Your credit score is vital when buying a home. It shows lenders how likely you are to repay your mortgage. A high score can help you get better loan terms and interest rates.

This makes your home purchase more affordable. A well-qualified buyer credit score proves you’re a responsible borrower. It’s key to securing favorable mortgage conditions.

Key Takeaways

- A well-qualified buyer credit score is a high credit score that makes you an attractive candidate for mortgage lenders.

- Your credit score significantly impacts the interest rate, loan terms, and overall affordability of your home purchase.

- Maintaining a strong credit score is crucial when applying for a mortgage.

- Understanding the factors that influence credit scores can help you improve your score and become a more attractive borrower.

- Knowing the minimum credit score requirements for different lenders can help you target the right loan program for your financial situation.

Understanding Credit Scores for Home Buyers

Your credit score is vital when buying a home. This three-digit number helps lenders assess your risk. It’s key in determining your loan eligibility and terms.

Importance of Credit Scores in the Mortgage Process

Lenders use credit scores to evaluate your creditworthiness. A higher score often means better loan terms and lower interest rates. Lower scores may lead to less favorable terms or loan denial.

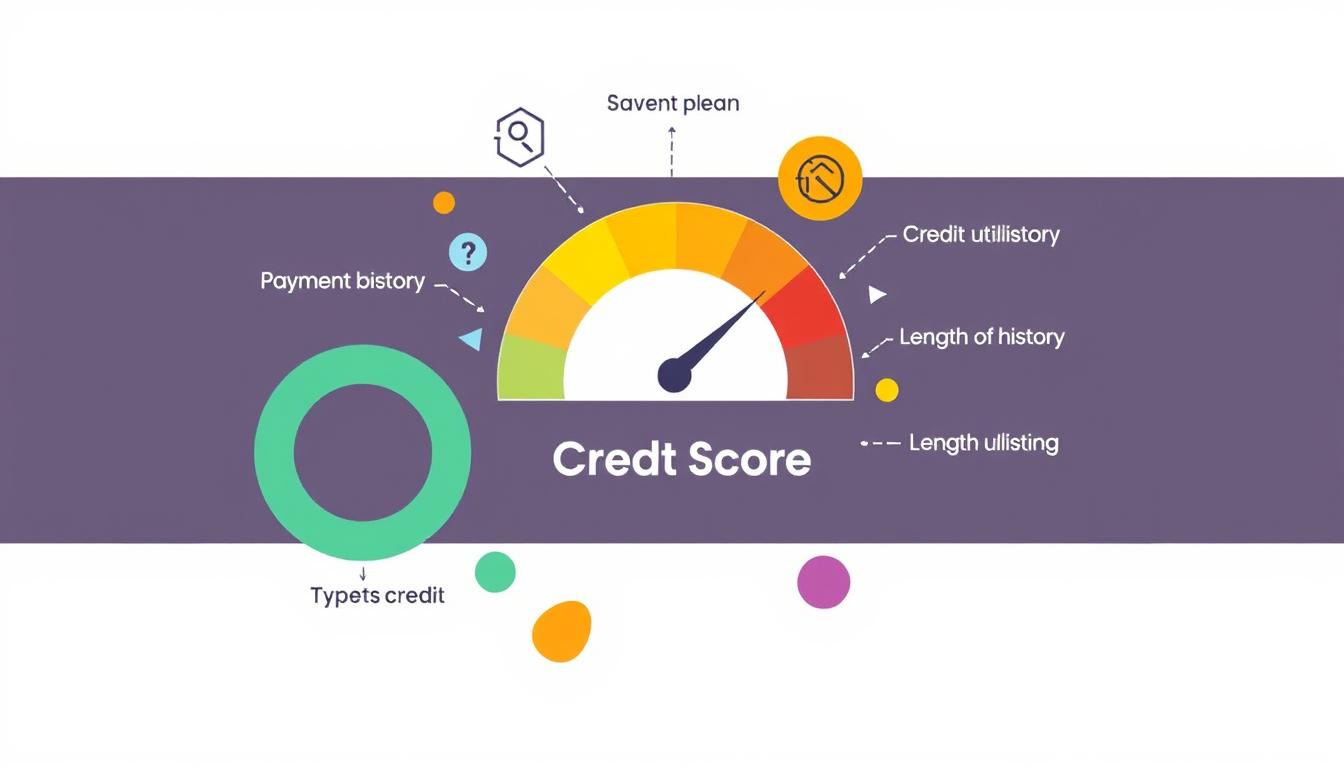

Factors that Influence Credit Scores

- Payment History: Your record of on-time payments for debts affects your credit score significantly.

