Your credit report and score play a vital role in your financial life. This article breaks down a sample credit report. We’ll explore its sections and how they affect your creditworthiness.

Our real-world example will help you understand your credit profile better. You’ll learn how to read your report and make smart money choices. This knowledge can lead to a healthier financial future.

Key Takeaways

- Familiarize yourself with the different sections of a credit report, including personal information, credit accounts, and credit score ranges.

- Learn how to identify and dispute common errors on your credit report to ensure accuracy.

- Discover strategies for improving your credit score, such as paying bills on time and reducing credit utilization.

- Understand the benefits of maintaining a good credit score and how it can impact your financial opportunities.

- Explore the role of credit monitoring services in keeping your credit profile healthy and secure.

Understanding the Importance of Credit Reports

Credit reports are key to your financial health. They show your credit history to lenders and banks. These documents are crucial for your financial success and opportunities.

Impact on Financial Opportunities

Your credit report affects your access to financial products. Lenders use it to judge if you’re a risk. This impacts your chances of getting loans, credit cards, and even rentals.

A healthy credit profile can lead to better financial opportunities. You might get lower interest rates and higher credit limits. It can also mean more favorable terms on loans.

Maintaining a Healthy Credit Profile

Keep your credit profile healthy to boost your credit report importance. Pay bills on time and keep credit use low. Check your credit report often for mistakes.

Taking these steps can improve your creditworthiness. This puts you in a better position for various financial opportunities.

“A good credit report is the foundation for a secure financial future. Investing time in understanding and maintaining a healthy credit profile can pay dividends for years to come.”

Anatomy of a Credit Report

A credit report is vital for your financial health. It’s a document that shows your credit history. Let’s explore the main parts of a typical credit report.

Personal Information

This part has your basic details. It includes your name, address, birth date, and Social Security number. Any past names or aliases are listed here too.

Credit Accounts

This is the core of your credit report. It shows all your credit accounts, like cards, loans, and mortgages. Each account has details about its type, limit, and balance.

You’ll also see payment history and account status. This information helps lenders assess your creditworthiness.

Public Records

This section lists legal and financial events. It includes bankruptcies, tax liens, and judgments. These items can greatly affect your credit score.

Inquiries

This part shows who’s viewed your credit report. It includes both you and potential lenders. Hard inquiries can briefly impact your score.

Knowing these parts helps you manage your credit better. You can take steps to keep your credit profile healthy.

Decoding Credit Score Ranges

Credit scores are key to your financial health. They show how trustworthy you are with money. These numbers affect your chances of getting loans and other financial perks.

Excellent Credit Score

An excellent credit score falls between 800 and 850. It shows you’ve managed money well over time. With this score, you’re seen as a low-risk borrower.

You’ll likely get the best loan terms and lower interest rates. You’ll also have more financial products to choose from.

Good Credit Score

A good credit score ranges from 700 to 799. It means you have a solid credit history. You handle your money well, though not as perfectly as those with excellent scores.

You can still get good lending terms. Many financial services will be open to you.

| Credit Score Range | Credit Score Category |

|---|---|

| 800 – 850 | Excellent |

| 700 – 799 | Good |

| 600 – 699 | Fair |

| 500 – 599 | Poor |

| 300 – 499 | Very Poor |

Knowing your credit score helps you understand your financial standing. It shows where you can improve. A good or excellent score opens doors to better financial options.

It also builds a strong base for long-term money stability. Aim to keep your score high for the best results.

