Buying a home is thrilling, but challenges may arise. A drop in your credit score before closing can be stressful. Your credit score is vital for mortgage approval.

We’ll examine how credit score changes affect the process. We’ll also look at common reasons for pre-closing drops. Finally, we’ll explore ways to handle these issues.

Key Takeaways

- Credit score changes can impact mortgage approvals and loan terms before closing.

- Understanding the common causes of pre-closing credit score drops is important.

- Lenders may react differently to credit score fluctuations, potentially requiring additional documentation or even reconsidering the loan.

- Communicating openly with your lender and real estate agent can help navigate credit score changes.

- Proactive steps can be taken to monitor and protect your credit score during the home buying process.

Understanding the Impact of Credit Score Fluctuations

Your credit score plays a crucial role in mortgage approval. Lenders use this number to assess your creditworthiness. It helps them decide on your loan terms.

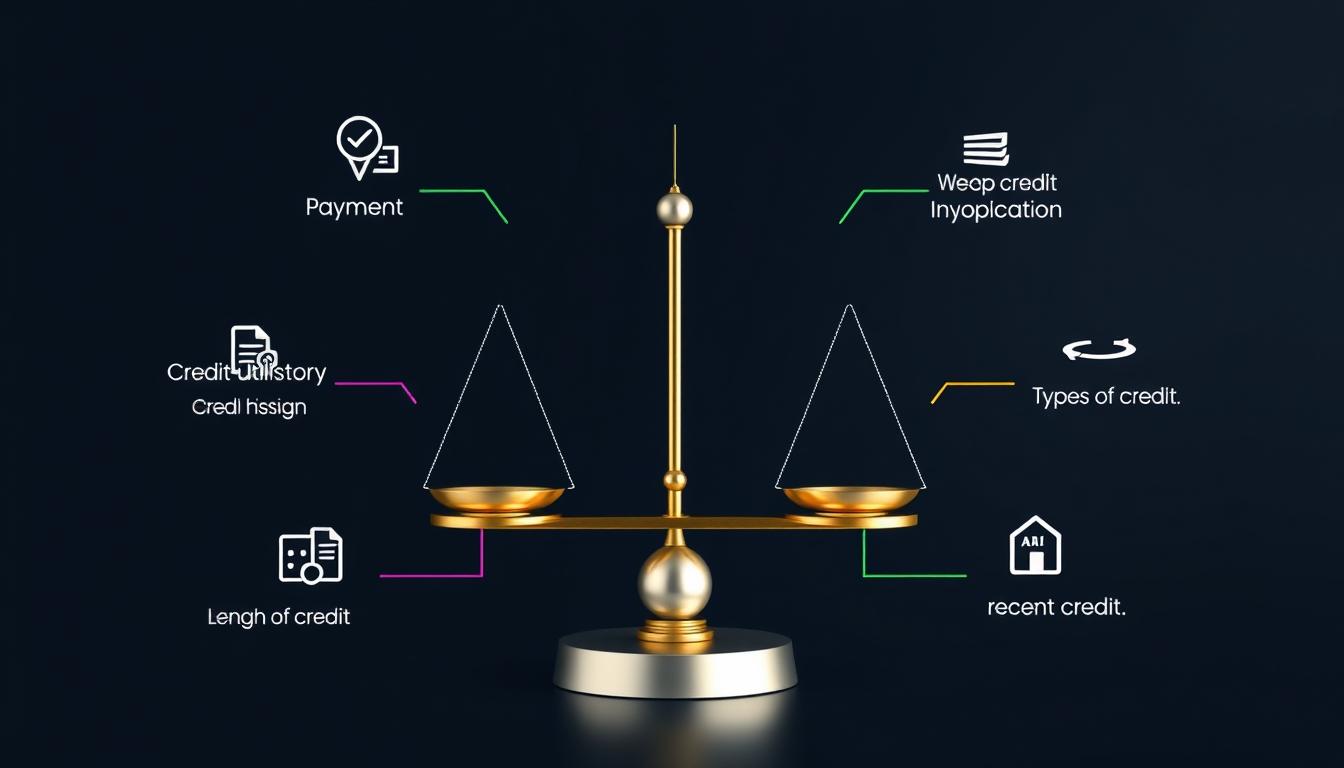

Several factors affect your credit score. These include payment history, credit utilization, and credit mix. Knowing these factors can help you navigate the mortgage application process.