- Credit Utilization: The amount of available credit you’re using impacts your score.

- Length of Credit History: Longer credit histories in good standing boost your score.

- Types of Credit Used: A mix of credit accounts can positively influence your score.

- Recent Credit Inquiries: Too many recent credit applications can temporarily lower your score.

Knowing these factors can help you improve your credit score for home buyers. You can take steps to enhance your credit score impact on mortgage.

By doing so, you’ll become a more attractive borrower to lenders. This can lead to better mortgage options and terms.

What Is Considered a Good Credit Score for Home Buyers?

Your credit score is vital when buying a home. It affects your mortgage eligibility and interest rates. A good credit score for home buying is typically 740 or higher.

Borrowers with high scores often get better mortgage terms. These include lower interest rates and more favorable loan conditions.

The minimum credit score for mortgage approval varies by lender and loan type. Some lenders may approve scores as low as 620 or 580 for certain programs.

Lower scores can lead to higher interest rates. They may also require larger down payments or stricter underwriting criteria.

The good credit score for home buying depends on several factors. These include your financial profile, loan type, and lender requirements.

Understanding credit scores helps home buyers prepare better. It can position you for a more successful home purchase.

What Is a Well Qualified Buyer Credit Score?

A well-qualified buyer credit score is crucial for home purchases. Scores of 760 or higher typically offer the best mortgage rates and terms. Lenders have different minimum credit score requirements for various loan types.

Some lenders require a score of 620 or higher for conventional loans. Government-backed loans like FHA and VA often have lower credit score thresholds.

Minimum Credit Score Requirements by Lender

Credit score needs vary by mortgage type and lender guidelines. Here’s a general overview of credit score requirements for common loan types:

- Conventional Loans: 620 or higher

- FHA Loans: 580 or higher (500-579 with a higher down payment)

- VA Loans: 580 or higher

- USDA Loans: 640 or higher

These are general guidelines. Individual lenders may have different credit score requirements. They could be higher or lower.

The well qualified buyer credit score range of 760 or above offers the best opportunities. It can help secure favorable mortgage rates and terms.

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional Loans | 620 or higher |

| FHA Loans | 580 or higher (500-579 with a higher down payment) |

| VA Loans | 580 or higher |

| USDA Loans | 640 or higher |

“Maintaining a well qualified buyer credit score of 760 or higher can open up the best mortgage options and rates for home buyers.”

How Credit Scores Affect Mortgage Rates and Costs

Your credit score greatly impacts your mortgage rates and home loan costs. Higher scores often lead to better interest rates. Lower scores may result in higher rates or bigger down payments.

Credit scores can significantly affect loan affordability. Understanding this relationship is key when buying a home.

According to industry data, a borrower with a credit score of 760 or higher can expect to pay around 0.5% to 1% less in interest rates compared to a borrower with a score below 680. This difference can save thousands over the loan’s lifetime.

| Credit Score Range | Estimated Mortgage Rate | Estimated Monthly Payment (on a $300,000 loan) |

|---|---|---|

| 760 and above | 5.5% | $1,704 |

| 700-759 | 5.75% | $1,754 |

| 680-699 | 6.0% | $1,799 |

| 620-679 | 6.5% | $1,896 |

| below 620 | 7.0% | $1,996 |

This table shows how credit scores affect monthly payments. A score above 760 could save you $292 monthly compared to a score below 620.

Over a 30-year mortgage, this difference adds up to over $100,000 in total interest paid.

Your credit score plays a crucial role in determining your mortgage costs. Higher scores lead to better rates and loan terms. This makes home purchases more affordable for those with good credit.

