A clean credit report is vital for your financial health. Negative items can hurt your credit score and limit opportunities. This guide offers a sample letter to remove negative items from your credit report.

Use it to improve your financial standing. Learn how to dispute inaccurate information and rebuild your credit effectively.

Key Takeaways

- Understand the importance of a clean credit report and the impact of negative items on your credit score.

- Identify the types of negative items that can be disputed and removed from your credit report.

- Learn the step-by-step credit bureau dispute process, including gathering supporting documentation and submitting a detailed dispute letter.

- Discover strategies for crafting an effective dispute letter that can help you successfully remove inaccurate or outdated information.

- Explore the legal considerations and best practices for rebuilding your credit after negative items have been removed.

Understanding the Importance of a Clean Credit Report

A clean credit report is vital for your financial health. Your credit score affects how lenders, landlords, and employers view you. Negative items can severely impact your score and lead to serious problems.

Impact of Negative Items on Credit Scores

Negative items on your credit report can hurt your score badly. Late payments might drop your score by up to 100 points. This makes getting loans, credit cards, housing, or jobs much harder.

Collections and charge-offs are equally harmful. They often cause your credit score to decrease significantly.

Consequences of a Poor Credit History

A poor credit history can cause many financial issues. You may struggle to get loans or credit cards. Higher interest rates or deposits for utilities and cell phones are common.

A low credit score can even affect your job prospects. Many employers now check credit history when hiring.

| Negative Item | Impact on Credit Score | Potential Consequences |

|---|---|---|

| Late Payments | Up to 100 points | Difficulty obtaining loans, credit cards, or securing housing/employment |

| Collections/Charge-Offs | Significant decrease | Higher interest rates, deposits, or denial of services |

| Bankruptcy | Severe, up to 200 points | Extensive and long-lasting damage to financial standing |

Knowing the value of a clean credit report is crucial. It’s the first step to better finances. By fixing negative items and keeping good credit, you’ll unlock better opportunities.

What Are Negative Items on a Credit Report?

Your credit report shows your financial history to lenders and creditors. Negative items on this report can hurt your creditworthiness. Knowing these items and their effects is key to a good credit profile.

Negative items include late payments, collections, charge-offs, bankruptcies, and public records. These marks can stay on your report for 7 to 10 years. They can lower your credit score and make it hard to get loans or jobs.

Check your credit report often for credit report errors or inaccuracies. These can hurt your credit unfairly. Knowing about negative items helps you fix them.

| Negative Item | Description | Impact on Credit Score |

|---|---|---|

| Late Payments | Payments made after the due date | Can significantly lower your credit score, especially if the late payments are recent or frequent |

| Collections | Unpaid debts that have been turned over to a collection agency | Can have a severe negative impact on your credit score and remain on your report for up to 7 years |

| Charge-Offs | Accounts that the creditor has written off as uncollectible | Can severely damage your credit score and remain on your report for up to 7 years |

| Bankruptcies | Legal proceedings that allow individuals to eliminate or repay debts | Can have a significant and long-lasting impact on your credit score, remaining on your report for up to 10 years |

| Public Records | Legal actions such as liens, judgments, and foreclosures | Can severely damage your credit score and remain on your report for up to 7 years (10 years for bankruptcies) |

Understanding types of negative items on your credit report is crucial. It helps you address issues and improve your credit report information. Taking action can boost your financial standing and fix credit report errors.

Disputing Inaccurate or Outdated Information

A clean and accurate credit report is vital for your financial health. Errors can sneak in, hurting your credit score. But you can dispute these issues and get them fixed.

Identifying Errors and Inaccuracies

Start by carefully reviewing your credit report for any discrepancies. Look for inaccurate information like wrong account details or erroneous negative items.

Check for outdated credit report items that shouldn’t affect your credit anymore. Spotting these issues is key to starting the dispute process.

- Thoroughly review your credit report for any suspicious or inaccurate information.

- Make note of any credit report mistakes you find, including account details, negative items, and outdated information.

- Gather supporting documentation that can help validate your claims and strengthen your dispute.