Credit Score Factors and Their Significance

Your credit score reflects your financial behavior. It shows how trustworthy you are with credit. Here are the key factors that shape your score:

- Payment history: This accounts for the largest portion of your credit score and highlights your reliability in making timely payments on your credit accounts.

- Credit utilization: This measures the amount of credit you’re using compared to your total available credit. Keeping your credit utilization low is crucial for maintaining a healthy credit score.

- Credit mix: Lenders prefer to see a diverse mix of credit accounts, such as credit cards, loans, and mortgages, as this demonstrates your ability to manage different types of credit responsibly.

- Length of credit history: The longer your credit history, the more information lenders have to evaluate your creditworthiness.

- New credit applications: Applying for multiple new credit accounts in a short period can negatively impact your credit score, as it may be seen as a sign of financial stress.

The Role of Credit Score in Mortgage Approvals

Your credit score is key in determining mortgage eligibility. It also affects your loan terms. A higher score usually means better interest rates and terms.

A drop in your score before closing can impact the lender’s decision. They might re-evaluate your application or even deny the loan. Staying informed about your score is crucial.

| Credit Score Range | Mortgage Interest Rate | Mortgage Approval Likelihood |

|---|---|---|

| 760-850 | Lowest interest rates | Highest approval chances |

| 700-759 | Slightly higher interest rates | High approval chances |

| 640-699 | Higher interest rates | Moderate approval chances |

| 580-639 | Highest interest rates | Lower approval chances |

| 500-579 | Extremely high interest rates | Lowest approval chances |

Knowing how credit scores affect mortgage approvals is vital for homebuyers. Monitor your score and understand what impacts it. This knowledge can help you secure better loan terms.

Common Causes of Credit Score Drops Before Closing

Buying a home is thrilling, but it can bring unexpected challenges. Your credit score might drop before closing. Several factors can cause this decrease. Knowing these reasons helps you address issues and keep good credit.

Taking on new debt is a major cause of credit score drops. This includes new credit cards or loans. New debt affects your credit utilization ratio, a key factor in credit scores.

Missed or late payments also harm credit scores. Even one late payment can negatively impact your score. Pay all bills on time to keep your credit stable.

- Changes in credit utilization: Increasing your credit card balances or maxing out your available credit can lead to a drop in your credit score.

- Errors on your credit report: Inaccuracies or errors in your credit report can also contribute to a credit score decrease. It’s essential to regularly review your credit report and dispute any discrepancies.

- Closing credit cards: Closing unused credit cards can sometimes lead to a decrease in your credit score, as it can affect your credit history and credit utilization ratio.

Knowing these causes helps you navigate home buying better. Address potential issues quickly. This helps maintain a strong credit profile. It also boosts your chances of successful home purchase.

“Maintaining a healthy credit score is crucial during the home buying process. Staying vigilant and addressing any potential credit issues can make all the difference in securing your dream home.”

What If My Credit Score Drops Before Closing

Lender’s Reaction to a Credit Score Drop

A credit score drop before closing can trigger various lender reactions. They might ask for new documents or a bigger down payment. In extreme cases, they could deny your mortgage application.

Your credit score greatly influences the lender’s decision-making process. Any major changes can affect how they view the risk.

Potential Consequences and Remedies

A credit score drop before closing can lead to several issues. These may include:

- Delay in the closing process as the lender reviews your updated credit profile

- Requirement to provide a higher down payment to offset the increased risk

- Potential denial of your mortgage application if the credit score drop is substantial

To tackle these problems, take quick action. Talk to your lender about their needs and provide any extra documents they request.

Look into fixing errors on your credit report. Address any factors that might have caused the score to drop.

| Consequence | Remedy |

|---|---|

| Delayed closing | Provide updated documentation promptly |

| Higher down payment | Negotiate with the lender or explore alternative financing options |

| Mortgage denial | Dispute credit report errors or address factors contributing to the drop |

Understanding your lender’s response is crucial. Take steps to address the credit score drop quickly.

This can help minimize the impact on your home purchase. Stay in touch with your lender and real estate agent throughout.

Preventing Credit Score Drops During the Home Buying Process

A stable credit score is vital when buying a home. Smart credit management can prevent drops before closing. Here are some strategies to keep your credit strong:

- Monitor Your Credit Regularly: Keep a close eye on your credit report and score. This helps you spot and fix any issues quickly.

- Minimize New Credit Inquiries: Don’t apply for new credit cards or loans. Each inquiry can cause a temporary dip in your score.

- Maintain Low Credit Utilization: Keep credit card balances below 30% of your limit. High utilization can hurt your credit score.

