loan approval chances. You might get better interest rates on loans, mortgages, or credit cards.

- Improved Rental Applications: Landlords often check credit reports. A report without closed accounts makes you a more attractive tenant.

- Simplified Financial Management: A streamlined report helps you monitor your credit profile. You can address discrepancies more effectively.

Taking proactive steps to remove closed accounts can improve your credit profile. This can help you achieve your financial goals more easily.

The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) safeguards consumers’ credit information rights and privacy. This federal law, enacted in 1970, ensures fair and accurate credit reporting practices.

Consumer Rights Under FCRA

The FCRA grants consumers important rights over their credit profiles. These rights allow people to maintain control of their credit information.

- The right to access their credit reports from the three major credit bureaus (Experian, Equifax, and TransUnion) for free once a year.

- The right to dispute any inaccurate or outdated information on their credit reports, and have it investigated and corrected by the credit bureaus.

- The right to be informed when information in their credit report has been used against them in a credit decision, such as a loan application or employment decision.

- The right to be notified if a credit report is provided to an employer for employment purposes.

- The right to opt-out of pre-screened credit and insurance offers.

These consumer rights under FCRA empower individuals to maintain accurate credit reports. This accuracy is vital for securing favorable credit terms and opportunities.

“The FCRA is a powerful tool that protects consumers from unfair credit reporting practices and gives them the ability to dispute and correct errors on their credit reports.”

Steps to Remove Closed Accounts on Credit Report

Removing closed accounts from your credit report can boost your credit score. This guide will help you through the process.

Obtaining Your Credit Reports

First, get your credit reports from Experian, Equifax, and TransUnion. You can get them free yearly at AnnualCreditReport.com.

Review each report carefully. Look for any closed accounts that are still being reported.

Identifying Inaccurate or Outdated Entries

Examine your credit reports for closed accounts still reported as open. Also, check for any inaccurate or outdated information.

- Look for accounts that are reported as open but have been closed for some time.

- Check for any accounts that were closed due to identity theft or fraudulent activity.

- Ensure that the balance, payment history, and other details of the closed accounts are accurate.

Spotting these issues is crucial for disputing and removing closed accounts. It’s the first step towards cleaning up your credit report.

| Action | Description |

|---|---|

| Obtain Credit Reports | Request your free annual credit reports from the three major credit bureaus. |

| Identify Inaccuracies | Carefully review your credit reports to find any closed accounts still being reported or other inaccurate information. |

| Dispute Errors | Follow the credit bureau’s dispute process to correct any errors and remove closed accounts from your credit report. |

Take charge of your credit report by following these steps. Ensure closed accounts are removed properly to improve your credit profile.

Remove Closed Accounts on Credit Report

Removing closed accounts from your credit report can boost your credit profile. These entries can affect your credit score and creditworthiness. Learn how to dispute and remove closed accounts from your credit reports.

Identify Closed Accounts

Get credit reports from Experian, Equifax, and TransUnion. Review each report to find closed accounts still being reported. Check account status, dates, and possible inaccuracies.

File a Dispute

- Contact the credit bureaus directly and submit a formal dispute for each closed account you want removed. Provide any supporting documentation, such as account closure letters or proof of payment.

- Dispute the accuracy and completeness of the information related to the closed account. Explain why the account should be removed or updated on your credit report.

- Follow up with the credit bureaus and ensure they investigate your dispute within the required 30-day timeframe.

Verify Removal

Credit bureaus will give you the results after investigating your dispute. They must remove inaccurate or outdated closed accounts from your report. Check your updated credit reports to confirm the account’s removal.

| Credit Bureau | Dispute Contact Information |

|---|---|

| Experian | P.O. Box 4500, Allen, TX 75013 |

| Equifax | P.O. Box 740256, Atlanta, GA 30374 |

| TransUnion | P.O. Box 2000, Chester, PA 19022 |

The Fair Credit Reporting Act (FCRA) gives you the right to dispute inaccurate information. Follow these steps to remove closed accounts and improve your credit profile.

Disputing Errors with Credit Bureaus

Incorrect info on your credit report can harm your finances. The Fair Credit Reporting Act lets you dispute errors with credit bureaus. Learn how to challenge mistakes and keep your credit report accurate.

Required Documentation

To dispute errors, gather these key documents:

- A copy of your credit report highlighting the inaccurate or outdated information

- Any documents that prove the disputed information is incorrect, such as bank statements, payment receipts, or settlement agreements

- A detailed letter explaining the nature of the dispute and the evidence you have to support your claim

Be thorough when providing evidence. Clear, concise proof strengthens your case. This increases your chances of removing wrong information from your report.

Credit bureaus must investigate your dispute by law. They have to give you results within a set time. If they can’t verify the info, they must remove it.

Take action to protect your credit standing. Follow the right steps to dispute errors effectively.

Credit Repair Strategies

Removing closed accounts is just the start of fixing your credit. You’ll need more tactics to boost your credit scores. Let’s look at some effective ways to improve your creditworthiness.

Address Negative Items

Your credit report may have other negative items besides closed accounts. These can include late payments, collections, or judgments. Work to fix these issues by talking to creditors or disputing errors.

Addressing these problems can greatly improve your credit scores.

Increase Credit Limits

Your credit utilization ratio is key in determining your credit score. It compares your balances to your available credit. Raising your credit limits can lower this ratio.

This shows responsible credit management and can boost your scores.

Build a Positive Credit History

Creating a long-term, positive credit history is vital for good credit scores. Make timely payments and keep balances low. Also, mix up your credit with different types of accounts.

These can include credit cards, installment loans, and mortgages.

| Credit Repair Strategies | Impact on Credit Scores |

|---|---|

| Address Negative Items | High |

| Increase Credit Limits | Moderate |

| Build Positive Credit History | High |

Credit repair takes time and effort. By using these credit repair strategies, you can steadily improve your credit scores. This will help you reach your financial goals.

Monitoring Your Credit Reports

Keeping tabs on your credit reports is vital for financial health. These reports show your credit history, payment habits, and credit use. Regular checks help you spot and fix issues quickly.

Monitoring credit reports lets you find and correct wrong info. This includes closed accounts, wrong balances, or signs of identity theft. Fixing errors improves your credit score and credit monitoring services.

Regular checks help you spot changes in your credit profile. You can catch suspicious activity like unauthorized inquiries or new accounts. Early detection helps protect your identity and credit.

Many banks and credit bureaus offer credit monitoring services. These services give updates, alerts, and track your credit score. While they cost money, they provide peace of mind and protection.

Make checking your credit reports a habit. You can do it yourself or use a service. Stay alert and address issues promptly to keep your credit strong.

Conclusion

Addressing closed accounts on your credit report is crucial. Taking action to remove inaccurate or outdated entries can boost your credit score. This helps maintain a healthy financial profile.

Effective credit management requires regular review of your reports. Identify and dispute any errors promptly. Ensure your credit history accurately shows your financial responsibility.

Stay alert and monitor your credit reports consistently. Don’t hesitate to ask credit experts for help if needed. With proper strategies, you can build a strong credit foundation.

Good credit practices unlock better loan rates and credit card approvals. They also contribute to your overall financial well-being. Keep working on your credit to secure a brighter financial future.