Improving Your Credit Score Before Buying a Home

Want to boost your credit score before buying a home? Take proven steps to improve it before applying for a mortgage. A better score can lead to lower interest rates and better loan terms.

Credit Repair Strategies

Start by disputing errors on your credit report. Incorrect information can significantly lower your score. Resolve these issues as your first step.

Paying down debts, especially credit card balances, can also help. This improves your credit utilization ratio, a key factor in your overall score.

Timelines for Credit Score Improvement

Improving your credit score can take 6 months to a year or more. The timeline depends on your credit profile and the steps you take.

Make on-time payments, reduce debt, and monitor your credit report regularly. These actions can steadily increase your score over time.

With effort, you can boost your how to improve credit score for home buying by 50-100 points or more. This puts you in a stronger position for a mortgage application.

“Improving your credit score before buying a home is one of the smartest financial moves you can make. It can save you thousands in interest and put you in a much better negotiating position with lenders.”

Follow credit repair tips and allow time for timeline to increase credit score. You’ll become a more attractive home buyer and potentially save significant money.

Alternative Lending Options for Lower Credit Scores

Don’t let a low credit score dash your homeownership dreams. Alternative mortgage options can help you buy a home. Government-backed loans often have more flexible credit requirements than conventional mortgages.

Government-Backed Loan Programs

These programs offer mortgage options for low credit score applicants. They have more accessible credit score and down payment requirements. Let’s explore some popular government loan programs:

- FHA Loans: Backed by the Federal Housing Administration, FHA loans typically require a minimum credit score of 580 and allow for a down payment as low as 3.5%.

- VA Loans: Exclusively for eligible military members, veterans, and their spouses, VA loans do not have a minimum credit score requirement and offer 100% financing.

- USDA Loans: Designed for low-to-moderate-income borrowers in rural areas, USDA loans have no minimum credit score and can provide 100% financing.

These government loan programs for home buyers can be excellent alternatives to conventional loans. They’re ideal for those with credit scores below traditional lender standards.

| Loan Program | Minimum Credit Score | Down Payment |

|---|---|---|

| FHA Loan | 580 | 3.5% |

| VA Loan | No Minimum | 0% |

| USDA Loan | No Minimum | 0% |

Explore these alternative lending options for lower credit scores to move towards homeownership. These programs offer flexibility and support for aspiring homeowners. You can achieve your dream home, even with a less-than-perfect credit score.

The Role of Credit Scores in Pre-Approval and Pre-Qualification

Your credit score is vital in the home-buying process. Lenders use it to decide your loan amount and interest rate. A good score can help you get a pre-approval letter, giving you an edge with sellers.

A strong credit score for pre-approval is key. It affects your mortgage eligibility and credit score impact on pre-qualification. Lenders have minimum score requirements for pre-qualifying and pre-approving loans.

Higher scores often lead to better terms. These include lower interest rates and larger loan amounts. Understanding how credit score affects mortgage pre-approval is crucial for home buyers.

A higher score opens doors to better loan options. A lower score may limit choices or increase costs. Monitor your credit and take steps to improve it.

“A good credit score can be the key to unlocking the door to your dream home.”

Keep informed about credit scores in pre-approval and pre-qualification. This knowledge helps you navigate the mortgage landscape effectively. It’s essential for achieving your homeownership goals.

Credit Monitoring and Maintaining a Good Score

Monitoring your credit is crucial, even after reaching a good score. Regular reviews help maintain a strong credit profile. This is key for securing favorable mortgage terms and rates.

Addressing discrepancies in your credit report is vital. It helps preserve your hard-earned credit score. A good score is essential for getting the best mortgage deals.

Tips for Responsible Credit Management

Pay your bills on time to manage credit responsibly. Keep credit card balances low and limit new credit applications. These habits show lenders you’re a reliable borrower.

Good credit practices improve your chances of securing great mortgage deals. They demonstrate your financial responsibility to potential lenders.

Credit monitoring services help maintain a good score. They keep you informed about changes in your credit profile. These tools allow you to address issues quickly.

Stay proactive with your credit management. This ensures your score remains in the well-qualified range for homebuyers. Consistent effort pays off when applying for a mortgage.