“Correcting inaccurate information on your credit report can be a powerful step in improving your overall financial health.”

By fixing credit report errors, you take control of your financial future. This action sets you up for long-term success.

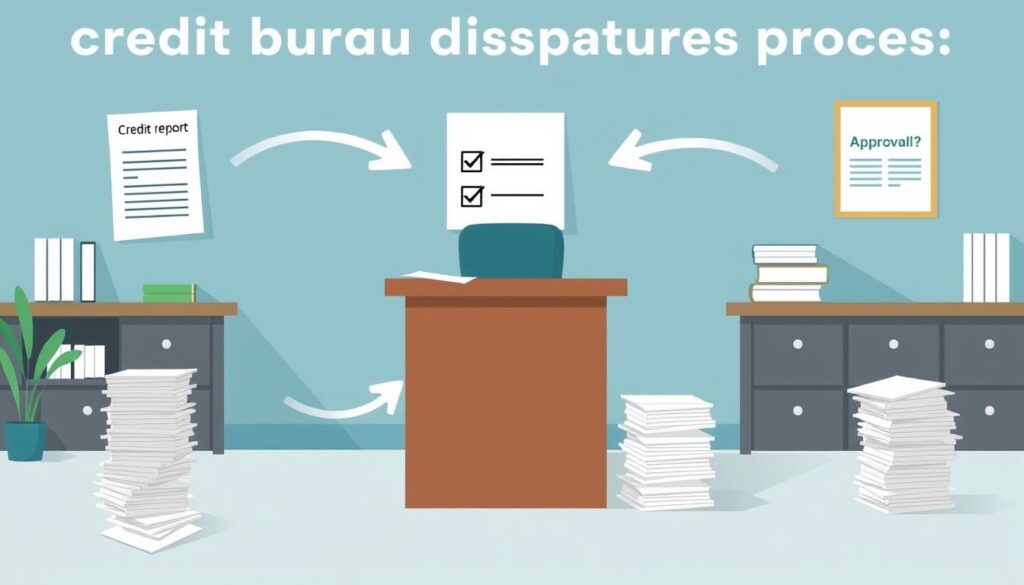

The Credit Bureau Dispute Process

Fixing errors on your credit report is vital for your financial health. The credit bureau dispute process helps you correct mistakes that may hurt your creditworthiness.

Gathering Supporting Documentation

Before starting a dispute, collect all relevant documents. These may include account statements, payment records, and creditor correspondence. Having these papers ready will strengthen your case during the investigation.

Submitting a Dispute Letter

Write a formal dispute letter to the credit bureaus after gathering your documents. Clearly state which items you’re disputing and why they’re wrong or outdated.

Include all account numbers, dates, and other key details. This info helps credit bureaus identify and investigate the issue quickly.

- Identify the specific items you’re disputing on your credit report.

- Explain why the information is inaccurate or outdated.

- Provide supporting documentation to substantiate your claims.

- Submit the dispute letter to the appropriate credit bureau(s).

Following these steps helps ensure your credit report is accurate. It’s a powerful tool for protecting your financial well-being. Stay proactive in maintaining a healthy credit profile.

Remove Negative Items From Credit Report Sample Letter

Removing negative items from your credit report can boost your credit score. A sample credit report dispute letter is a useful tool. It helps you challenge inaccurate or outdated information on your credit file.

The credit report dispute letter includes key components. These elements help you communicate effectively with credit bureaus.

- Identification of the specific negative item: Clearly state the item you are disputing, such as a late payment, collection account, or erroneous public record.

- Explanation of the error or inaccuracy: Provide a detailed explanation of why the negative item is incorrect or outdated, supported by any relevant documentation.

- Request for investigation and removal: Explicitly ask the credit bureau to investigate the matter and remove the negative item from your credit report if the information is found to be inaccurate or unverifiable.

- Inclusion of supporting documents: Gather and attach any relevant documents, such as payment receipts, account statements, or correspondence with creditors, to strengthen your case.