- Dispute Errors on Your Credit Report: Check your report for mistakes and dispute them promptly. Fixing errors can prevent score drops.

- Avoid Major Financial Changes: Don’t make big money moves like changing jobs or large purchases. These can affect your credit profile.

Following these credit management tips during the home buying process is crucial. They can help prevent credit score drop and smooth your path to homeownership.

“Proactive credit management is the key to maintaining a strong credit score during the home buying process.”

Monitoring Your Credit Score Before Closing

Keeping an eye on your credit score is vital during the home buying process. Regular checks help you spot and fix issues quickly. Many tools can help you monitor your score easily.

Tools and Resources for Credit Monitoring

Credit monitoring services offer a great way to track your credit score. They provide updates and alerts for changes or suspicious activity. Many are affordable and fit well into your financial routine.

Free options are also available for credit monitoring. AnnualCreditReport.com lets you access reports from major bureaus once a year for free. This helps you review your credit report and check its accuracy.

- Enroll in a credit monitoring service to receive regular updates and alerts

- Take advantage of free credit report platforms like AnnualCreditReport.com

- Regularly review your credit report for any discrepancies or potential issues

Active monitoring of your credit score and credit report is crucial. It helps prevent problems and ensures a smooth home-buying process. Stay informed to make your home purchase a success.

Communicating with Your Lender and Real Estate Agent

Open communication with your lender and real estate agent is vital if your credit score drops before closing. Being proactive helps find solutions. Share any changes or concerns to navigate the process smoothly.

The Importance of Transparency and Proactive Communication

Inform your lender and real estate agent about credit score changes promptly. This shows your commitment to the home-buying process. They can work with you to address any issues.

Being proactive proves you’re a reliable partner. It helps keep the transaction on track, even when challenges arise.

- Notify your lender and real estate agent immediately if you notice a drop in your credit score.

- Explain the reasons for the change, if known, and provide any supporting documentation.

- Work closely with your lender to understand the impact on your mortgage approval and explore potential solutions.

- Collaborate with your real estate agent to navigate any challenges and keep the transaction on track.

Open communication builds trust with everyone involved in your home purchase. It can help solve problems caused by credit score changes.

| Benefit | Description |

|---|---|

| Transparent Communication | Keeping your lender and real estate agent informed about credit score changes shows your commitment to the process. |

| Proactive Approach | Taking the initiative to address the issue demonstrates your willingness to be a collaborative partner. |

| Smooth Transaction | Open communication can help resolve any challenges and keep the home-buying process on track. |

Clear communication is crucial when buying a home. Stay open and proactive with your lender and real estate agent. This approach can lead to a successful closing, even with credit score changes.

“Communication is the key to a successful home-buying experience, especially when credit scores fluctuate. Stay transparent and proactive to keep the process on track.”

Strategies for Mitigating the Impact of a Credit Score Drop

Don’t panic if your credit score dips before closing on your home. There are effective ways to lessen the impact. Understanding the reasons behind credit score changes is crucial.

Work closely with your lender to address the situation. Be proactive and transparent about any changes in your financial circumstances.

Explaining Legitimate Reasons for Score Changes

Credit scores can fluctuate for various legitimate reasons. It’s vital to provide your lender with documentation explaining any drops. This helps them understand your situation better.

- Recent credit applications – Applying for new credit can temporarily lower your score as lenders conduct credit inquiries.

- Changes in credit utilization – If you’ve recently used a larger portion of your available credit, this can impact your score.

- Corrections to credit report errors – Fixing inaccuracies on your credit report may initially cause a score decrease before the changes are fully reflected.

Communicate these reasons to your lender promptly. This can help mitigate the impact of a credit score drop. It also demonstrates your commitment to maintaining good credit.

Your goal is to work closely with your lender throughout this process. Be transparent about factors influencing your credit score changes. This approach can help keep your home-buying journey on track.

Alternative Financing Options to Consider

A drop in your credit score before closing may require exploring other financing options. FHA loans, VA loans, and private lender financing offer more flexibility for credit score requirements. These alternatives can help you achieve homeownership despite credit setbacks.

FHA loans, backed by the Federal Housing Administration, often have lower credit score thresholds. This makes them a good choice if your credit score has decreased. VA loans for eligible military members and veterans typically have more lenient credit requirements.

Private lenders can provide new financing opportunities. They may consider your overall financial profile, not just your credit score. Exploring these options increases your chances of securing your desired home.