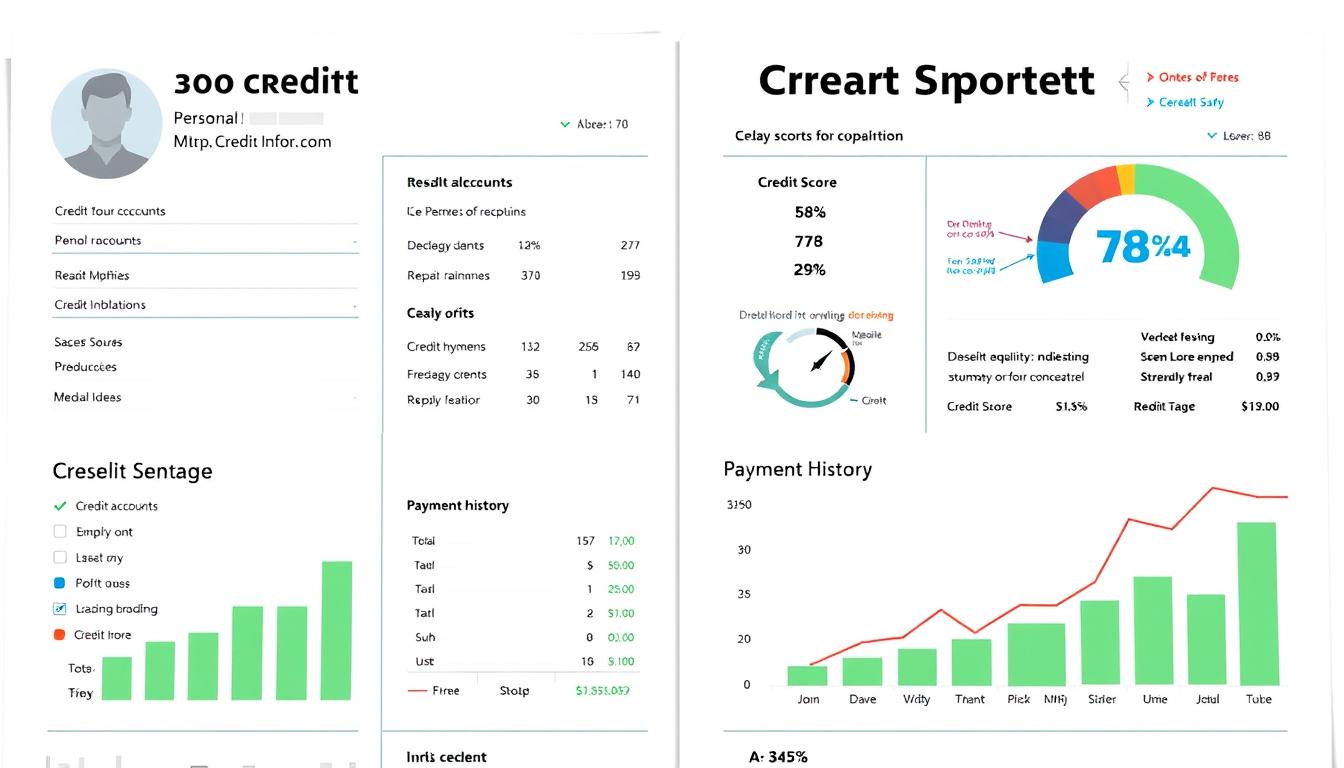

sample credit report with score

Your credit report plays a vital role in your financial health. Let’s look at a sample report with a credit score. This example will show you how your credit information appears.

The sample report highlights key elements that lenders evaluate. It includes personal information, credit account history, and a credit score summary. These details help assess your creditworthiness.

The credit score in this example ranges from 300 to 850. Higher scores indicate a lower risk of default. Lenders use this score to set loan terms and interest rates.

Studying this sample report can provide valuable insights into your credit profile. It can help you make better financial choices. You’ll learn how to improve or maintain your credit standing.

“A good credit score is like a key that opens the door to financial opportunities. Knowing your score and how to interpret your credit report is essential for navigating the world of personal finance.

Analyzing Your Credit Report Sections

Your credit report holds key information about your financial health. By examining its sections, you can spot areas needing attention. This helps you maintain a strong credit profile.

Personal Information

This section lists your name, birth date, addresses, and Social Security number. Check that all details are correct. Any errors could point to identity theft or inaccuracies in your credit history.

Credit Accounts

Here you’ll find your credit account history. It includes account types, open dates, credit limits, and payment records. Look for unfamiliar accounts or unauthorized activity.

Check for late or missed payments. These can affect your credit report analysis and credit score.

| Account Type | Open Date | Credit Limit | Balance | Payment History |

|---|---|---|---|---|

| Visa Credit Card | January 2015 | $5,000 | $1,200 | Always on time |

| Auto Loan | April 2018 | $20,000 | $10,000 | Occasionally late |

| Mortgage | June 2020 | $250,000 | $230,000 | Always on time |

Understanding your personal information and credit accounts is crucial. It helps you spot issues and take action. This way, you can keep your credit report analysis and credit score in good shape.

Disputing Errors on Your Credit Report

Your credit report can greatly affect your financial future. Credit report errors happen more often than you might expect. It’s vital to spot and challenge these mistakes for a healthy credit profile.

Identifying and disputing inaccuracies helps maintain your financial well-being. Taking action on errors ensures your credit information stays accurate and up-to-date.

Common Errors to Look For

When checking your credit report, watch out for these frequent mistakes:

- Accounts that do not belong to you

- Incorrect account balances or payment history

- Duplicate accounts

- Outdated or inaccurate personal information

- Accounts that have been incorrectly reported as delinquent

Step-by-Step Dispute Process

Found errors on your credit report? Start a dispute with the credit bureaus right away. Here’s how to tackle the credit report dispute process:

- Get your credit report from Experian, Equifax, and TransUnion.

- Carefully review the reports and spot any mistakes.

- Collect documents like bills and statements to back up your claim.

- Contact the credit bureaus directly to submit a formal dispute.

- Provide the bureaus with information and proof to support your case.

- Keep an eye on your dispute and follow up if needed.

Stay on top of your credit report to protect your financial health. Regular checks and quick action on errors can make a big difference.

Credit Monitoring Services

Protecting your financial well-being is crucial in today’s digital age. Credit monitoring services offer valuable insights into your credit reports and scores. These services help you detect and address potential issues quickly.

Credit monitoring services provide many benefits to safeguard your financial future. They alert you to suspicious activity, like unauthorized account openings or fraudulent transactions. This early detection empowers you to dispute errors and prevent further credit damage.

These services offer a comprehensive view of your credit standing. They often include credit score tracking, credit report analysis, and personalized recommendations. This information helps with important financial decisions like applying for loans or renting apartments.

When selecting a credit monitoring service, consider the information provided and update frequency. Also, look at the level of customer support offered. A reliable service helps protect your finances and unlock new opportunities.

| Credit Monitoring Service | Key Features | Pricing |

|---|---|---|

| Experian |

| $24.99 per month |

| TransUnion |

| $19.95 per month |

| Equifax |

| $16.95 per month |

A reliable credit monitoring service is a valuable tool for maintaining a healthy credit profile. It helps safeguard your financial future and provides peace of mind.

Strategies for Improving Your Credit Score

A strong credit score opens doors to better financial opportunities. Two key strategies can boost your credit score: timely bill payments and lowering credit use. Let’s explore these methods to enhance your creditworthiness.

Paying Bills on Time

Your payment history greatly impacts your credit score. Prompt bill payments show lenders you’re a responsible borrower. This includes credit cards, loans, and other financial obligations.

Consistently meeting due dates builds a positive record. Over time, this habit can significantly improve your credit score.

Reducing Credit Utilization

Credit utilization compares your used credit to your total available credit. Experts suggest keeping this ratio below 30% for a healthy credit profile.

Lowering balances on credit cards and revolving accounts reduces your utilization. This shows lenders you’re managing debt wisely, which can boost your credit score.