- Contact information and deadline: Provide your full contact information and a reasonable deadline for the credit bureau to respond to your dispute.

A well-crafted credit report dispute letter template streamlines the process. It helps you remove negative items from your credit report. This proactive step can improve your financial standing.

| Credit Report Dispute Letter Template | Explanation |

|---|---|

| Your Name Your Address Your City, State, Zip Code | This is your contact information, which should be clearly displayed at the top of the letter. |

| Date | Include the current date to demonstrate when the letter was written. |

| Credit Bureau Name Credit Bureau Address Credit Bureau City, State, Zip Code | Address the letter to the specific credit bureau you are disputing the item with. |

| Re: Dispute of [Negative Item] on Credit Report | Clearly state the purpose of the letter and the specific negative item you are disputing. |

| Dear [Credit Bureau], | Formally address the credit bureau you are contacting. |

| I am writing to dispute the following item on my credit report: [Describe the negative item in detail]. | Provide a clear and concise description of the negative item you are disputing. |

| This item is [inaccurate/outdated] because [Explain the error or inaccuracy]. | Explain why the negative item is incorrect or outdated, and provide supporting evidence if available. |

| I am requesting that you investigate this matter and remove the [Negative Item] from my credit report. | Formally request that the credit bureau investigate the issue and remove the negative item from your credit report. |

| Enclosed are copies of [List supporting documents]. | Indicate any supporting documents you have included with the letter, such as payment receipts or account statements. |

| Please let me know the results of your investigation within [Time frame, e.g., 30 days]. | Provide a reasonable timeframe for the credit bureau to respond to your dispute. |

| Thank you for your prompt attention to this matter. | Close the letter with a polite and professional tone. |

| Sincerely, [Your Name] | Include your signature and printed name at the end of the letter. |

This sample letter serves as a helpful guide. It can help you craft an effective message to credit bureaus. Using it increases your chances of removing negative items from your report.

Crafting an Effective Dispute Letter

Disputing inaccurate or outdated information on your credit report is crucial. A well-crafted dispute letter can help remove negative items from your credit report. Let’s explore the key elements of an effective dispute letter.

Key Elements of a Dispute Letter

A credit report dispute letter should include these essential components:

- Identification of the Negative Item: Clearly state the specific negative item you’re disputing. Include the account number, creditor name, and reporting date.

- Reason for the Dispute: Explain why the negative item is inaccurate or outdated. Provide supporting documentation to back up your claims.

- Request for Investigation: Ask the credit bureau to investigate the disputed item. Request removal if the information is inaccurate or unverifiable.

- Contact Information: Include your full name, current address, phone number, and email address. This helps the credit bureau reach you during the investigation.

- Copies of Supporting Documents: Attach relevant documentation to support your dispute. This may include payment records, account statements, or creditor correspondence.

These key steps can boost your chances of writing successful credit report disputes. They’ll help you in removing negative items from your credit report.

An effective dispute letter can significantly improve your financial standing. It’s a powerful tool for securing a brighter financial future.

| Credit Report Dispute Letter Elements | Description |

|---|---|

| Identification of Negative Item | Clearly state the specific negative item, including account details and reporting date. |

| Reason for Dispute | Explain why the information is inaccurate or outdated, providing supporting documentation. |

| Request for Investigation | Make a clear and direct request for the credit bureau to investigate and remove the item. |

| Contact Information | Include your full name, address, and contact details for follow-up during the investigation. |

| Supporting Documents | Attach relevant documentation to substantiate your dispute claims. |

“By crafting an effective dispute letter, you can take a significant step towards improving your credit report and securing a brighter financial future.”

Following Up on Your Dispute

After submitting your credit report dispute, it’s vital to monitor the process. Credit bureaus must investigate and respond within 30-45 days. This is called the credit report dispute timeline.

Keep a close eye on your credit report during this period. Look for any changes or updates. If the negative item disappears, that’s great news!

If you’re unsatisfied with the resolution, take further action. Ensure your credit report accurately reflects your creditworthiness. You have the right to follow up on the credit report dispute.

Contact the bureau directly or submit more documentation. You can also escalate the issue to the Consumer Financial Protection Bureau (CFPB).

- Monitor your credit report during the credit bureau dispute response period.

- If the negative item remains, ask the credit bureau for an explanation.

- Consider escalating to the CFPB if the dispute isn’t resolved satisfactorily.

Stay proactive when following up on credit report disputes. Your persistence ensures an accurate financial history. It paves the way for a brighter financial future.

“Removing negative items from your credit report can significantly improve your financial well-being. Stay persistent, even if it takes time. Your efforts will pay off.”

Rebuilding Your Credit After Removal

Successfully removing negative items from your credit report is just the beginning. Now, it’s time to focus on rebuilding your credit. Smart credit management is crucial for boosting your score and financial health.

By using effective strategies, you can take control of your credit. This sets you up for long-term financial success and opens new opportunities.

Responsible Credit Management Practices

To rebuild your credit, try these responsible management practices:

- Make on-time payments: Consistent, timely payments are key. Your payment history greatly impacts your credit score.

- Maintain low credit utilization: Keep card balances below 30% of your limit. This shows responsible borrowing and improves your credit utilization ratio.

- Diversify your credit mix: Have different credit types like cards, loans, and mortgages. This proves you can handle various credit types responsibly.

- Monitor your credit reports: Check your reports often for accuracy. This helps you catch errors and new negative items quickly.

These practices will help you steadily rebuild your credit. Your improved score will show your commitment to financial responsibility. This can lead to new financial opportunities.

| Responsible Credit Management Practices | Benefits |

|---|---|

| Make on-time payments | Improve payment history, a key factor in credit score calculation |

| Maintain low credit utilization | Demonstrate responsible borrowing and improve credit utilization ratio |

| Diversify your credit mix | Show lenders your ability to manage various types of credit responsibly |

| Monitor your credit reports | Catch errors or new negative items to maintain credit health |

Follow these rebuilding credit after removing negative items and credit repair strategies. Use responsible credit management to improve your credit score. It takes time, but a healthy credit profile is worth the effort.

Working with Credit Repair Professionals

Credit repair professionals can be valuable allies in fixing your credit. They possess expertise in disputing inaccuracies and removing negative items from credit reports. These experts can navigate the complex process efficiently.

Credit repair services excel at handling multiple disputes simultaneously. They take on the burden, working tirelessly to ensure your credit report’s accuracy. This saves you time and effort in managing the process yourself.

Credit repair companies know the credit bureau dispute process inside out. They understand the necessary documentation and strategies for successful outcomes. This knowledge can save you time and reduce stress.

“Hiring a professional credit repair assistance service can be a game-changer for individuals looking to improve their credit scores and financial well-being.”

The cost of credit repair professionals can vary widely. Research different providers to find one that fits your needs and budget. Be cautious of companies making unrealistic promises or claiming to remove accurate negative information.

| Benefit | Description |

|---|---|

| Expertise | Credit repair professionals have in-depth knowledge of the credit repair process, increasing the chances of successful disputes. |

| Time-saving | They can handle multiple disputes simultaneously, saving you the time and effort of managing the process on your own. |

| Personalized Strategies | Credit repair companies can develop customized strategies based on your unique credit situation and goals. |

Weigh the pros and cons of working with credit repair professionals. Consider if this approach aligns with your needs and budget. The goal is to achieve a clean credit report and strong financial future.

Preventing Future Negative Items

Proactive credit management is crucial for maintaining a healthy credit report. Regularly monitor your credit reports to spot discrepancies or errors. This helps prevent potential harm to your credit score.

Monitoring Your Credit Reports Regularly

Review your credit reports from Experian, Equifax, and TransUnion yearly. This allows you to catch and address any negative items promptly. Staying vigilant protects your creditworthiness.

Taking a proactive approach to credit report maintenance safeguards your financial future. By staying on top of your credit, you can ensure its accuracy and strength.

- Check your credit reports for accuracy and identify any potential errors or fraudulent activity.

- Dispute any inaccurate or outdated information with the credit bureaus to have it removed from your report.

- Maintain healthy credit utilization ratios and make timely payments on all your accounts to build a strong credit history.

Preventing future negative items is vital for a healthy credit profile. Monitoring your credit reports regularly helps you address issues quickly.

Taking control of your financial future ensures your credit report remains a valuable asset. Regular monitoring and maintenance are key to long-term credit health.

| Metric | Importance | Impact |

|---|---|---|

| Credit Report Monitoring | High | Proactively identifies and resolves negative items, protecting your credit score. |

| Credit Report Maintenance | High | Ensures your credit report accurately reflects your financial history, enabling better credit management. |

| Preventing Future Negative Items | High | Avoids the damaging consequences of negative items on your credit profile, preserving your creditworthiness. |

Credit Repair Legal Considerations

Credit repair involves understanding complex legal issues. U.S. laws protect consumers from unfair practices in the credit repair industry. These regulations ensure fair treatment and transparency.

The Fair Credit Reporting Act (FCRA) is crucial for credit reporting. It allows consumers to challenge incorrect information on credit reports. The FCRA also sets rules for handling disputes by credit bureaus.

The Credit Repair Organizations Act (CROA) regulates credit repair companies. It bans false advertising and requires written contracts. These contracts must outline consumer rights and services provided.

Consumer protection laws vary by state. They offer extra safeguards against unfair practices. Consumers should know their rights under these laws.

The Federal Trade Commission (FTC) oversees the credit repair industry. State agencies also help protect consumers. They investigate and act against illegal practices by credit repair companies.

| Regulation | Key Provisions |

|---|---|

| Fair Credit Reporting Act (FCRA) | Grants consumers the right to dispute inaccurate or unverifiable information on their credit reports |

| Credit Repair Organizations Act (CROA) | Prohibits credit repair companies from making false claims and requires them to provide a written contract |

| State Consumer Protection Laws | Provides additional protections against unfair or deceptive practices in the credit repair industry |

Knowing these laws helps consumers make smart choices about credit repair. It ensures they work with honest companies that follow legal guidelines.

Success Stories and Real-Life Examples

Credit repair’s effectiveness shines through real-life success stories. These tales showcase tangible benefits of diligent credit repair efforts. Inspiring examples highlight credit score improvements and removal of negative items from reports.

Sarah, a young professional, struggled with poor credit due to missed college payments. She disputed inaccurate information on her credit report. As a result, several negative items were removed, boosting her credit score significantly.

This improvement opened new financial doors for Sarah. She secured a lower mortgage interest rate and qualified for a better credit card.

Mark, a small business owner, faced loan denials due to past credit issues. He worked with a credit repair specialist to address errors on his report. Several derogatory items were removed, transforming his credit situation.

This change allowed Mark to access needed financing. He expanded his business, contributing to its growth and success.

| Name | Initial Credit Score | Credit Score After Dispute | Outcome |

|---|---|---|---|

| Sarah | 650 | 720 | Secured a lower interest rate on a mortgage and qualified for a more favorable credit card |

| Mark | 580 | 650 | Obtained the financing needed to expand his small business |

These credit repair success stories showcase the power of effective strategies and perseverance. They highlight real-life credit score improvements and inspire others to take charge. These examples demonstrate the transformative potential of addressing positive outcomes from credit report disputes.

“Credit repair was a game-changer for me. It opened up so many doors and gave me the financial freedom I had been seeking for years.”

– Sarah, Successful Credit Repair Client

Conclusion

A clean credit report is vital for your financial health. This guide has shown you how to remove negative items. Understanding their impact empowers you to take control of your credit history.

We’ve covered disputing inaccurate information and gathering supporting documents. These steps can help improve your credit score. Better credit opens doors to more financial opportunities.

Cleaning your credit is just the beginning. Regular credit monitoring and timely payments are crucial. These habits protect your credit and prevent future issues.

Proactive credit management strengthens your financial position. It can lead to personal and professional growth. Take charge of your credit today for a brighter financial future.